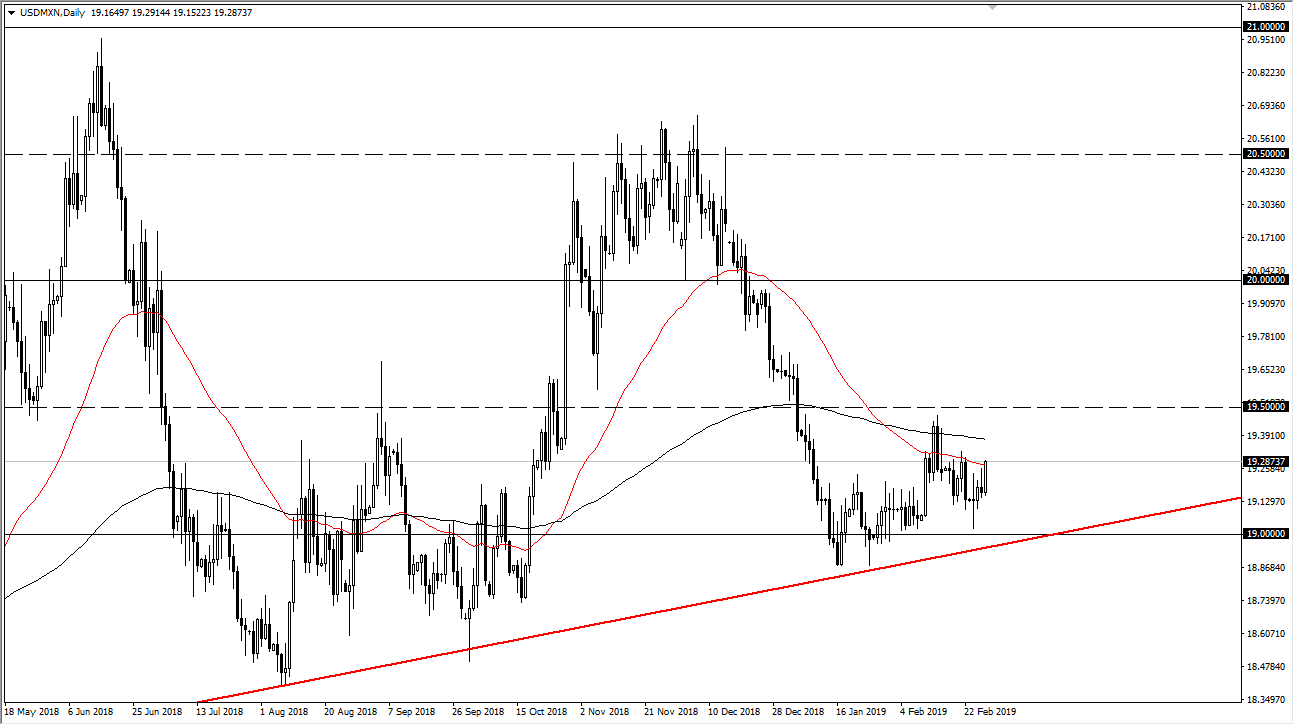

USD/MXN

The US dollar rallied a bit during the trading session against the Mexican peso on Thursday, as we have broken slightly above the 50 day EMA. This being the case, it looks like we are probably going to go looking towards the 200 day EMA above near the 19.39 level. I suspect that we will probably head there during the next 24 hours, but at this point it also makes sense that short-term pullbacks should be bought as there is massive support underneath. We have been grinding for several weeks, with the trend line holding that coincides with roughly 19 pesos.

Otherwise, if we can break above the 19.50 pesos level, we could recover towards the 20 pesos level, but keep in mind that this will come down to whether or not people are buying the US dollar overall. If the US Dollar Index rises, that should send this market to the upside by proxy. Otherwise, if the US Dollar Index falls, that may send the market back down towards the uptrend line, and then perhaps breaking down below the 19 pesos level. A close below that level would send this market much lower, perhaps fulfilling the bearish flag shape that we are looking at.

Speaking of that bearish flag, we have rallied significantly towards the 19.50 pesos level about two weeks ago to put a bit of doubt into that shape. That’s why if we break above that level, I think that we go much higher, because it would then be a “higher high.” So the question is have we bottomed? I suspect we will find out some answers rather soon, with 19 pesos on the bottom being a sell signal and 19.50 pesos on the top being a buy signal for a longer-term trade. In the short term, it looks as if we do have more of an upward bias.