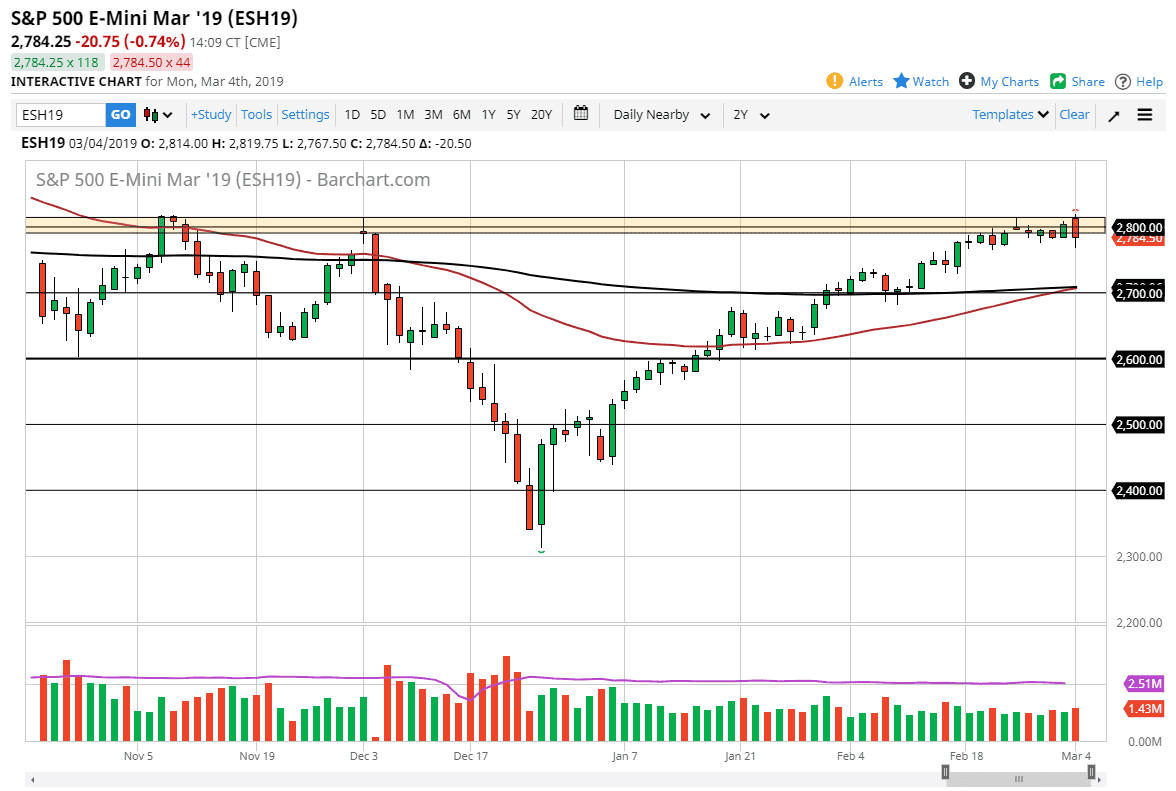

S&P 500

The S&P 500 had a volatile session during trading on Monday, initially gapping higher but then rolling over at 2810 to break down rather significantly. That being the case, it looks as if we are forming a relatively negative candle stick and if we can break down below the bottom of that candlestick, the market will drop a bit further from here, perhaps down to the 2700 level. However, if we can turn around and break above the top of the candle stick for the trading session on Monday, that would be an extraordinarily bullish sign. I think at this point you can count on a lot of noise, because we are trading on hope when it comes to the US/China trade negotiations. At this point, I think that the one thing you can count on is a lot of volatility.

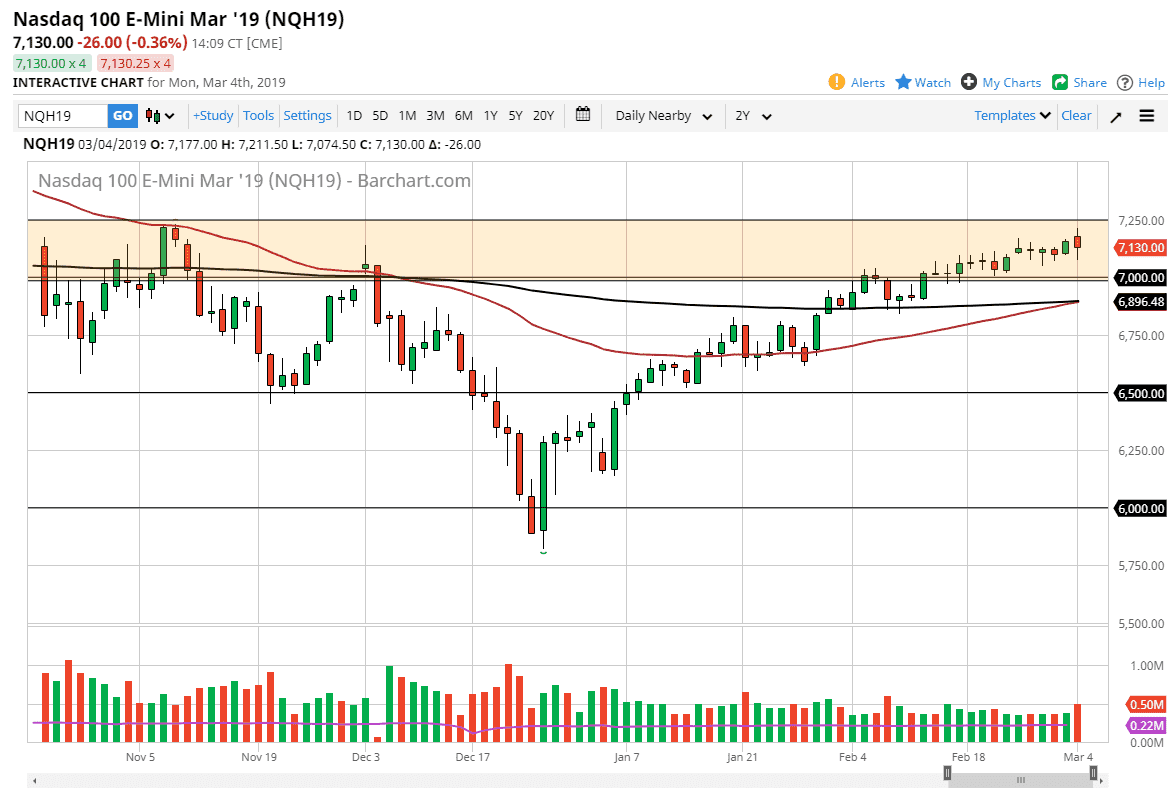

NASDAQ 100

The NASDAQ 100 also had a very volatile session on Monday but recovered much more significantly than the S&P 500. Because of this, it’s very likely that the market will probably lead the way if we rally. The 7250 level will of course be resistance as we have seen before, but if we can break above that level then the market should continue to go much higher. Otherwise, if we turn around and break below the 7000 handle then we could go looking towards the 200 day EMA. At this point, it’s probably going to remain quite volatile as we are at such a significant level when it comes to this market. The market will continue to move on those US/China headlines, with the NASDAQ 100 being particularly sensitive to those headlines as technology is such a huge part of that scenario.