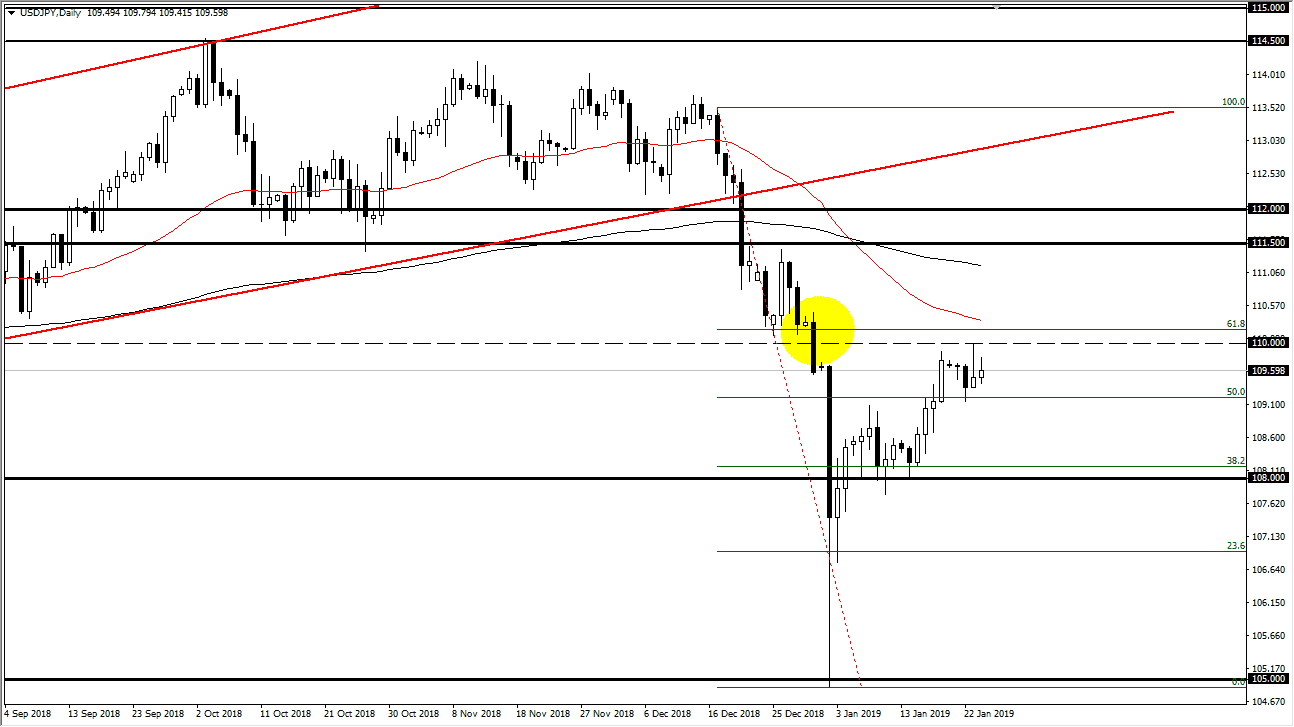

USD/JPY

The US dollar rallied slightly during the trading session on Thursday but gave back quite a bit of the gains from the move, just as we did on Wednesday. I believe that the ¥110 level will continue to offer significant resistance, as it not only is a round figure, but it also is an area where we had seen a lot of selling previously, and then of course the 61.8% Fibonacci retracement level, as well as the 50 day EMA. Because of this, I think that eventually the sellers will overwhelm the buyers, as we had seen so much technical damage done previously. Ultimately, I believe that this market will drop towards the ¥108 level, an area that was massive support previously, and if we can break down below there it’s likely that we will continue to go even lower, perhaps heading down to the 170 in level next.

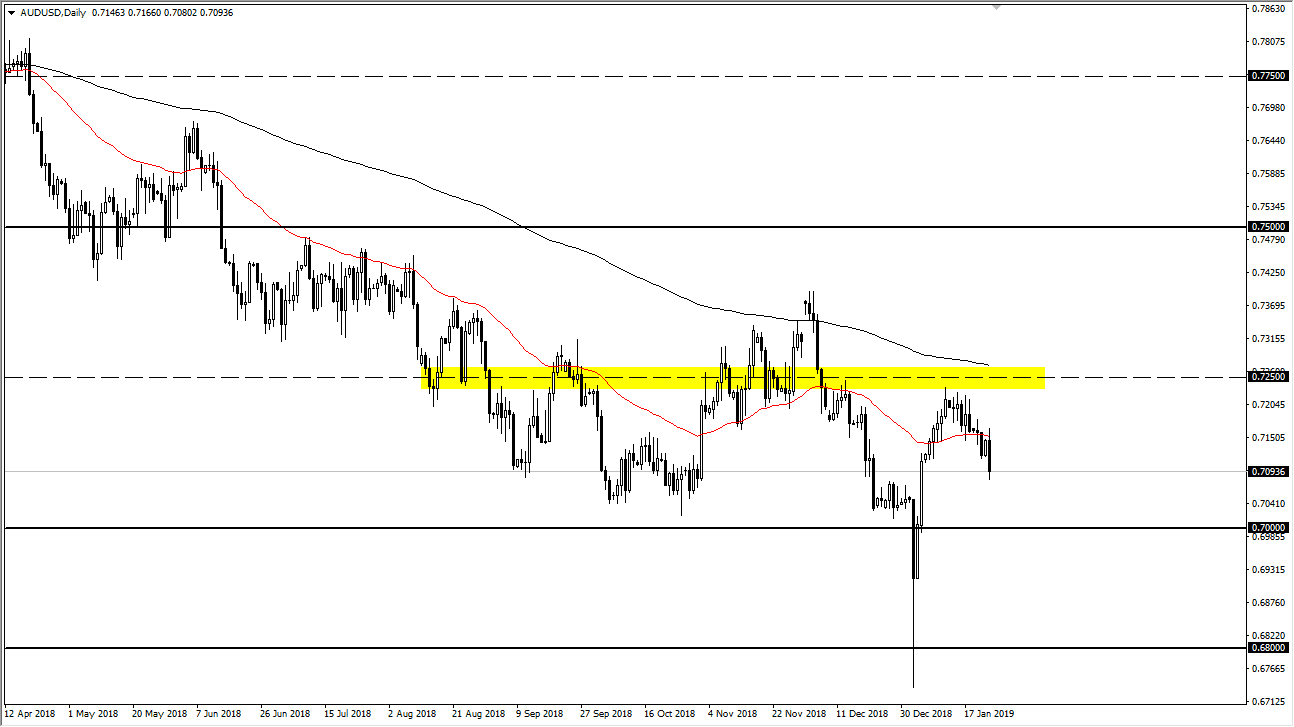

AUD/USD

The Australian dollar initially rallied during the trading session on Thursday but rolled over as the 50 day EMA has caused too much resistance. It looks as if we are going to continue to go a little bit lower, but I do think that there is massive amounts of support underneath, especially near the 0.70 level. I believe that begins a massive amount of support that extends down to the 0.68 level, an area that has importance not only during the recent trading action, but also the weekly and monthly time frames. I believe that this market will continue to move upon the idea of the US/China trade relations, and whether or not they will succeed or not. As the headlines come out, you can expect to see a lot of volatility. However, the Australian dollar has sold off so much that it’s difficult to imagine there are many sellers left. I do believe we are getting close to the bottom.