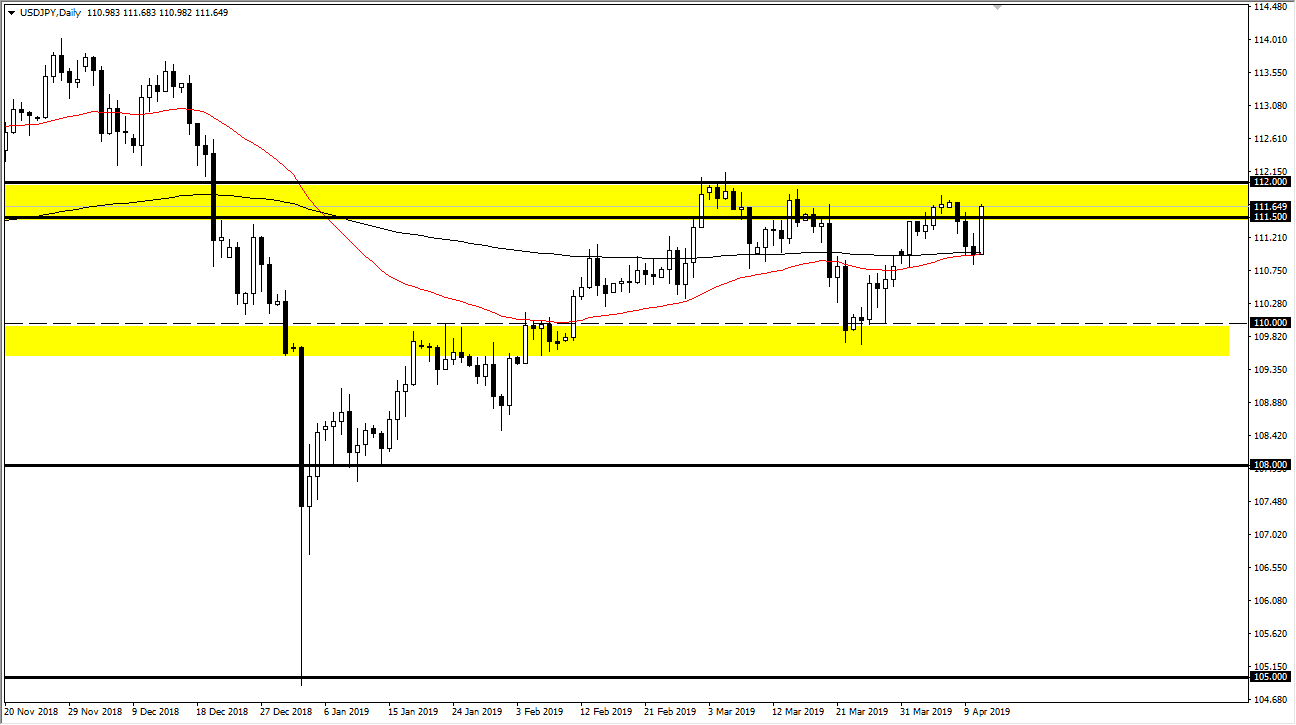

USD/JPY

The US dollar rallied rather significantly during the trading session on Thursday, slicing through the vital 111.50 level, which is massive resistance that extends to the ¥112 level. We are closing at the top of the candle stick so it is a very bullish sign, but at this point it’s only a matter time before the sellers probably come back. However, if we were to break above the ¥112 level, the market could very well go towards the ¥113.50 level. A pullback from here makes sense, but at this point we don’t have any signs of exhaustion that could give us some hope. That being said, short-term charts may offer that, but I certainly wouldn’t be a buyer until we can clear the ¥112 level. If we can, then I think the market will pick up quite a bit of momentum. Otherwise, we probably roll over towards the moving averages that I have plotted on the chart, possibly even down to the ¥110 level.

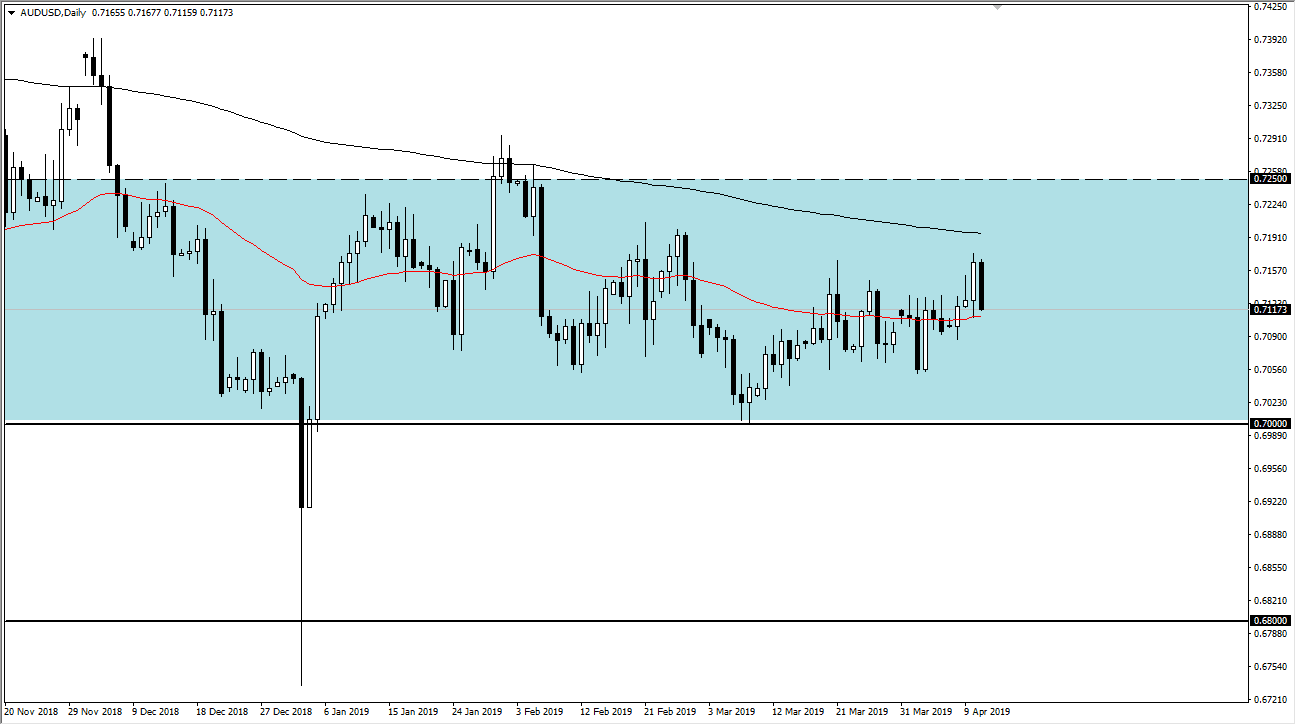

AUD/USD

The Australian dollar fell hard during the trading session on Thursday, crashing in towards the 50 day EMA. Ultimately, I think that there will be buyers underneath, as we have seen more than once. This is a market that has plenty of buyers underneath, so I like the idea of buying these dips as it gives us an opportunity to pick up value in a market that looks as if it is trying to build a bit of a base. In fact, already have a standing buy order down at the 0.7050 level. It’s not until we would break down below the 0.68 level that it changes my analysis for this pair, so at this point I think it’s very likely that it continues to be a market that you can take advantage of such a well-known support level. If we can get Chinese economic numbers picking up and of course the US/China trade situation picking up, that could be good for this pair as well.