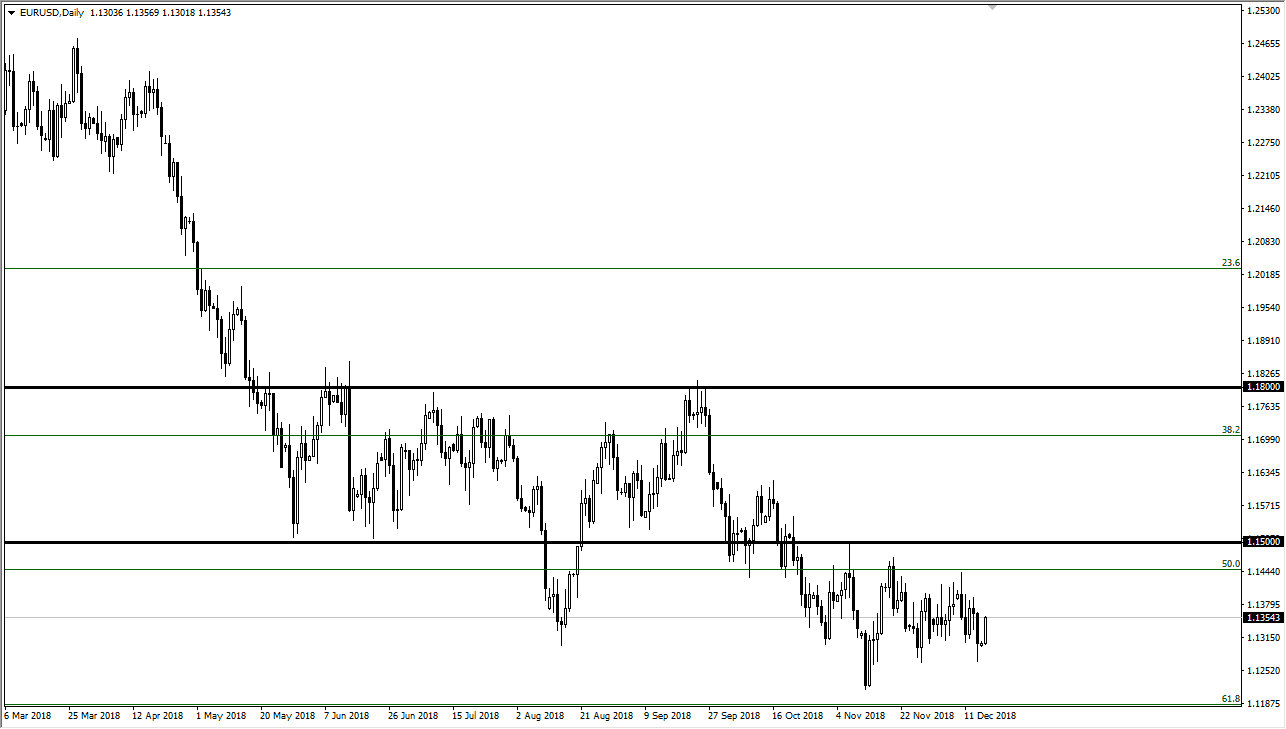

EUR/USD

The Euro rallied a bit during the trading session on Monday but is still within consolidation. This is a market that of course will continue to be noisy overall, as we await the Federal Reserve interest rate announcement, and more importantly the statement afterwards. I believe that the statement will be parsed as we try to figure out how the Federal Reserve will react next year. If they have a bit more dovish statement than anticipated, this could send this pair much higher. However, Jerome Powell sounds a bit more hawkish or at least willing to stick with an extra three interest rate hikes next year, we could see this market drop. Overall though, I think we are looking at a lot of sideways action. Choppiness will continue to be the way of this pair. I believe that the 1.15 level above is significant resistance and might be very difficult to break above anytime soon.

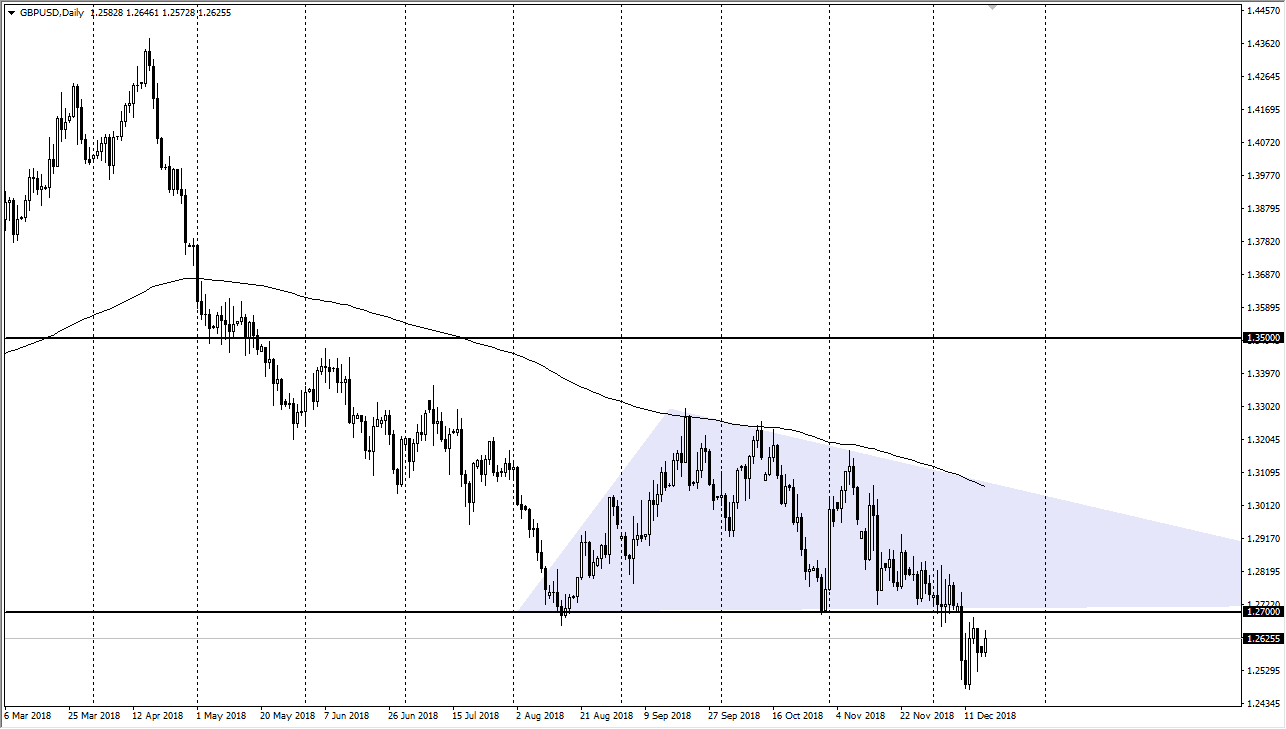

GBP/USD

The British pound continues to make a lot of noise in general, as we continue to react to the Brexit and all that comes with that. The headlines of course will continue to throw twitter around, and Twitter will continue to throw the British pound around. There are a lot of headlines flying around that continues to cause a lot of volatility, but the one thing that we do see quite often is going to be selling pressure. So at this point I believe that rallies are to be sold, and that the 1.27 level will continue to be very difficult to break to the upside. In fact, I suspect that based upon the previous descending triangle, we are probably going to go looking towards 1.22 level underneath.