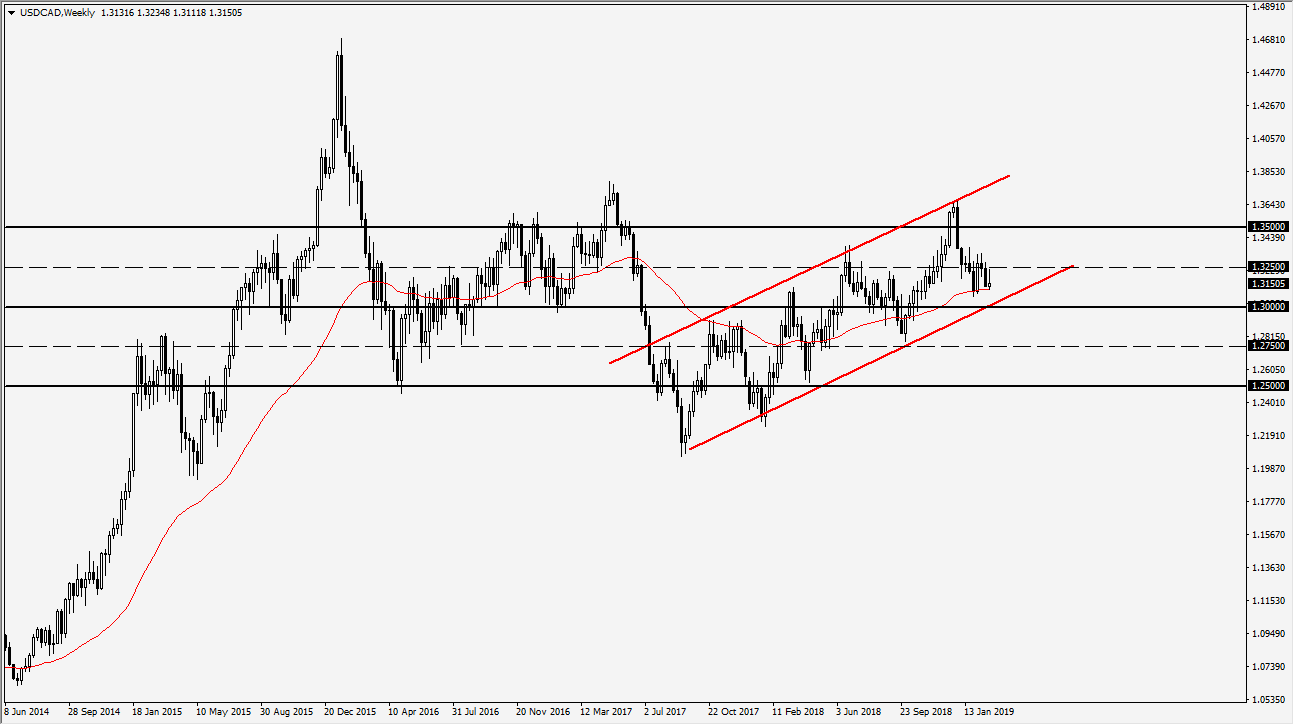

USD/CAD

The US dollar has been noisy against the Canadian dollar over the last four weeks, as February looks to be negative at the end. We are testing the 50 week EMA, but at the end of the day what we are really looking at is an up trending channel that’s about to be targeted. The uptrend line underneath coincides quite nicely with the 1.30 level, and I believe that a lot of things will be decided at that level.

Remember that the Canadian dollar is highly sensitive to oil, but there is also talk that the Bank of Canada will have to become a bit more dovish after recent economic disappointment. If that’s going to continue to be the case, it’s very likely that the up trending channel will hold closer to the 1.30 level. If we get a daily close below that handle though, it opens up the door to the 1.2750 level to the downside.

Remember, this pair tends to be very choppy in general, so keep your position size somewhat light. However, it’s likely that we are going to see a decision made over the next couple of weeks as to where we are going for the next few months. Simply put, below 1.30 we start to fall. If we see signs of that level, then we probably turn around and reach towards 1.3250 level. If we turn around and go back above the 1.3250 level without pulling back, that would be a very strong sign. It would probably coincide with weakness in the oil market.