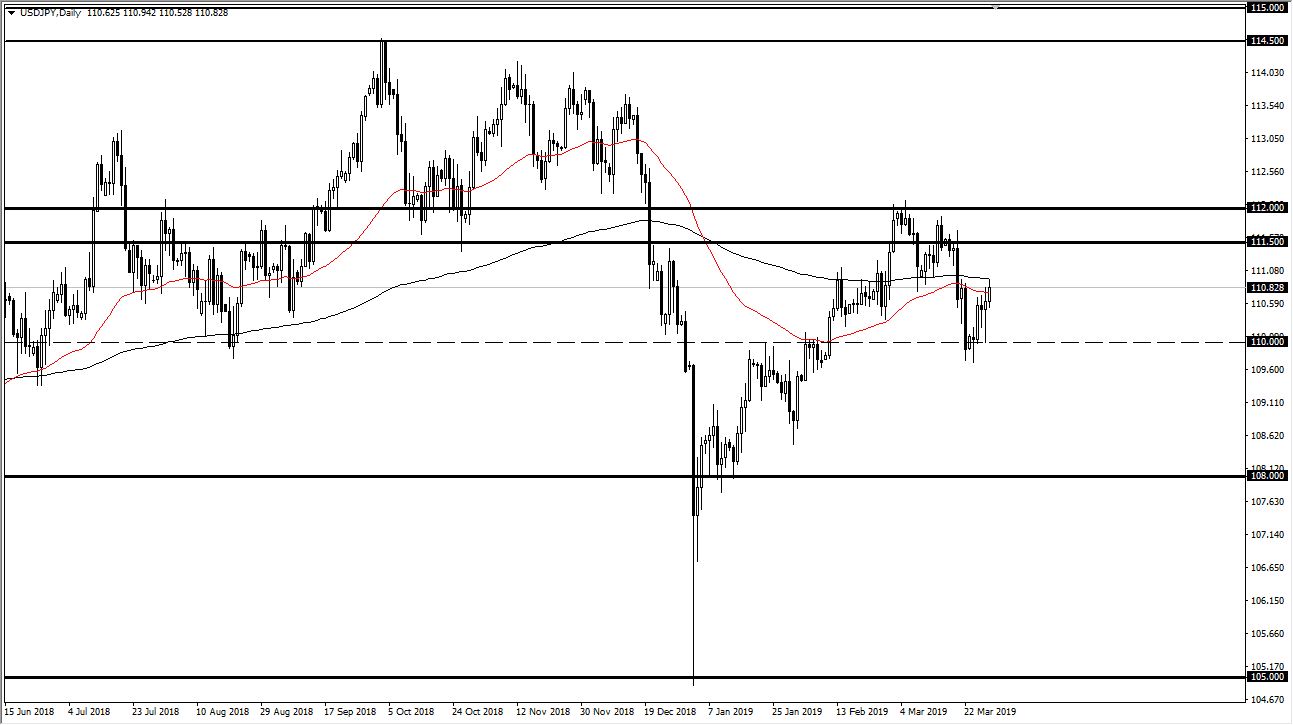

USD/JPY

The US dollar rallied a bit during the trading session on Friday, reaching towards the 200 day EMA. The market has been bullish over the last couple of days, as we have seen the market pulled back rather significantly towards the ¥110 level on Thursday but then turned around to show signs of life. After that, we then reached towards the 200 day EMA here on the Friday session. If we can break above that, then the market goes looking towards the ¥111.50 level which is the beginning of significant resistance to the ¥112 level. Overall, I like buying short-term pullbacks but I recognize that overall this is a market that’s going to be stuck in this range so it’s something that I’m going to play back and forth so I’m waiting to get to the extreme edges of the markets in order to play this pair.

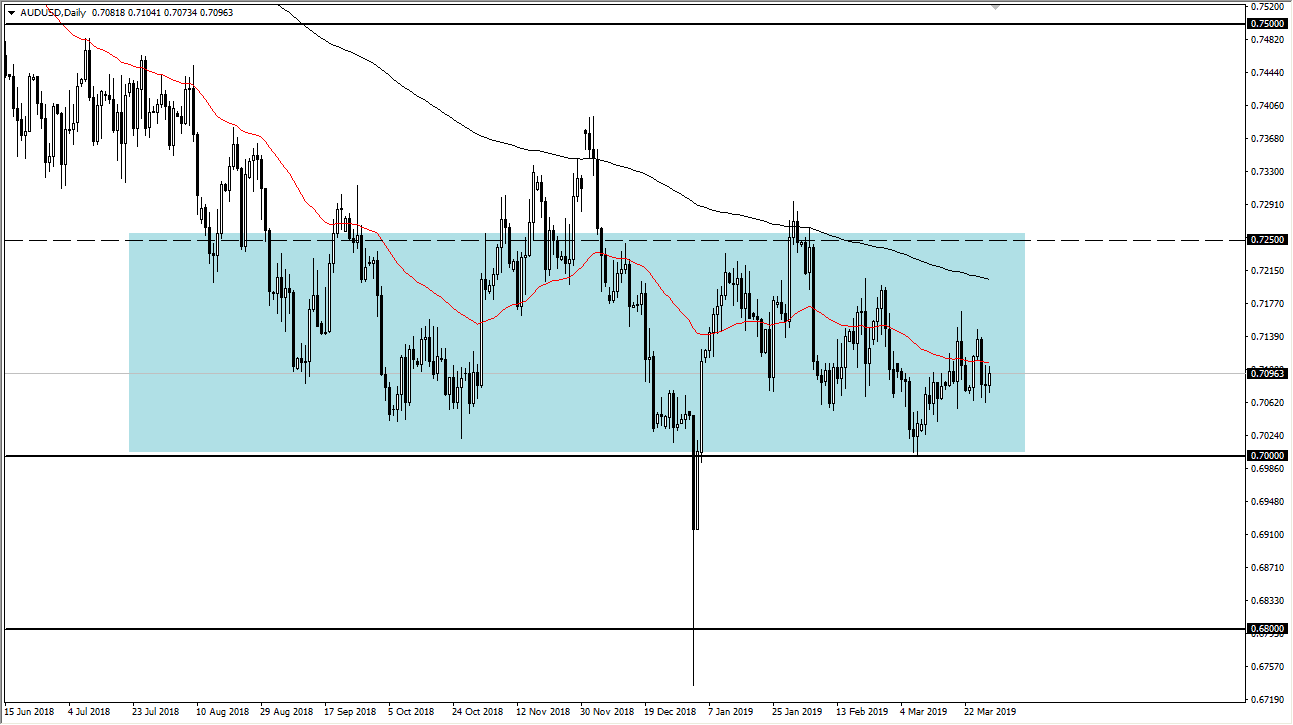

AUD/USD

The Australian dollar has rallied a bit during the trading session on Friday but continues to struggle with the 50 day EMA as it is essentially “balance” for the short term trading range. Overall though, there’s even more in interest down at the 0.70 level at the bottom, which is the beginning of massive support that extends all the way down to the 0.68 level. That shows up on the monthly charts as well, and of course because of this unplanned the market as such. I like buying short-term pullbacks, just to pick up 20 or 30 pips. Overall, the market is bullish and I think it is trying to change its tune overall, changing the trend to the upside. However, don’t expect big moves anytime soon as the Australian dollar is so sensitive to the US/China situation that is somewhat stagnant.