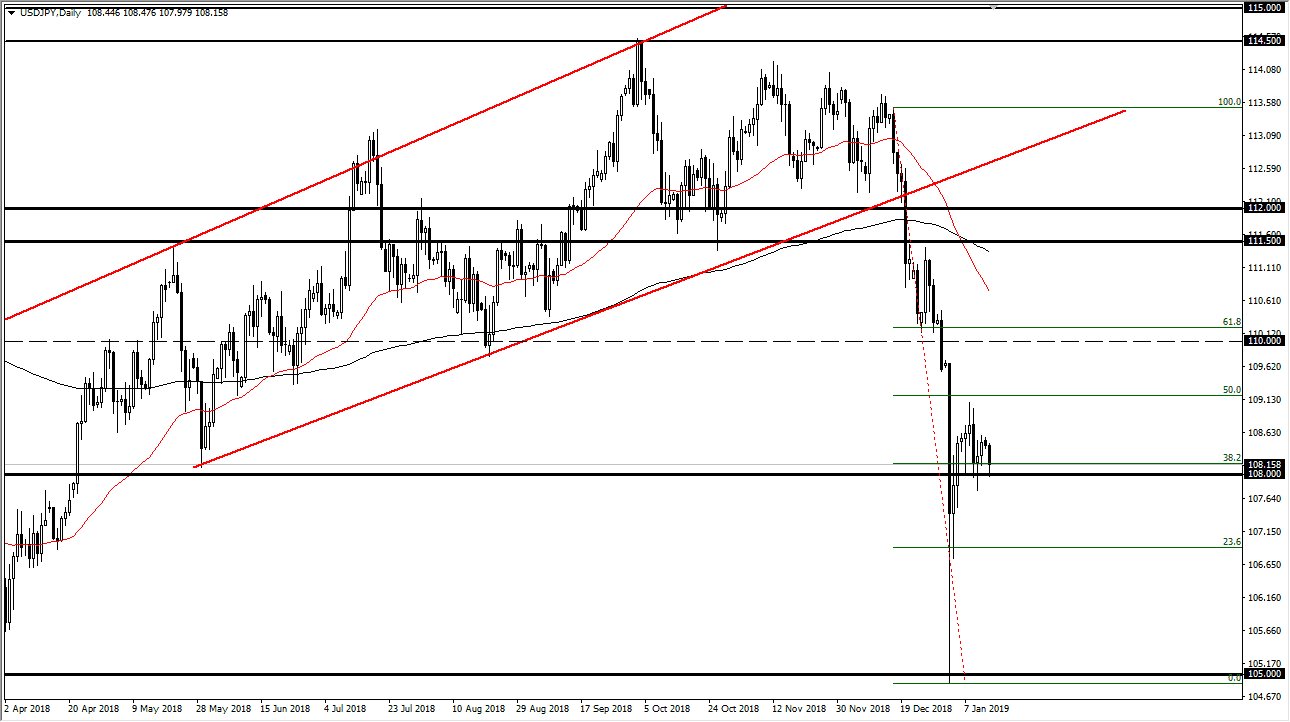

USD/JPY

The US dollar broke down during the trading session on Monday to kick off the week, testing the ¥108 level. This is a market that of course will move with the overall attitude of the US dollar, but more importantly move with the overall attitude of markets globally. Remember, it is very risk sensitive, and as stock markets go, so will this pair. Rallies at this point will probably continue to see resistance at the ¥109 level, and then perhaps the ¥110 level as well. I think at this point though, if we break down below the ¥108 level, then we go down to the ¥107 level, perhaps even down to the ¥105 level which was the bottom of the “flash crash” that we had seen. Expect a lot of volatility, but I still favor the downside.

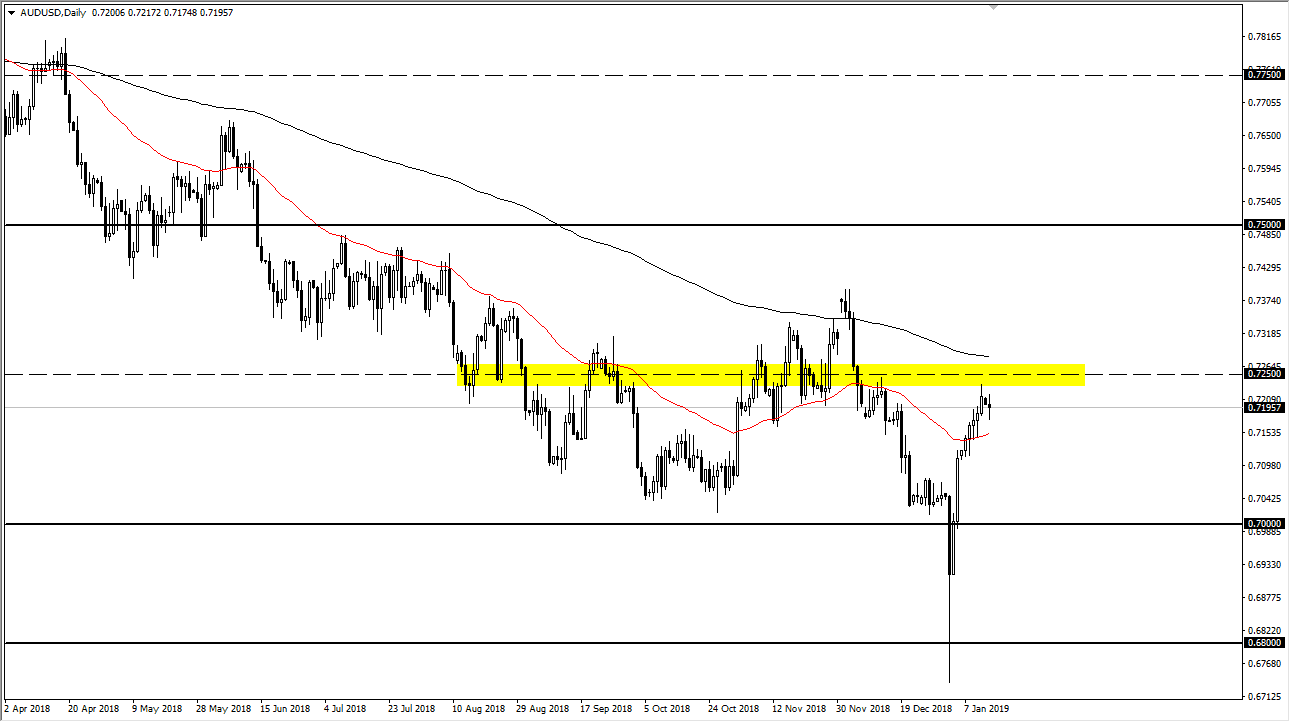

AUD/USD

The Australian dollar went back and forth during the trading session on Monday, as we continue to see a lot of volatility. The 0.7250 level above continues to be resistance, and of course we have the 200 day EMA just above there. Ultimately, if we break down below the candle stick for the trading session on Monday, then I think will test the 50 day EMA, then perhaps even the 0.70 level. I think the alternate scenario is that we break above the 200 EMA, and if we do then it’s likely that we could go much higher.

This is a market that has bounced quite drastically, perhaps based upon hopes coming out of the US/China trade situation. I think at this point, the market has gotten a bit ahead of itself, and I think the first negative tweet or headline will send this market right back over.