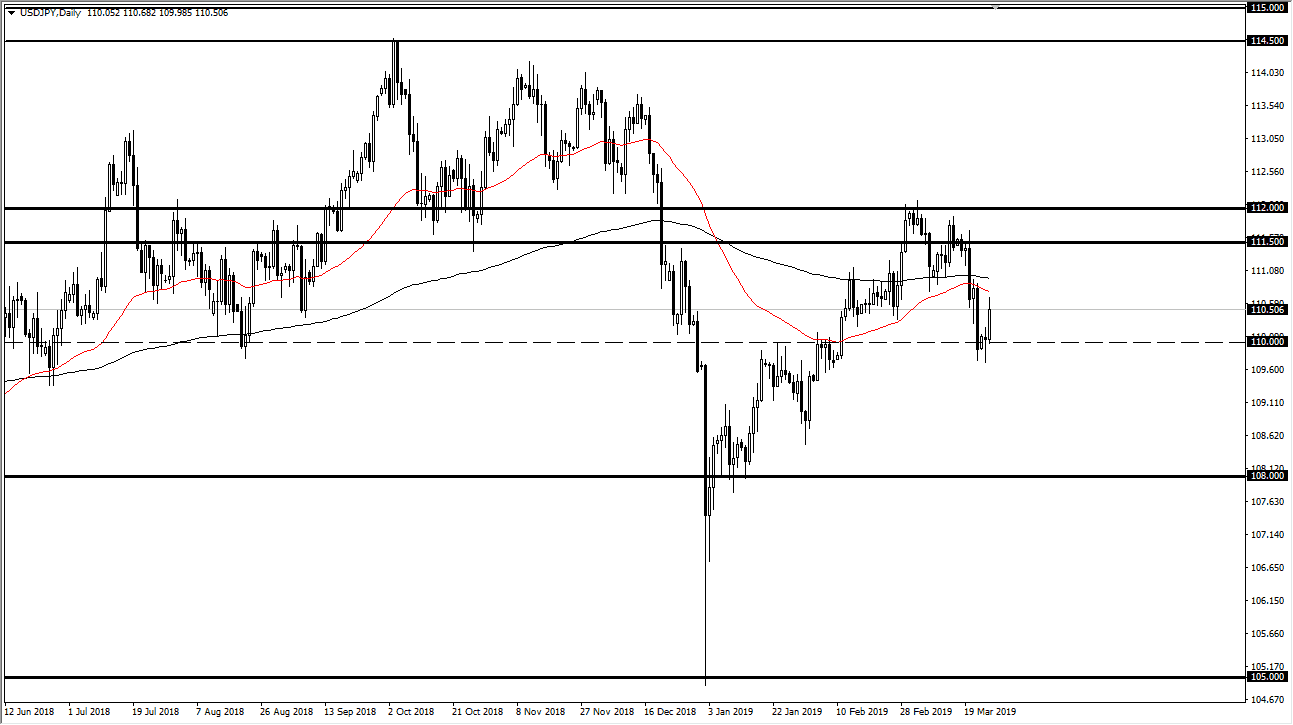

USD/JPY

The US dollar rallied rather significantly during the trading session on Tuesday, breaking the top of the hammer from Monday. This is a bullish sign, and therefore it looks as if we are trying to use the ¥110 level as massive support. That being the case, I think we could go looking towards the resistance above. Overall, it looks like we are essentially stuck in some type of consolidation area. The bottom of the consolidation area is of course the ¥110 level, just as the resistance starts at the ¥111.50 level. With all of that in mind, we are essentially in the middle of this consolidation, so it’s difficult to put a lot of money to work in one direction or the other. At this point, it’s probably better to wait until we get to the outside of the area to place a trade, either selling at resistance or buying at the support underneath.

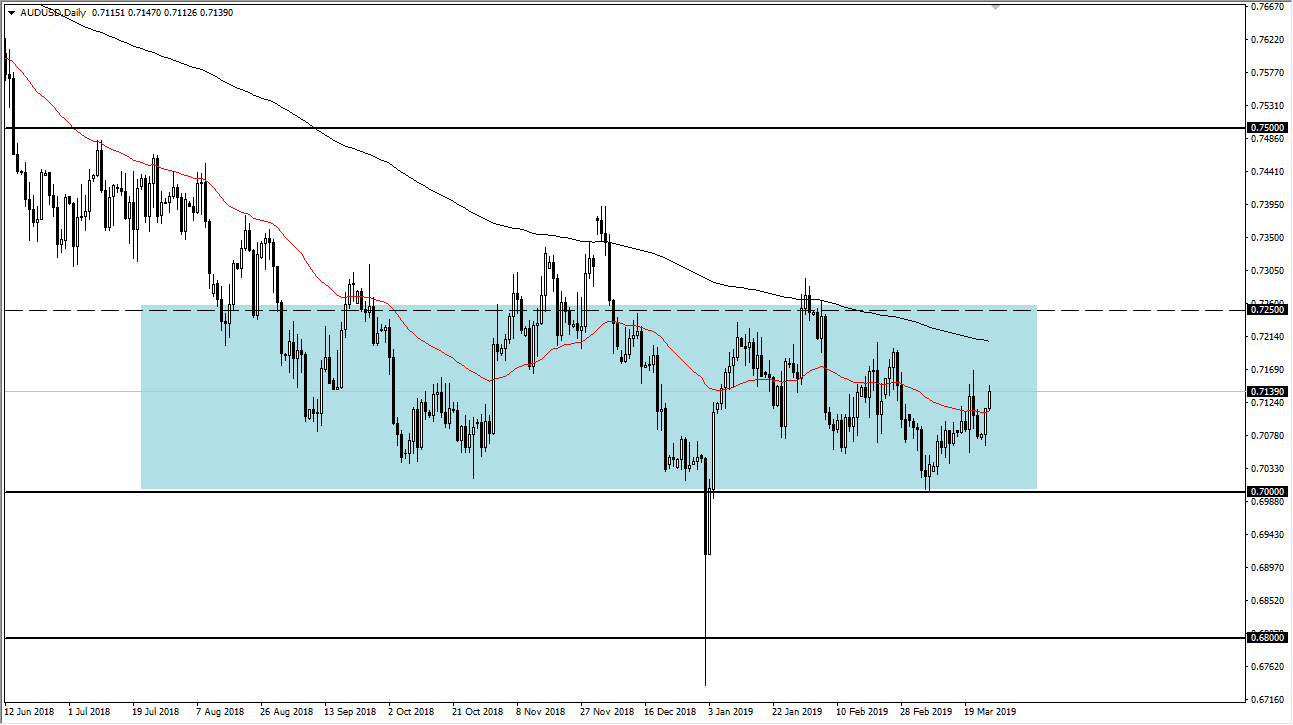

AUD/USD

The Australian dollar rallied a bit during the trading session on Tuesday, reaching towards the 0.7150 level. This is an area that has been important more than once, so it’s likely to be a scenario where we pull back from here and find buyers underneath again. This is a market that has plenty of support at the 0.70 level, extending down to the 0.68 level. This is an area that shows up on the monthly chart, so I fully anticipate that it will continue to hold as support. Buying value for short-term trades continues to be the best way forward when it comes to the Aussie dollar from what I see. It’s not until we get some type of resolution to the US/China trade situation that we will have a longer-term trade present itself.