USD/MXN

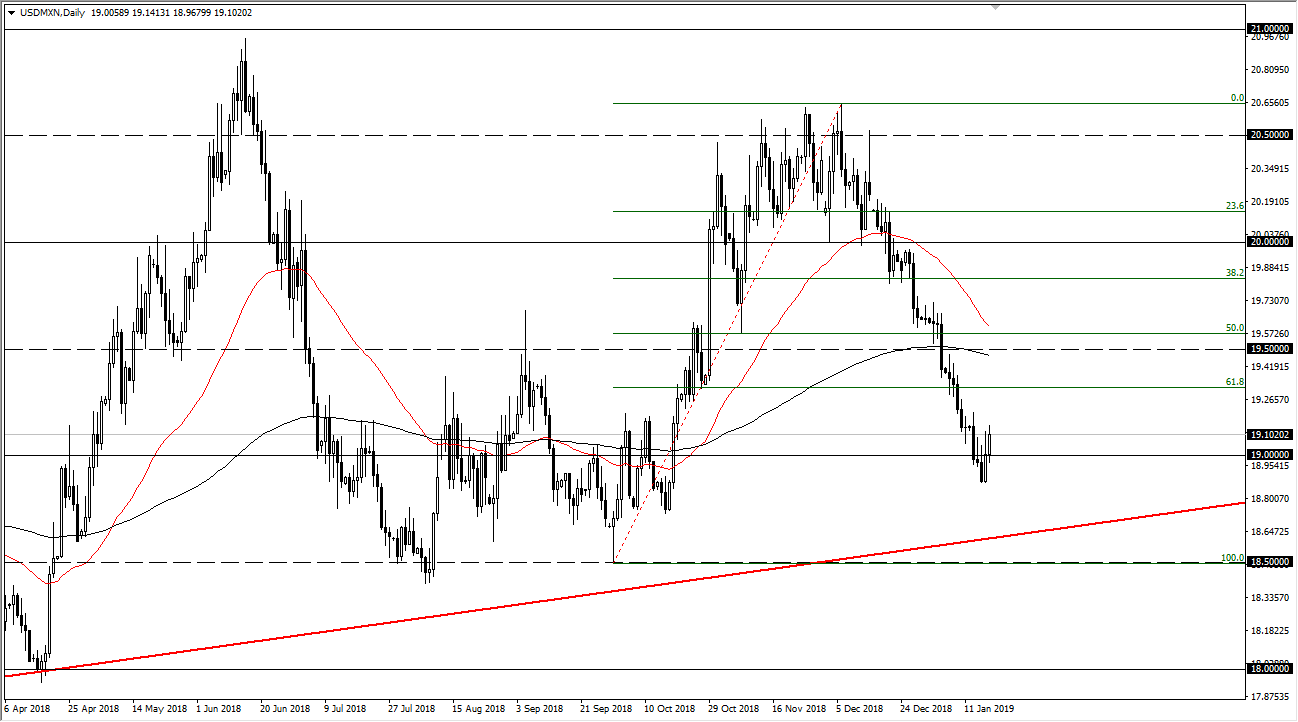

The US dollar has rallied a bit during the trading session on Friday, as we have seen a bit of US dollar strength overall. The fact that we have bounced above the 19 pesos level is a good sign, and of course there is the uptrend line just below. At this point, I think the US dollar being sold off against the Mexican peso has been a bit overdone, and a bounce is almost certainly needed. The 19.50 pesos level above could be a target as it is where the 200 day EMA is. Ultimately, the uptrend line underneath will more than likely be what keeps the market afloat, but if we do crash through it and the 18.50 pesos level, we could go much lower.

If oil rallies, that should help the Mexican peso, but most of this move has been right along with that. I think that oil probably could pull back a little bit as well, so I think a bounce makes a lot of sense on that front as well. The US dollar will continue to soften longer-term though, at least against most currencies as the Federal Reserve looks likely to sit on their hands in a somewhat neutral stance going forward. That being the case, I think that a short-term burst should attract selling at higher levels so I would look to fade rallies at this point now that we are well below the 61.8% Fibonacci retracement level, which normally gives way to wiping out the entirety of the move. If you are patient enough, you should get an exhaustive daily candle stick that you can take advantage of. If we were to turn around and break above the 19.50 pesos level, then we could have a complete turnaround.