USD/MXN

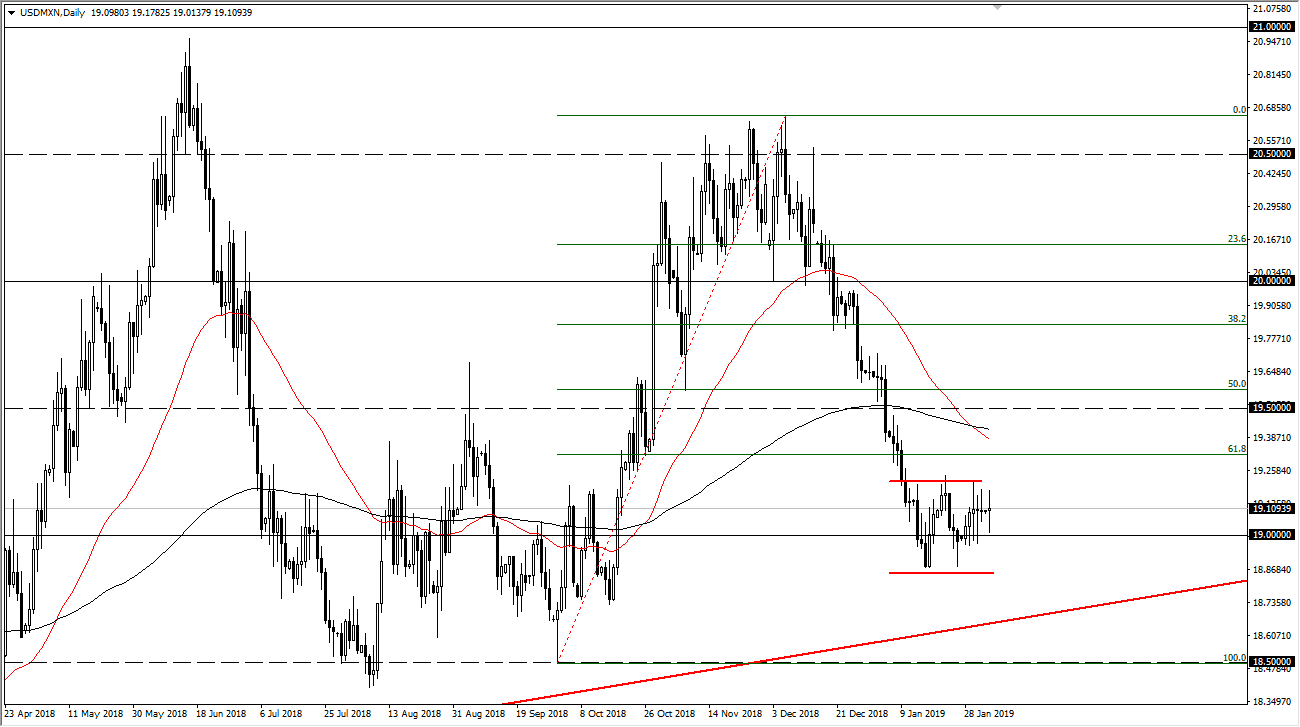

The US dollar has gone back and forth quite a bit against the Mexican peso to kick off the week, as we continue to test the 19 pesos region. As you can see, the action lately has been very choppy as we have a lot of neutral candles in a row, suggesting that we may be getting ready to see an impulsive move. I also have drawn a couple of lines representing support and resistance in this tight area, so when we break out of it I would expect that to be the beginning of the next major move.

The US dollar has taken it on the chin against several currencies around the world, and of course the Mexican peso hasn’t been any different. If crude oil can rally, that may help the peso as well, as it has been testing the $55 level in the WTI Crude Oil market. If that does in fact continue to break out to the upside that should break this pair down.

Another major driver of this potential move to the downside would be simple chasing of yield. The interest rate differential is rather large between the United States and Mexico, so as traders are looking for more yield, it makes sense that they go into emerging market currencies. With the Federal Reserve looking softer than it once did, that suggests that we should see some type of selling off of the US dollar, as interest rates are the biggest drivers of FX markets.

From a technical perspective, we also have seen the 61.8% Fibonacci retracement level broken to the downside, which typically means very bearish things. Beyond that, we also have just seen the “death cross” above of the 50 day EMA and the 200 day EMA. However, if we do break out to the downside we need to worry about a trend line just below that could keep this market somewhat resilient. Expect choppiness, and until we break out of the little rectangle that we are forming, it’s probably a short-term type of market.