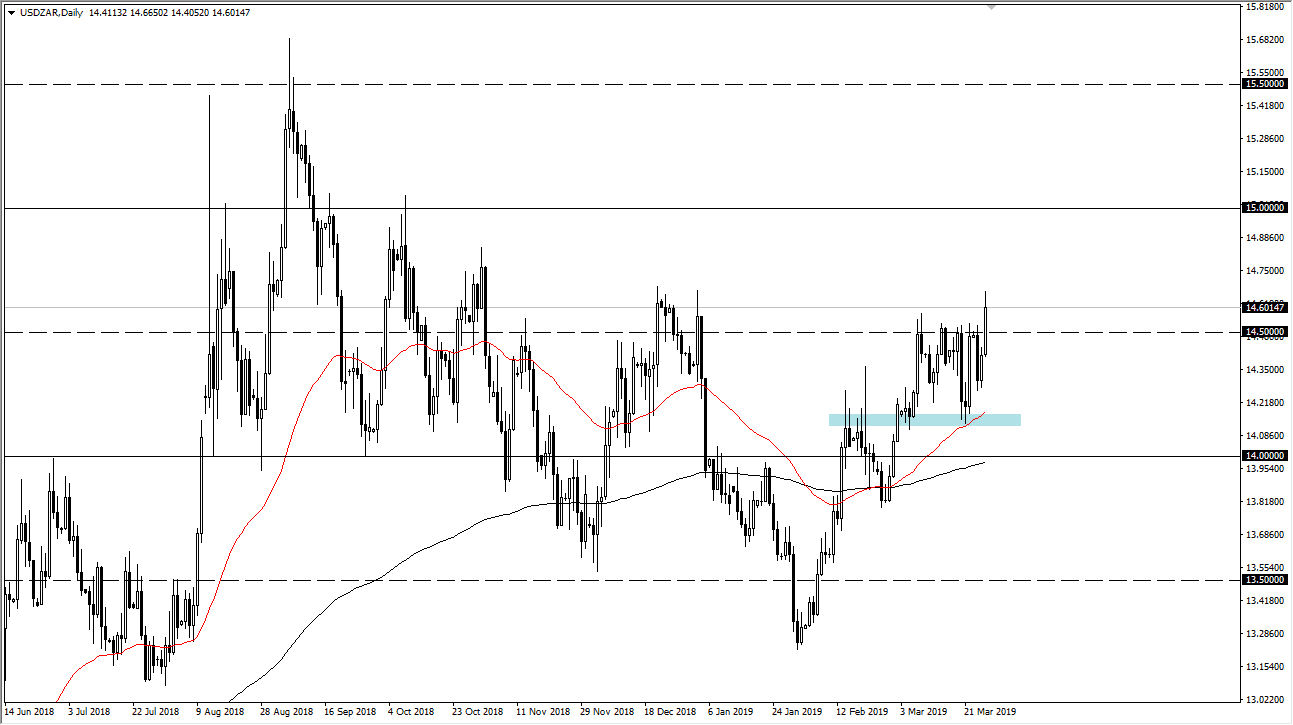

The US dollar rallied rather significantly against the South African Rand during trading on Wednesday, finally breaking above the crucial 14.50 Rand resistance barrier. This is an area that has been crucial for several weeks, and the fact that we close towards the top of the candle stick also suggests that we are getting ready to go higher.

Remember, I had recently suggested that the 14.65 level needs to be overcome in order to continue going higher, but it certainly looks as if we are going to make a significant attempt to do exactly that. Once we do, I would anticipate that the 14.75 Rand level would be next, followed by the 15.00 Rand level. This looks to be a classic breakout scenario, but obviously being an exotic currency pair you need to be a little bit more cautious about potential volatility than you would in a pair like the EUR/USD.

Looking to the downside, I believe there should be significant support now at the 14.40 Rand level as it is the bottom of the candle stick that was the breakout. If we can’t even hold the range for the day, then one would have to assume that it is essentially a false breakout. Beyond that, we also have the 50 day EMA which has recently offered support and is most certainly trying to shoot to the upside as we have recently had a major “golden cross” in this pair.

As far as selling is concerned, I don’t really like the idea of buying the Rand as there are a lot of concerns when it comes to global growth. South Africa obviously is more emerging-market than it is first world, so it makes more sense for the US dollar to rally than it does the Rand.