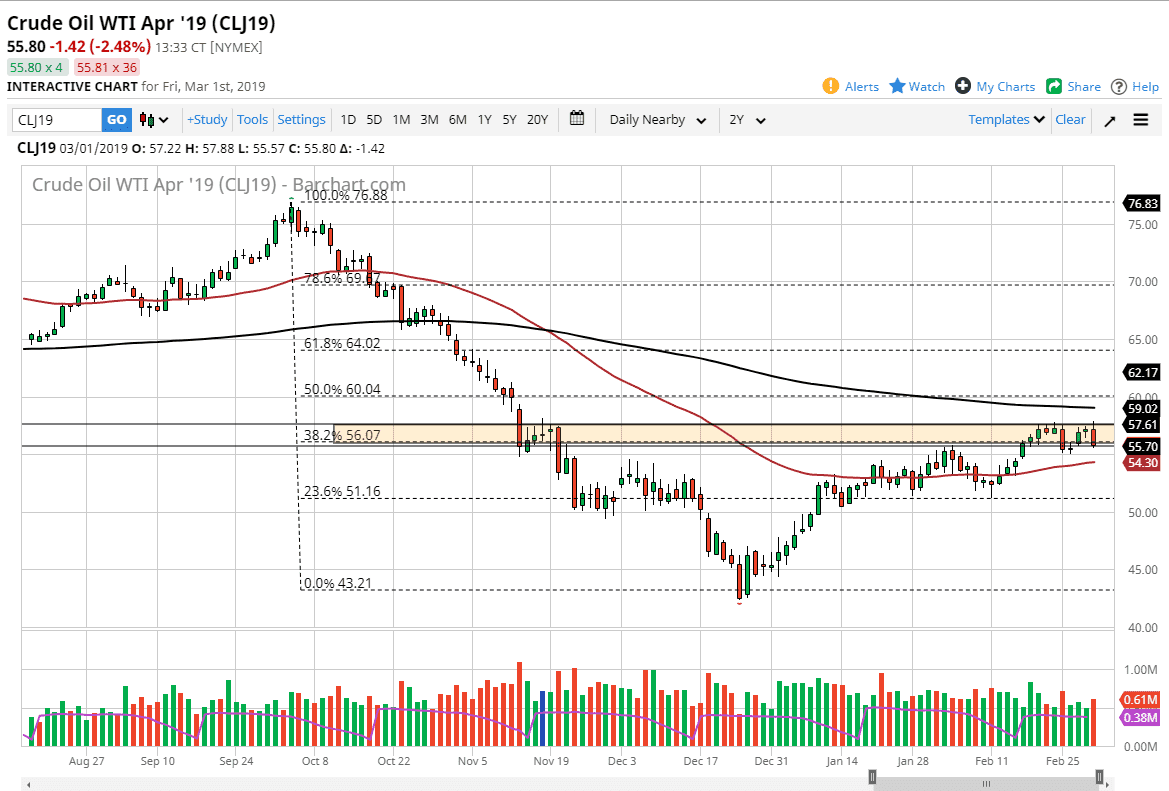

WTI Crude Oil

The WTI Crude Oil market initially tried to rally during the trading session on Friday, but broke down significantly at the highs again, as we continue to simply go back and forth. This is a market that is stuck between the 200 day EMA above and the 50 day EMA below. I think at this point the market is trying to figure out where it’s going next, and you should be thinking more along the lines of extraordinarily short-term trades, as it’s the only thing working at the moment. If we can finally break above the 200 day EMA, then the market should take off to the upside for a longer-term move. Alternately, a move below the 50 day EMA is extraordinarily negative. Right now, there is simply no conviction in one direction or the other.

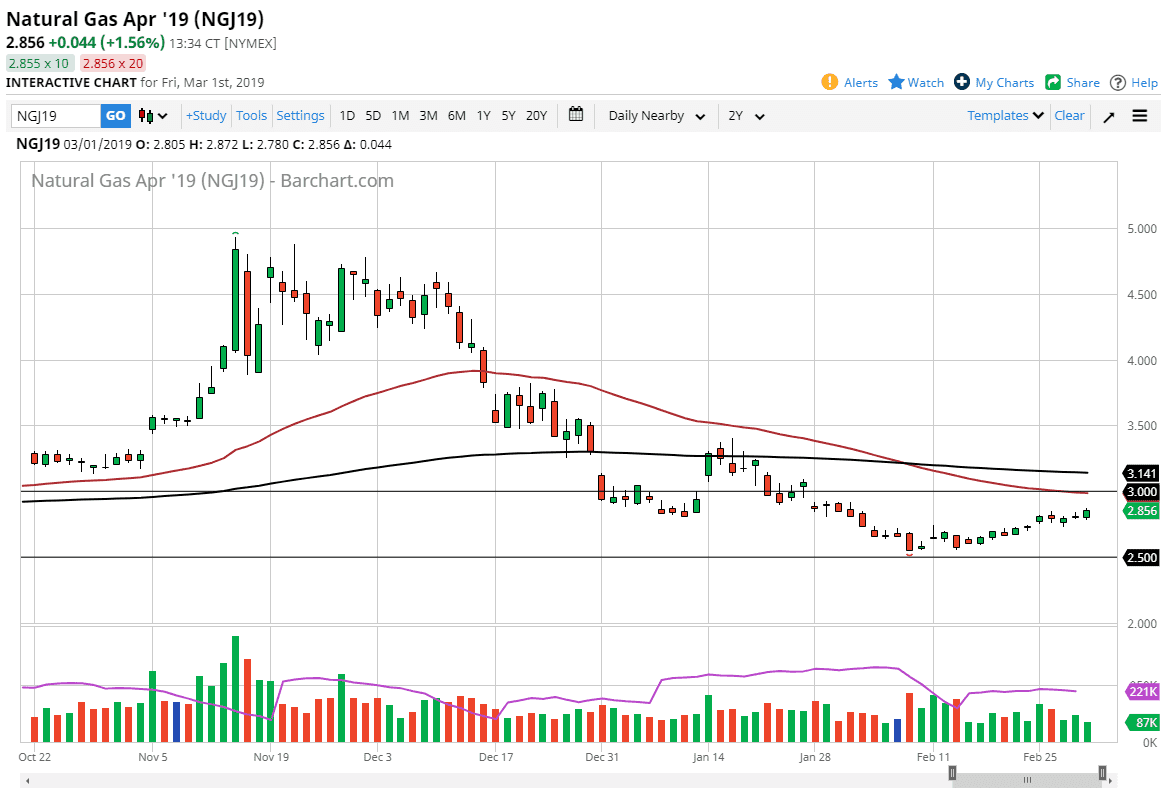

Natural Gas

Natural gas markets rallied a bit during the trading session on Friday, as we continue to work our way towards the gap that is at the $3.00 level. Overall, if we rally towards that area I will be the first person to start selling at the signs of exhaustion. At that point, I believe that we could have a better move just waiting to happen. However, if we continue to go higher then I think we’re looking at an opportunity to start selling the market at $3.15, where we see the 200 day EMA. At this point, the market looks very likely to continue to focus on the longer-term fundamentals and right now I think what we are simply seeing is a bit of profit taking from those who had sold at such high levels. This is a market that is oversupplied, so therefore I have no interest in trying to buy this market.