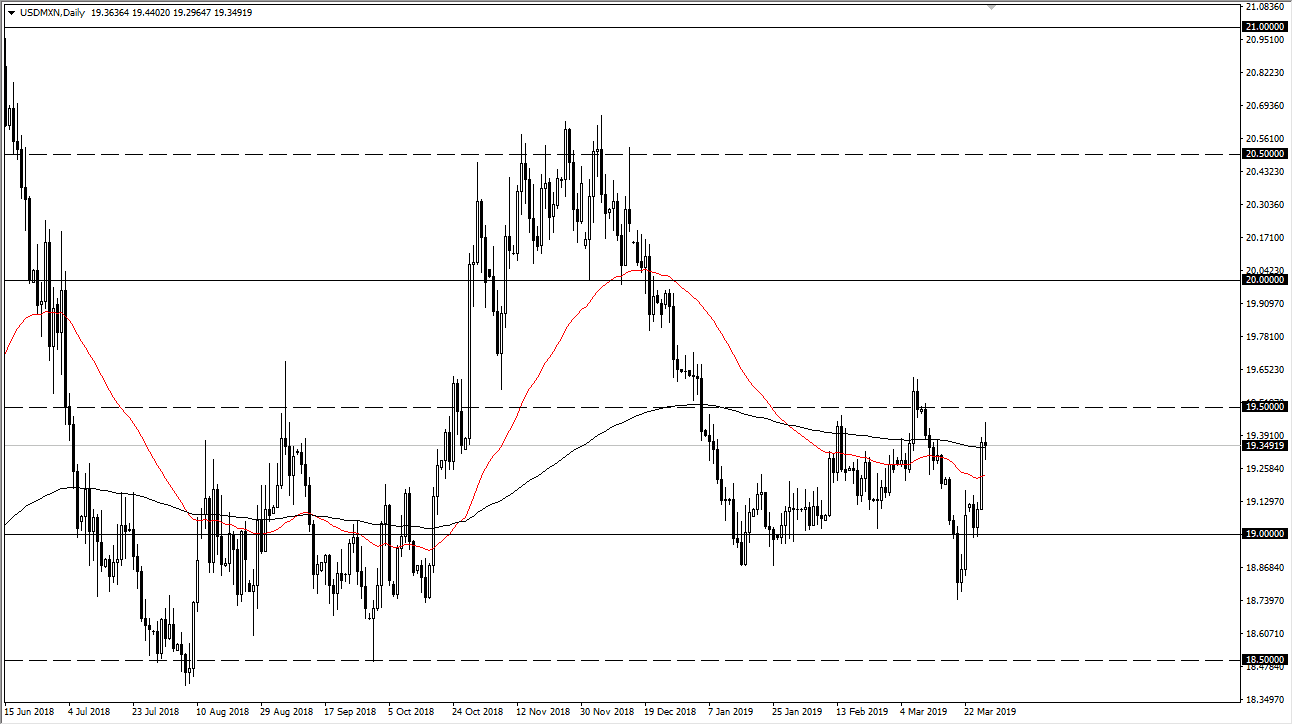

The US dollar went back and forth during the trading session on Thursday as we tried to break above the crucial 200 day moving average against the Mexican peso. The market has been very noisy during the trading session, as there are a lot of concerns when it comes around the US dollar as of late. The market of course has a certain amount of risk appetite attached to it, as the US dollar is considered to be much safer than the Mexican peso. There was a lot of volatility around the world during the trading session on Thursday, so of course the US dollar was highly volatile.

That being said, by the time the day ended, we did of forming a relatively neutral looking candle right at a major moving average and of course just below the vital 19.50 pesos level. That suggests to me that we may get a bit of a roll over here, and you can also, if you squint, make out a small trend line that had been broken and now has been retested.

Beyond that the Mexican peso does tend to be somewhat sensitive to oil markets which look ready to break out any day now. Every time they sell off the buyers come back into pick up value. With that in mind, a break down below the bottom of the trading session on Thursday could send the US dollar much lower against the peso, perhaps down towards the 19 pesos level underneath which offered short-term support. The alternate scenario of course is that we break above the highs that we recently made near the 19.65 pesos level, which opens up the door to the 20 pesos handle after that.