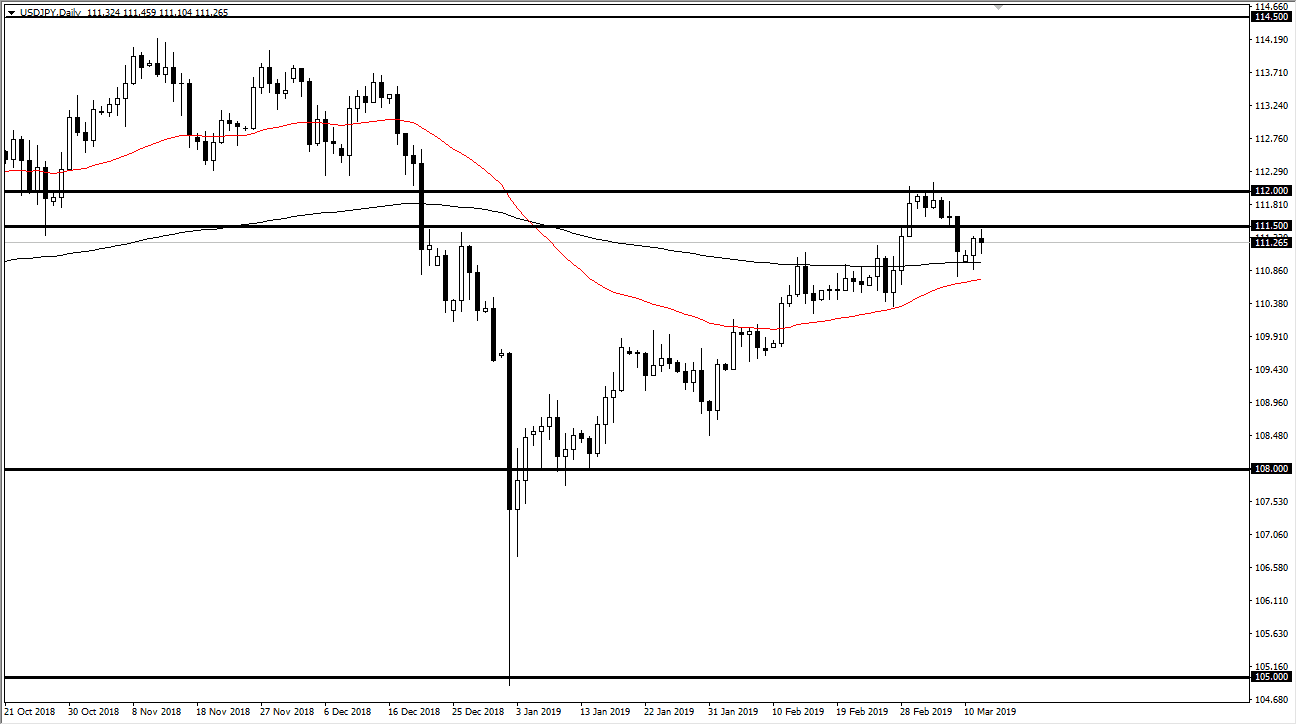

USD/JPY

The US dollar went back and forth during the trading session on Tuesday, as we continue to struggle above the ¥111.50 level. This should not be a major surprise, considering that we have been talking about these levels for some time. The selloff that happened late last week reached down to the 200 day EMA, which is currently just below the region we are trading in. If we could break above the ¥111.50 level, the market probably will go reaching towards the ¥112 level next. Alternately, if we were to break down below the 50 day EMA, which is pictured in red on the chart, we could go much lower, probably down to the ¥108 level given enough time. Ultimately though, I think that were looking at a lot of sideways choppiness as there are a multitude of moving pieces out there when it comes to risk appetite.

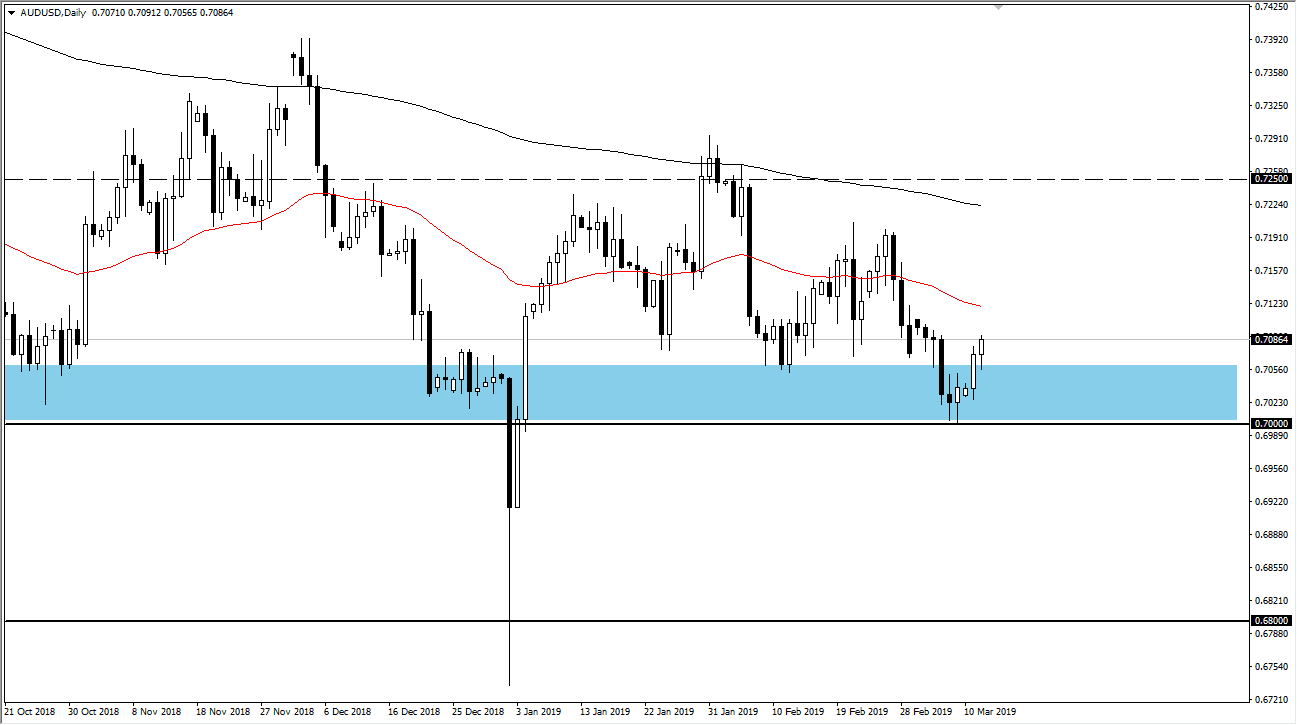

AUD/USD

The Australian dollar initially pulled back a little bit during the trading session on Tuesday, but then reached towards the 0.71 handle. If we can break above that level, then the market will be free to go much higher, perhaps reaching towards the 0.72 handle. I see a ton of support extending down to the 0.70 level, so I think that we should continue to buy short-term pullbacks, as the market has clearly shown a proclivity to rally after short-term pullbacks. If we can get the US/China trade talks working out, that should help the Australian dollar over the longer-term. The 0.70 level is a massive support level that extends down to the 0.68 handle, so I have no interest whatsoever in shorting this pair, and I think that you should be looking at it from a value proposition type of standpoint. If it drops a bit, pick it up because it’s being offered on sale.