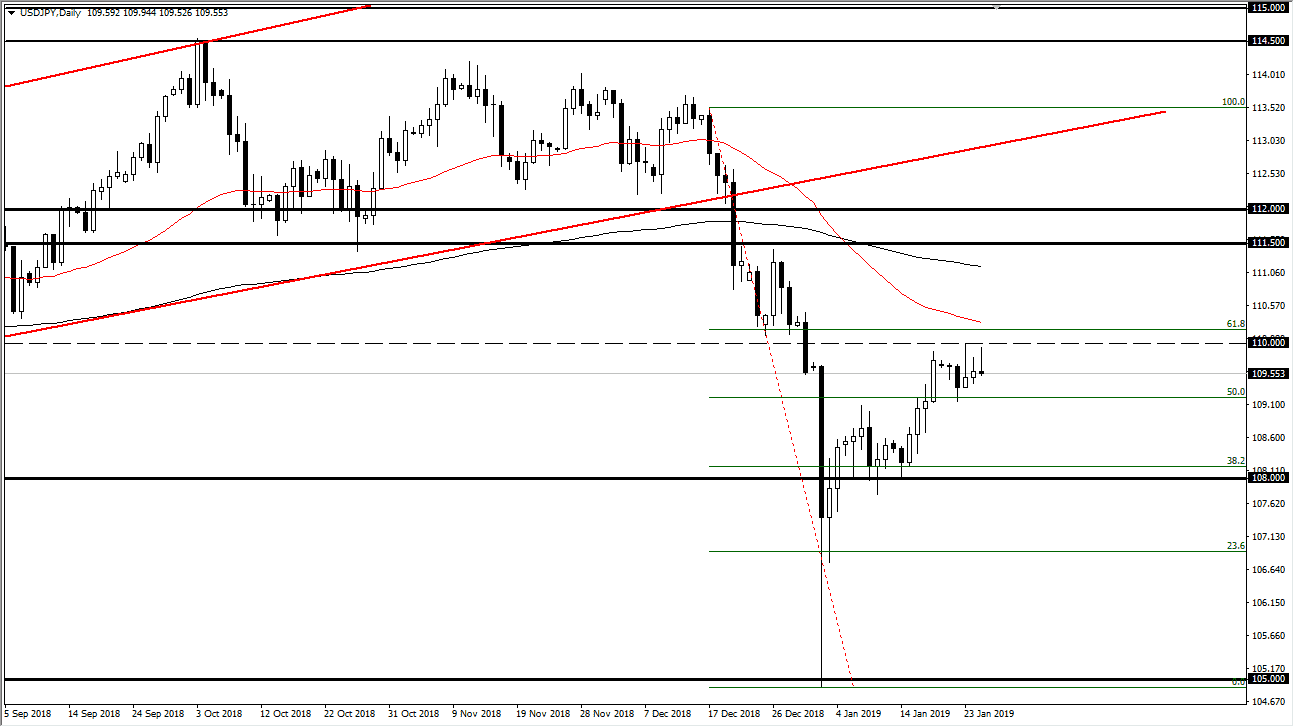

USD/JPY

The US dollar initially tried to rally during the trading session on Friday, but clearly has seen a lot of trouble at the ¥110 level. Ultimately, I think that the market will probably continue to rollover so I like the idea of selling short-term rallies as the ¥110 level has been a bit of a brick wall. Beyond that, it’s the 61.8% Fibonacci retracement that is just above it causing resistance. Looking at this chart, the 50 day EMA is just above as well, and I think we will continue to see a bit of downward pressure. I have no interest in buying this pair, because the 200 day EMA above also offers resistance, so I’m looking at exhaustion for three consecutive candles as a sign that we will in fact continue to see negativity here.

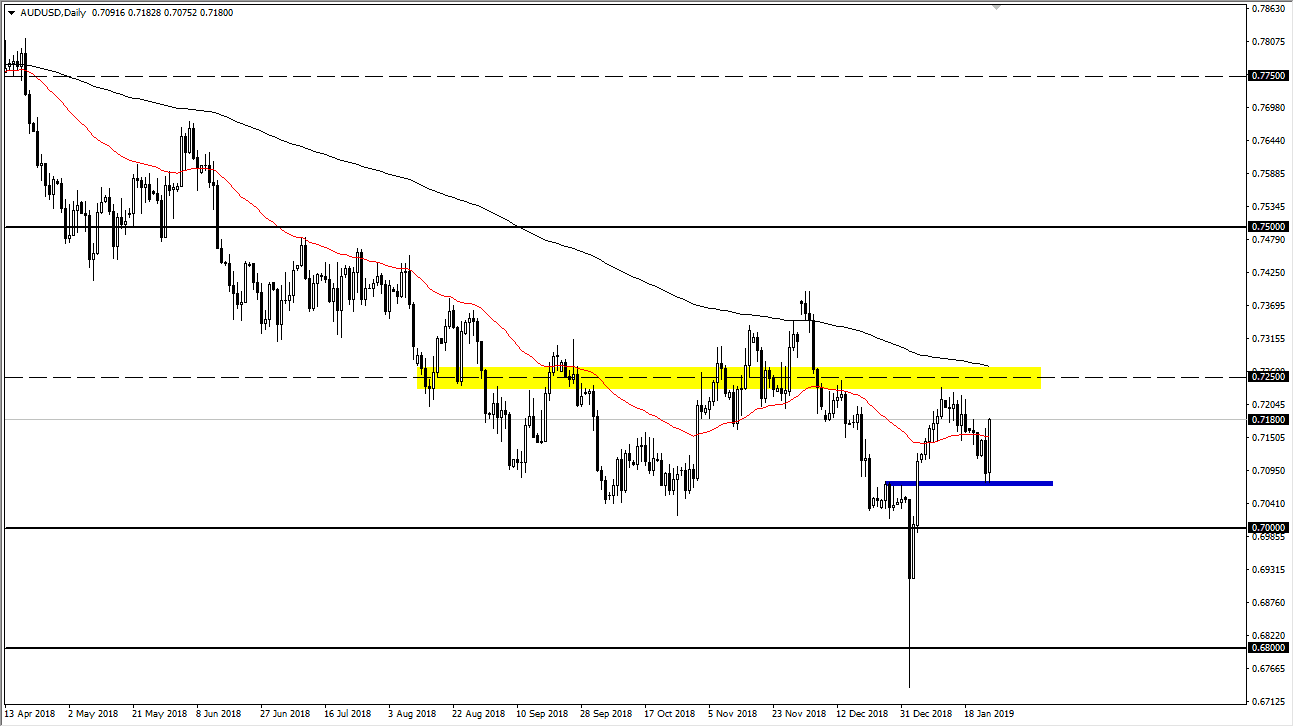

AUD/USD

The Australian dollar bounced significantly during the trading session on Friday as well, showing signs of strength as we broke above the 50 day EMA. I think that the market is ready to go back towards the 0.7250 level, as well as the 200 day EMA that is just above there. If we can get some type of movement between the Americans and the Chinese, it’s likely that the Australian dollar will rally significantly from there, but the 0.70 level underneath is the beginning of massive support so I think longer-term traders are going to continue to look at that as a “bottom” to the market. I think that bottom extends down to the 0.68 level, and I believe that it’s only a matter time before we go to the 0.75 handle given enough time. This is a market that continues to see a lot of volatility, but we have made a substantial bounce over the last couple of weeks.