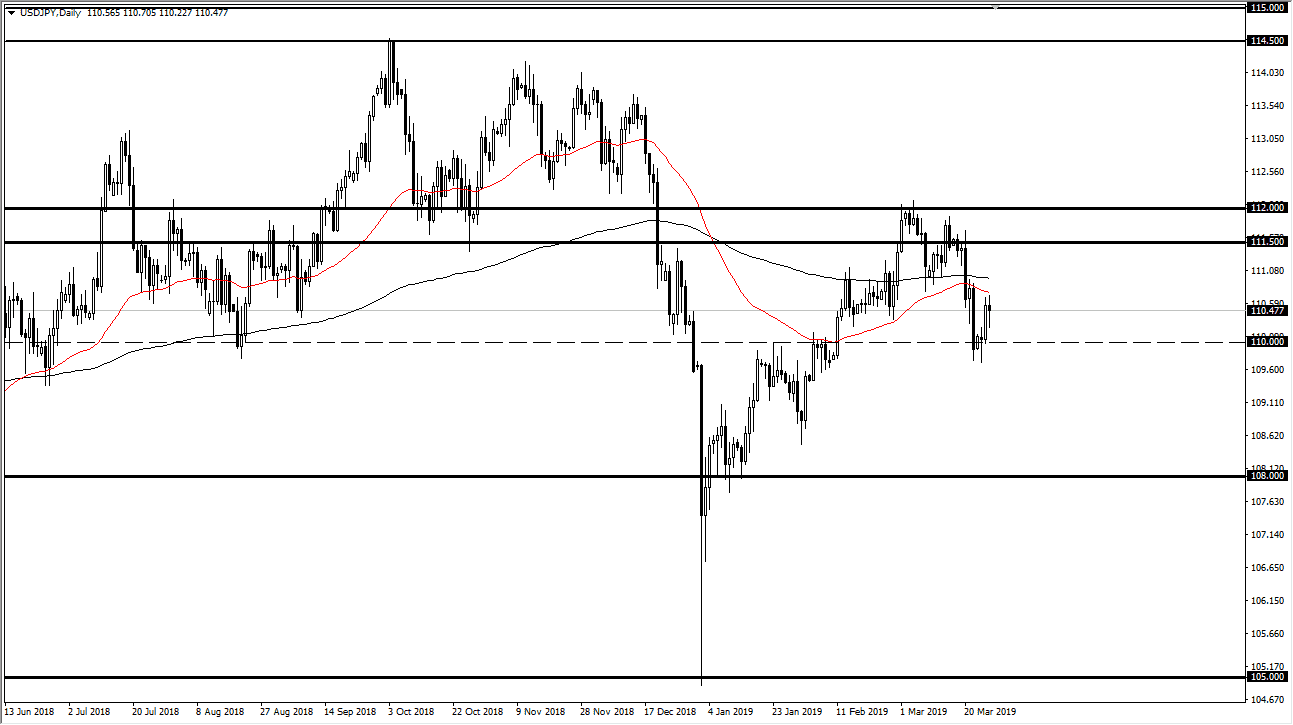

USD/JPY

The US dollar initially fell against the Japanese yen to kick off the Wednesday session but we have seen buyers step back in just above the ¥110 level, showing signs of resiliency that looks very much like a market trying to define an overall range. The range has ¥110 underneath as support, just as it has the ¥111.50 level as resistance above. We are basically in the middle of the area and testing the 50 day EMA. If you remember yesterday, I had suggested that perhaps this is a market that’s in the middle of a larger consolidation area and therefore it wasn’t worth trading. By the end of the day, we are basically trading unchanged, but one thing that has been confirmed is that there is most certainly support underneath. Short-term dips could be small buying opportunities.

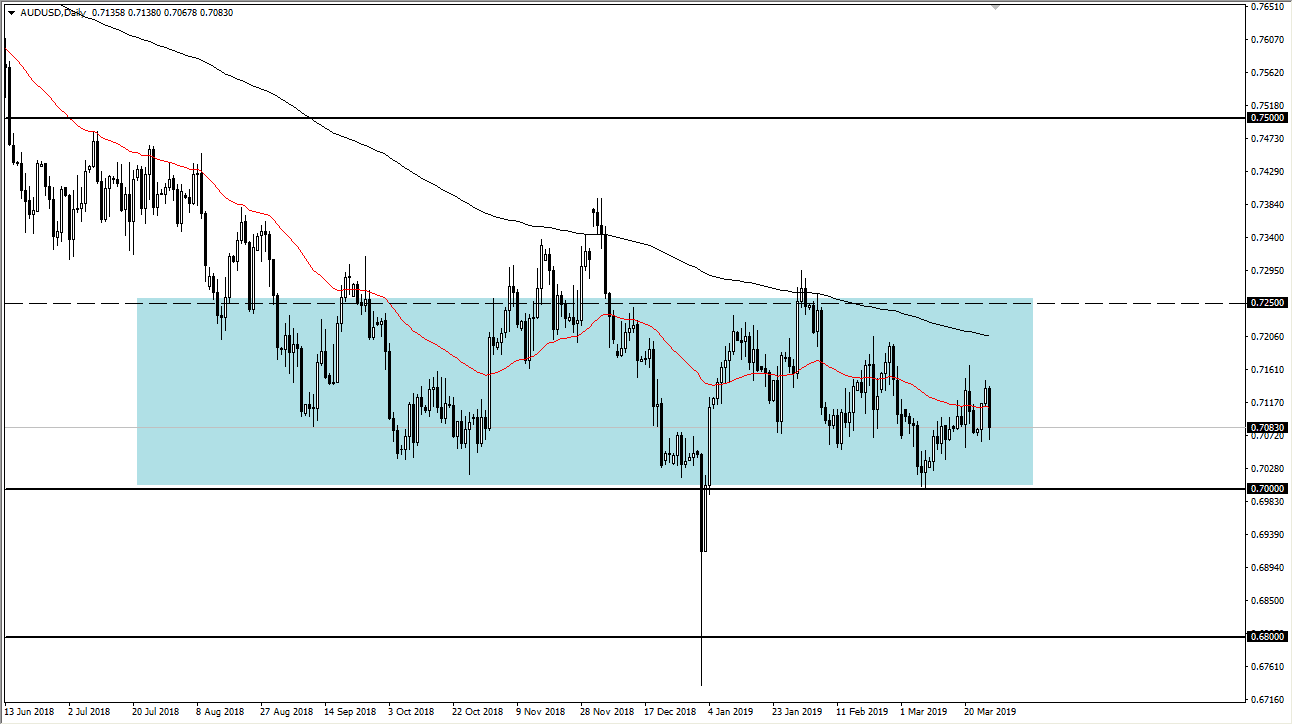

AUD/USD

The Aussie dollar has fallen rather hard during trading on Wednesday but is still well within the tolerance of the overall consolidation area. We sliced through the 50 day EMA, but that’s nothing we haven’t done before. I think it’s very likely that we will see buyers underneath, and in fact by the end of the day we already started to see a little bit of resiliency. When I look at the longer-term chart, I recognize that the 0.70 level underneath is crucial, and it certainly looks as if it is continuing to hold the market up at the very least.

I have been buying short dips in the market and will continue to do so as they offer value. I’m not looking for some type of explosive move to the upside until we get some resolution to the US/China trade situation, but in the meantime it’s obvious that we have a lot of demand near the 0.70 handle. That being said, picking up 20-30 pips at a time certainly seems feasible.