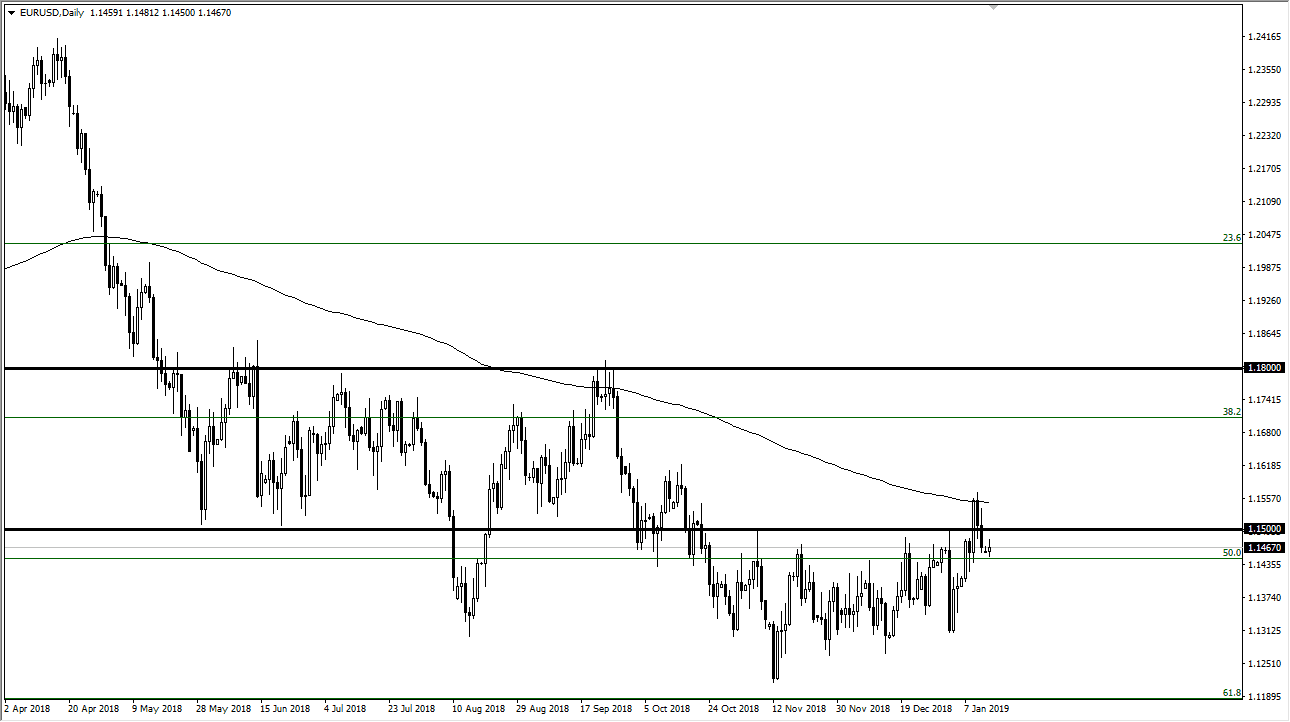

EUR/USD

The Euro tried to rally during the trading session on Monday but gave back quite a bit of the gains. The 1.15 level continues offer resistance, and it should be noted that the 200 day moving average has offered dynamic resistance. However, when I look at the longer-term picture, it appears that we have been forming a “rounded bottom.” That of course is a bullish sign but I think at this point what we are going to see a lot of choppy back-and-forth type of action. I do believe that if the Federal Reserve continues to suggest the option is, then we will eventually break out to the upside. After all, the European Central Bank is supposedly drawing down its asset purchases. I believe that the 1.14 level underneath should offer support, just as the 200 day EMA will offer resistance. I like short-term pullbacks for buying opportunities but I don’t expect much in the next few days.

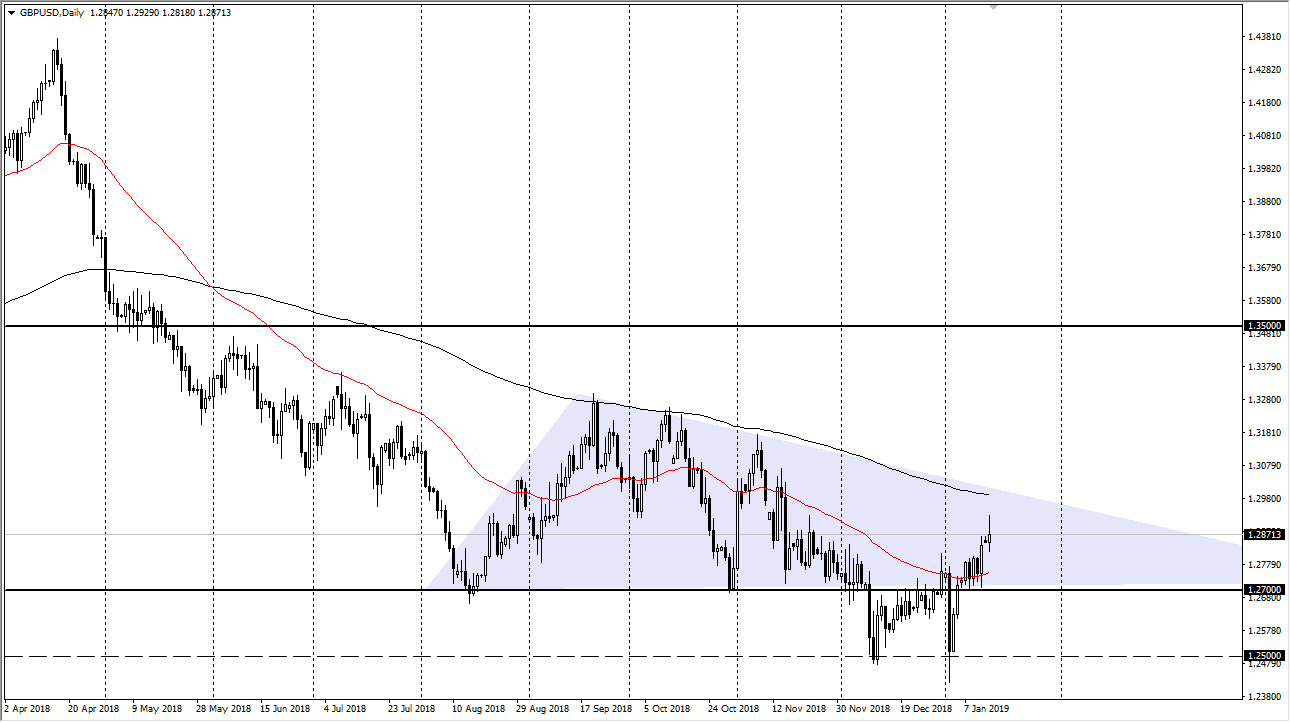

GBP/USD

The British pound rallied during the session on the opening day of the week, but as you can see we turned around and formed a massive shooting star. This is a market that has the 200 day EMA just above, and more importantly we have the British Parliament voting on the Brexit deal during the day on Tuesday. This will of course be important for the future of the British pound, and I think what we are setting up for is an opportunity to start selling again. Ultimately, the 1.27 level underneath is support, and if we can break down below there we could then go to the 1.25 handle. The alternate scenario is that we turn around and break above the 200 day EMA, which would be an extraordinarily bullish sign and could send this market looking all the way to the 1.35 handle. The next 24 hours could be crucial.