EUR/USD

The Euro initially tried to rally during the trading session on Friday but found enough resistance near the 200 day EMA to turn things around and drop below the 1.15 handle. That of course is a very bearish sign, and I think that we could see some short-term negativity. However, I think that given enough time we will see buyers jump back in and make another attempt at the 200 day EMA. I think ultimately this is a market that is simply seen some profit taking ahead of the weekend. I believe that we will get either a bounce or some type of supportive candle that we can take advantage of. If we can make a fresh, new high, then we can go much higher, perhaps reaching towards 1.18 level above. Ultimately, I think that we see a lot of noise in this area, but I still think that we are trying to turn things around.

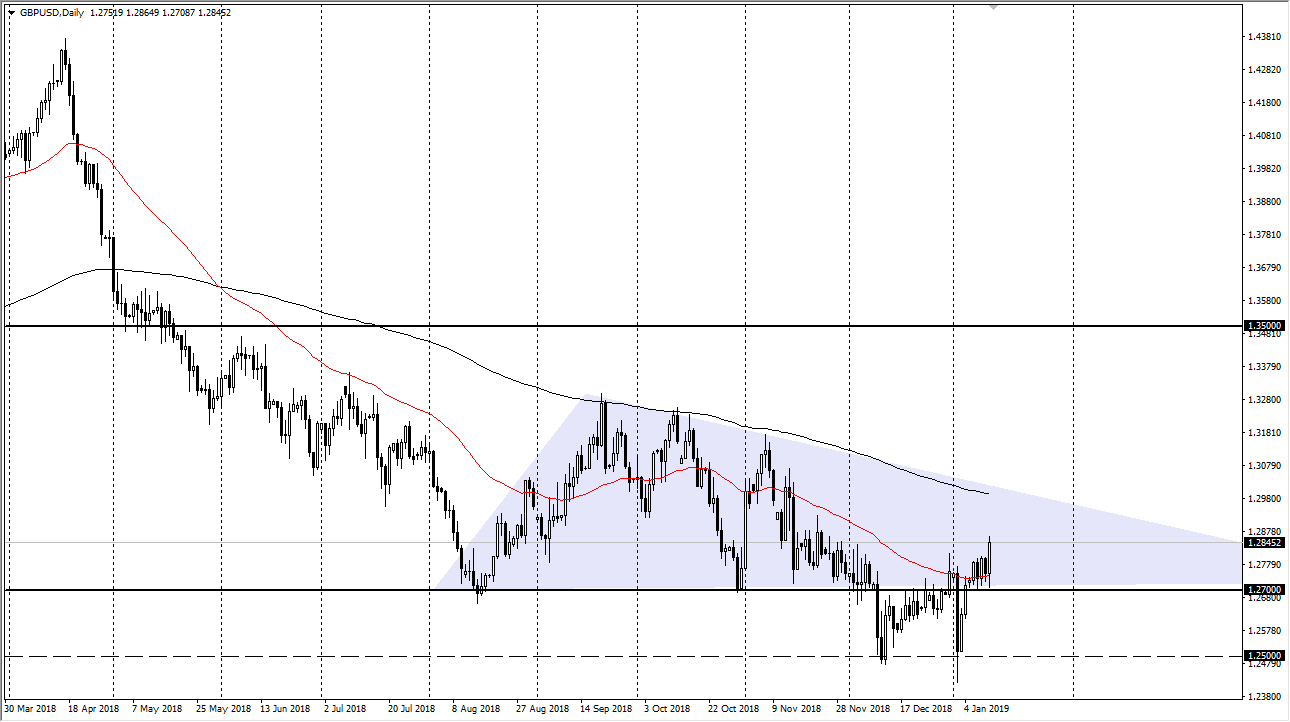

GBP/USD

The British pound initially pulled back during the trading session on Friday but found enough support at the 1.27 level to turn around to rally significantly. We broke above the 1.28 handle as well, which of course is a very bullish sign, and then I think that the market could go as high as the 200 day EMA. A lot of the move that we have seen has been due to the headlines coming out that the Brexit may be delayed beyond the March 29 deadline, and that seems to have people encouraged. I do think that we will get a nice selling opportunity above though, especially if we see the 200 day moving average come into play. I’m waiting for signs of exhaustion to fade, because unless there is some type of change the policy, nothing truly has changed that would matter.