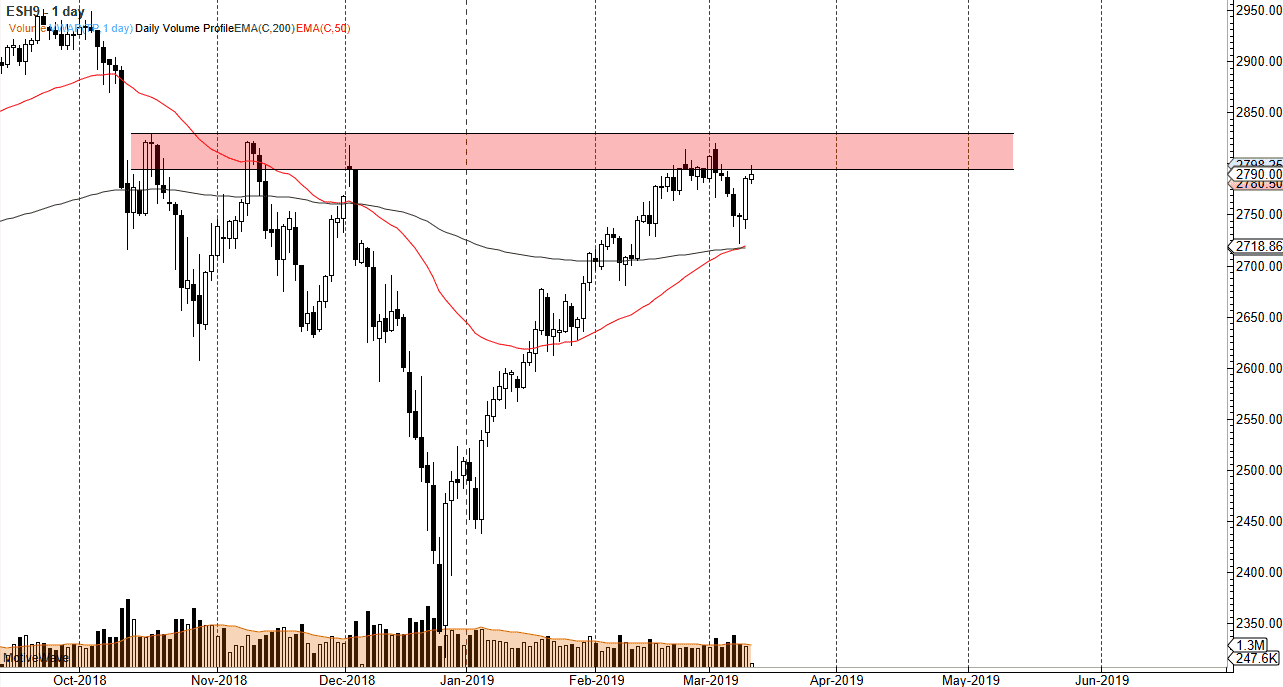

S&P 500

The S&P 500 rallied during trading on Tuesday, continuing the bullish pressure that we had seen on Monday. However, we could not overcome the resistance area, and therefore it’s obvious that we are running into a major problem. As we closed just a few points above positive, we have run into exhaustion and most certainly have had very little in the way of volume. This tells me that there are still plenty of people concerned about the obvious barrier overhead, so I would not be surprised at all to see this market pull back. That being said, if we broke higher during the trading session, it would be an extraordinarily bullish sign. All things being equal though, I anticipate that this market will probably pull back and go looking for buyers underneath.

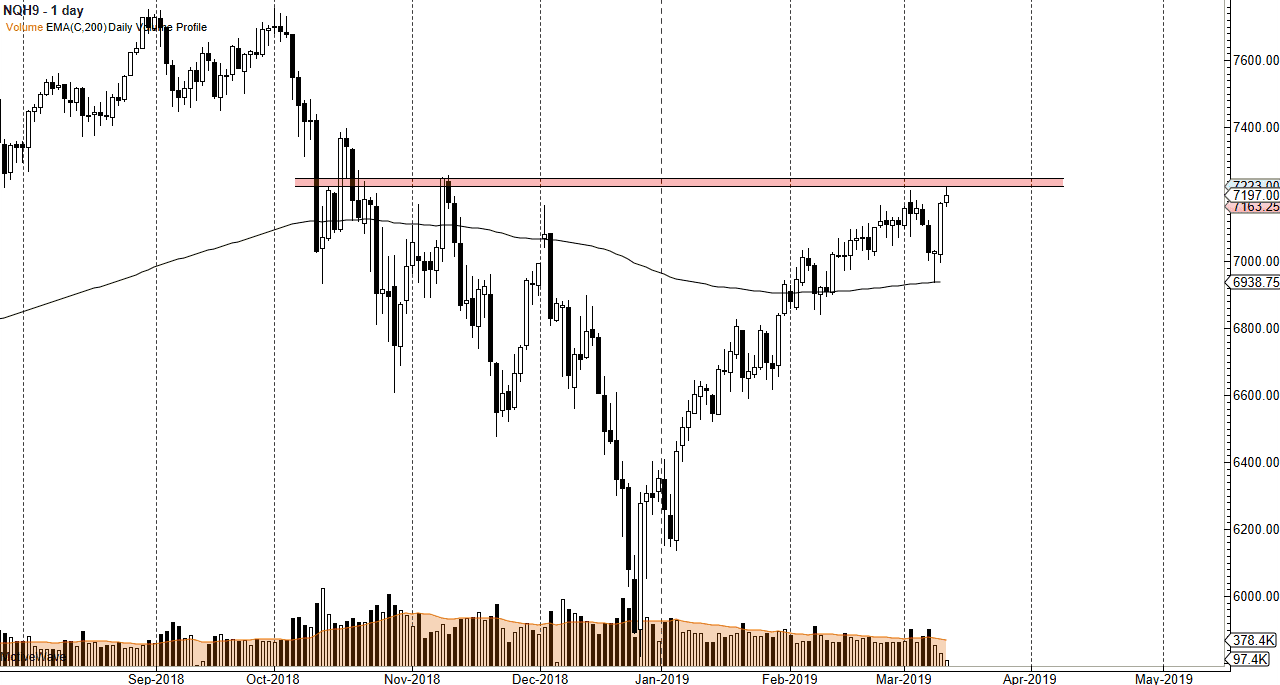

NASDAQ 100

The NASDAQ 100 also tried to rally during the day but couldn’t hang onto gains. Having said that, it was a larger percentage gain than the S&P 500, but we are clearly running into a buzz saw of trouble. I suspect that the market just doesn’t have the catalyst to go higher, which may be the Federal Reserve, or it could simply be people trying to see some type of US/China trade agreement. If we get that, that could be the catalyst to go higher, or it could be a “sell the event” situation, as so many people are expecting it. That being said, it’s obvious that we are facing a barrier above, so a pullback is probably the most likely situation. That being said, this is a bullish chart so even though today was a rather quiet, the reality is that the buyers are still very much in control, even if they are going to take a break more than likely on Wednesday.