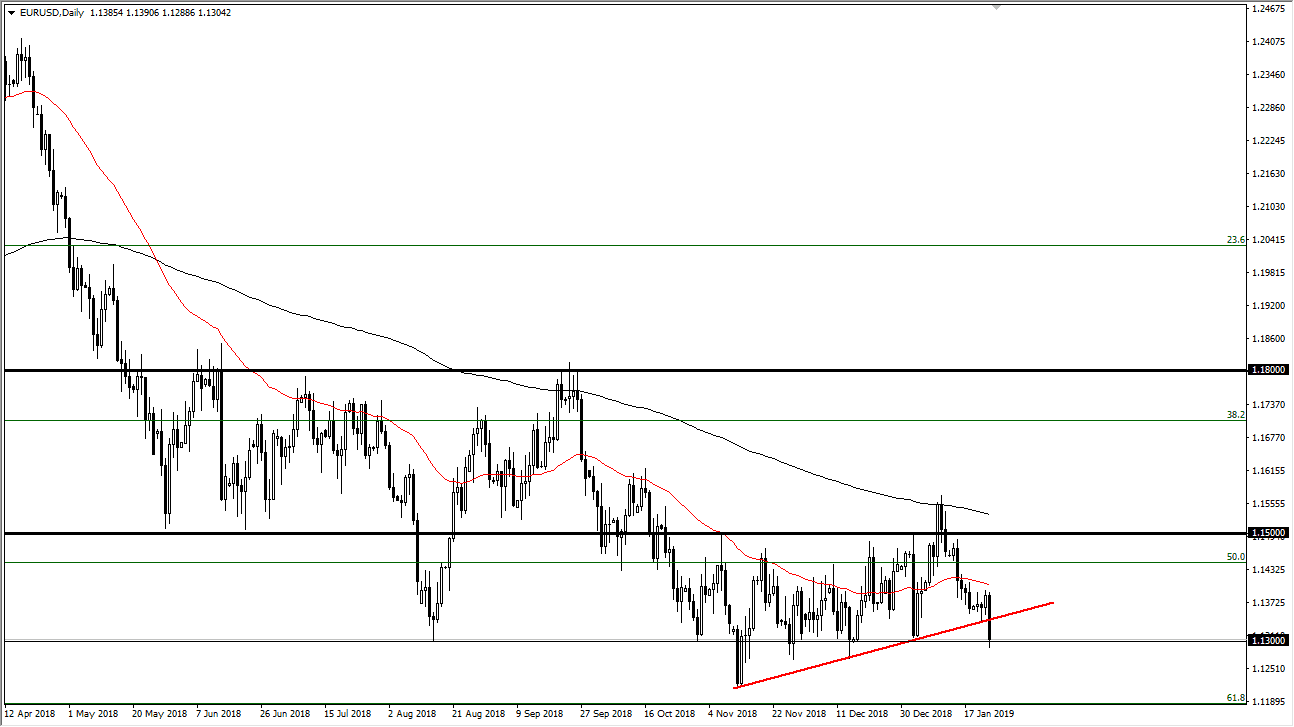

EUR/USD

The Euro broke down significantly during the trading session on Thursday, slicing through the uptrend line. That of course is a very negative sign, as we went crashing into the 1.13 level. The ECB had a press conference during the trading session, which sounded very dovish, and then sent the market down. We did get a bit of a bounce initially, but then we turned right back around and show just how bearish the market is. If we break down below the bottom of the candle stick for the trading session on Thursday, then I think the market could go a little bit lower but I also recognize that the 61.8% Fibonacci retracement level underneath will also offer support. At the end of the day, I think this is a market that has far too much in the way of sloppiness to get involved.

GBP/USD

The British pound pulled back a bit during the trading session on Thursday but found enough support above the 200 day EMA to turn around and form a bit of a hammer. If we can break to the upside, then we should go looking towards 1.33 handle. If we break down below the 200 day EMA, then we would essentially have a “hanging man”, which could lead to a pull back to the 1.2850 level. Ultimately, the fact that we have broken the 1.30 level is a very bullish sign for the British pound, as we continue to see traders buy the British pound due to a delay in the Brexit. I think that the softening tone of the Federal Reserve is also helping, so I look at pullbacks as potential buying opportunities, but obviously headlines can change this market in the blink of an eye.