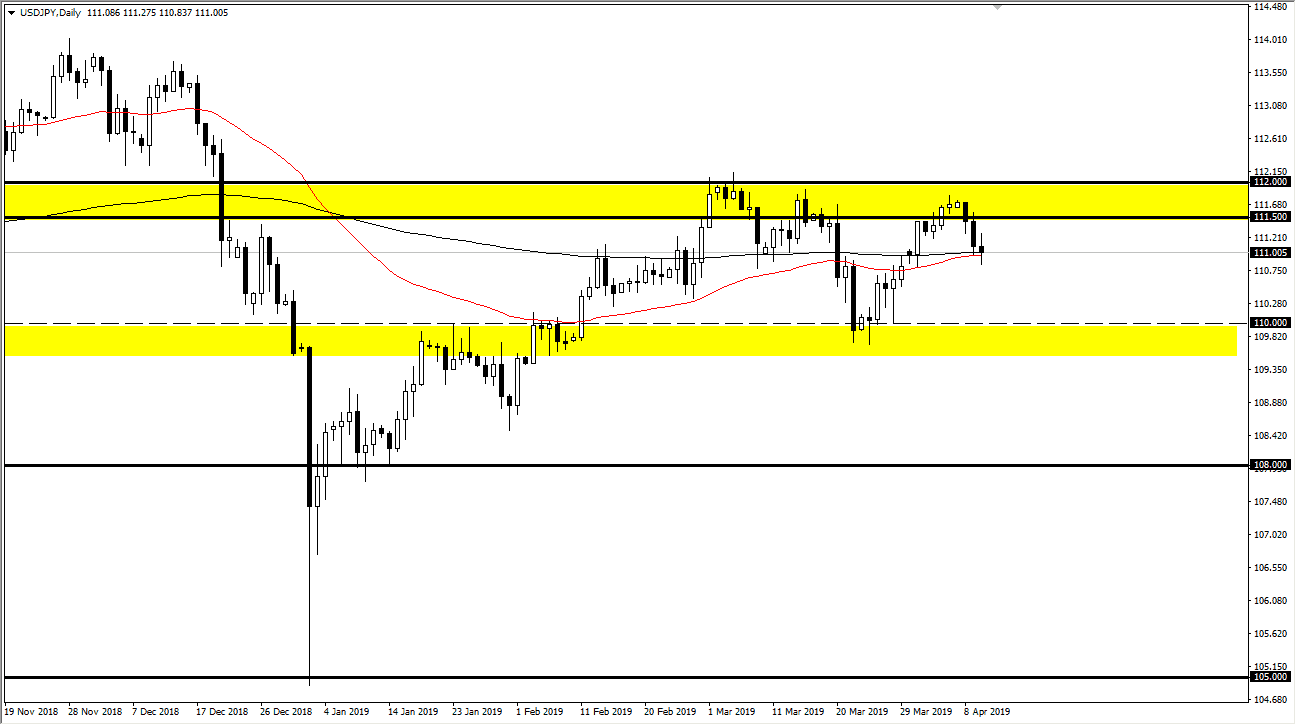

USD/JPY

The US dollar went back and forth during the trading session on Wednesday, as we saw a lot of choppiness in the stock markets as well. We awaited the Federal Reserve Meeting Minutes, and the ECB press conference. By the end of the day nothing had changed, so therefore it makes sense that the risk appetite barometer, and this place the USD/JPY pair, did very little as well. In general, I like the idea of trading in a range with the ¥110 level underneath, and the ¥112 level above. You can see that I have 50 point ranges shown as support and resistance, and as we are in the middle of these couple of barriers, I think there isn’t much to do currently.

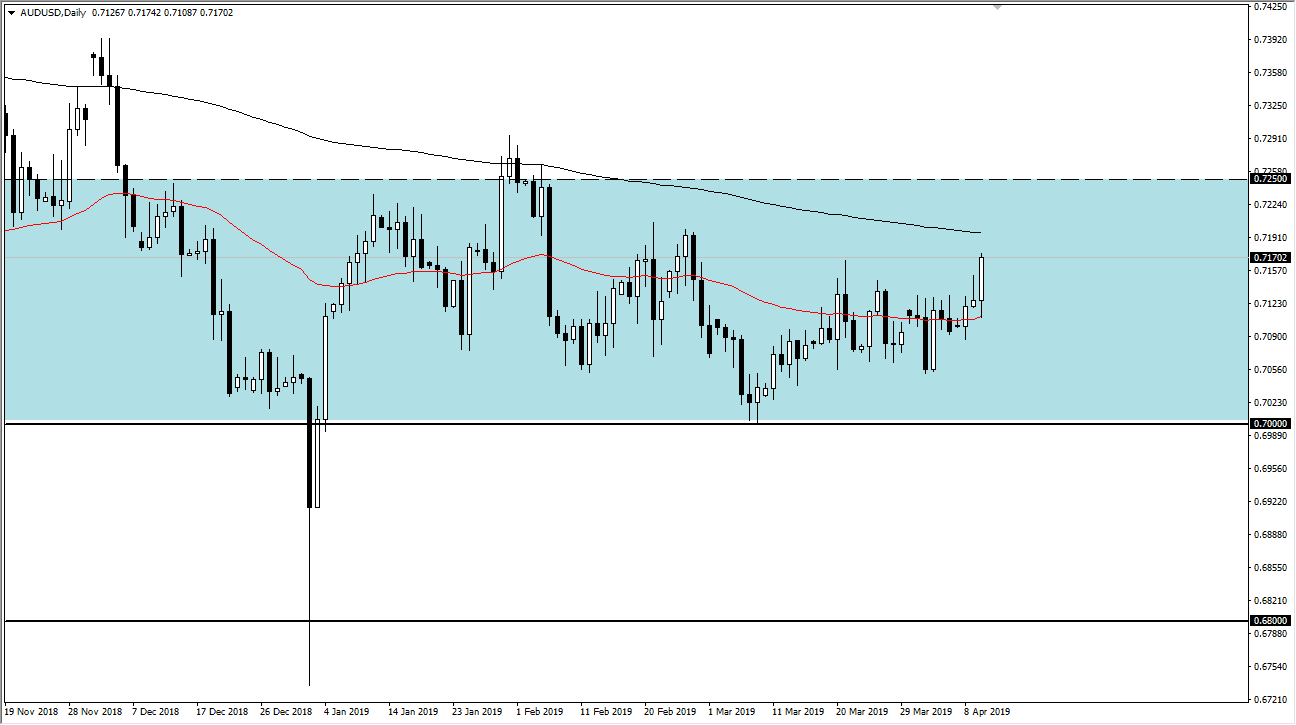

AUD/USD

The Australian dollar initially pulled back a bit during the trading session on Wednesday, but then found the 50 day EMA supportive enough to cause a significant bounce. In fact, this is some of the best action that we have seen in days, so it looks as if the Australian dollar is trying to form I longer-term base. A short-term pullback should be a buying opportunity, and the 0.70 level underneath is a massive support level for longer-term charts. I have no interest in shorting the Australian dollar and I am simply waiting for value so that I can get long of this market. The longer-term outlook for this pair is much higher if China can reinflate its economy, something that looks very likely to happen. Beyond that, the Federal Reserve remains very dovish, and that of course should put downward pressure on the greenback as traders are out there looking for a bit of a yield differential.