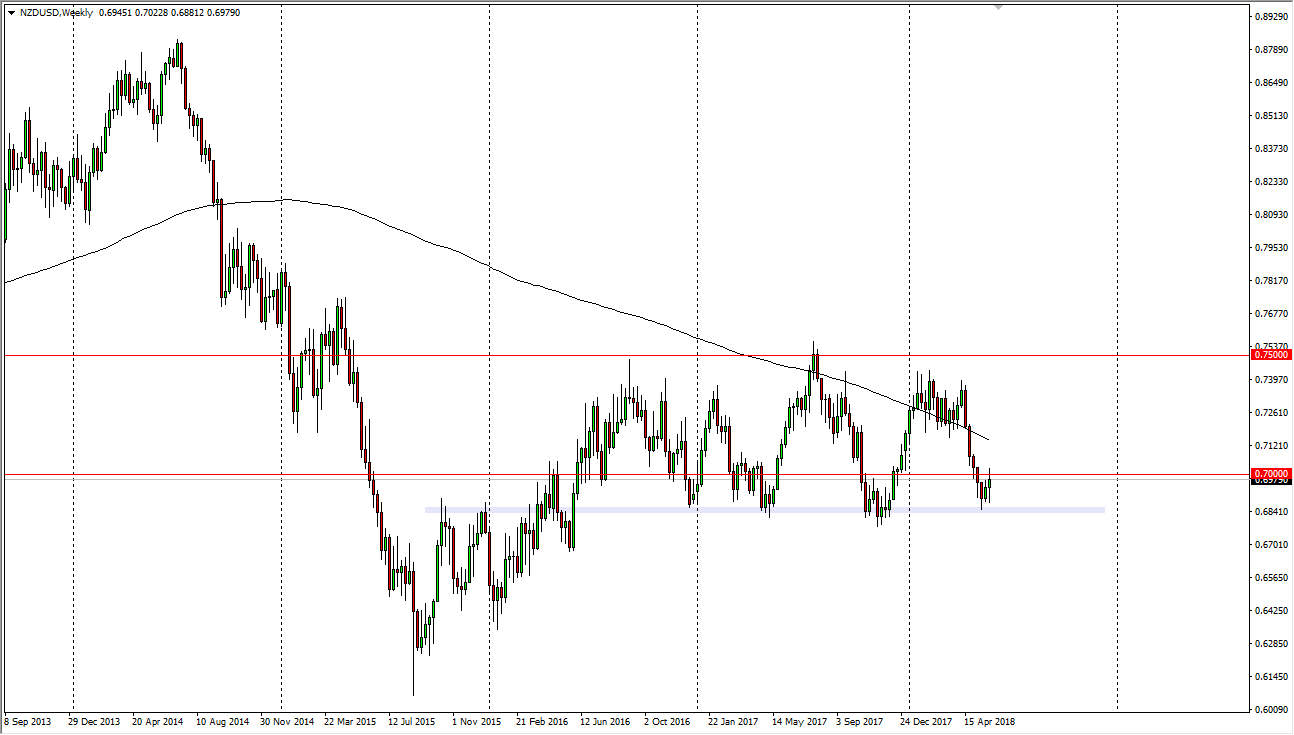

NZD/USD

The New Zealand dollar has gone back and forth during the week, as we continue to bounce around between the 0.68 level on the bottom, and the 0.70 level on the top. We did break above there momentarily, but if we can break above the top of the candle stick, I think the market reenters the longer-term consolidation and it should send this market looking towards the .74 region. Alternately, if we break down below the 0.68 handle, the market probably goes down to the 0.65 level, possibly even lower than that. However, we have been consolidating for a couple of years. I anticipate it’s easier to go higher than lower.

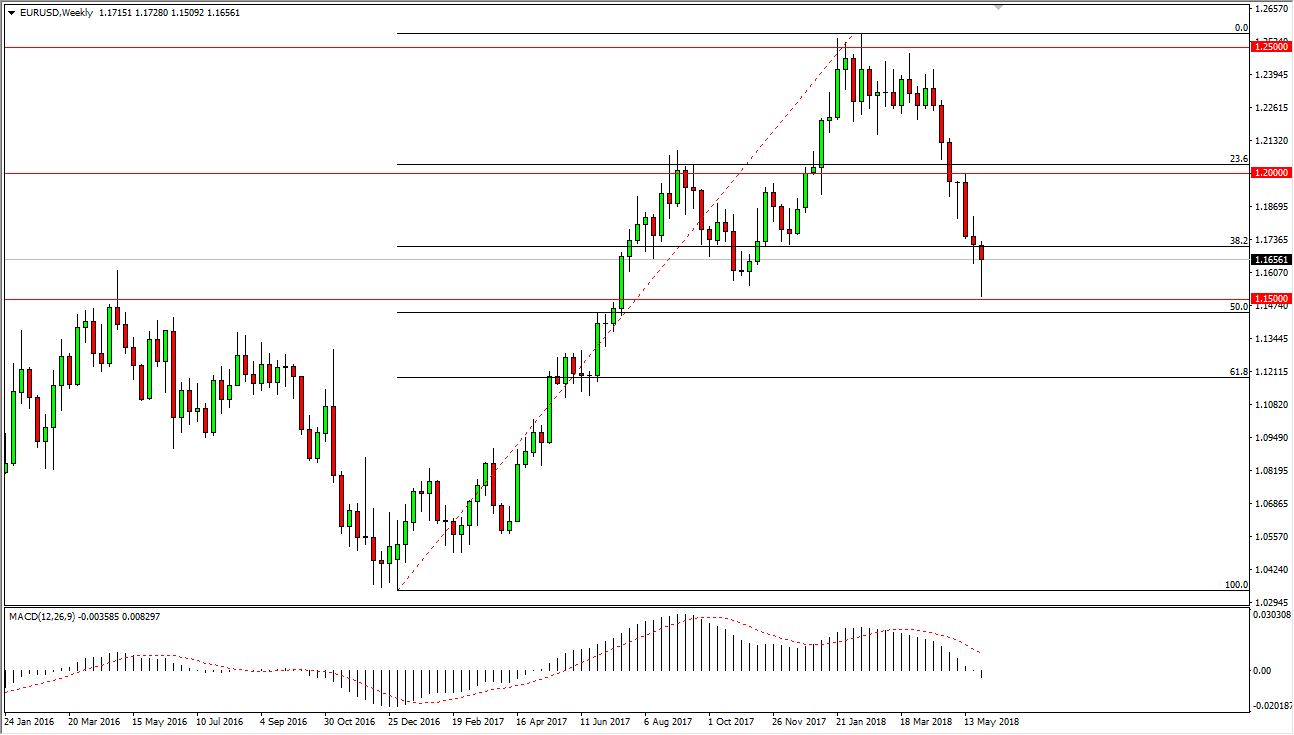

EUR/USD

The Euro fell significantly during the week but turned around to rally from the 1.15 handle. That’s an area that coincides with the 50% Fibonacci retracement level, and also structural resistance that now should offer support. The fact that we formed a hammer tells me that buying on the dips and building a position to go higher is probably what the so-called “smart money” is doing.

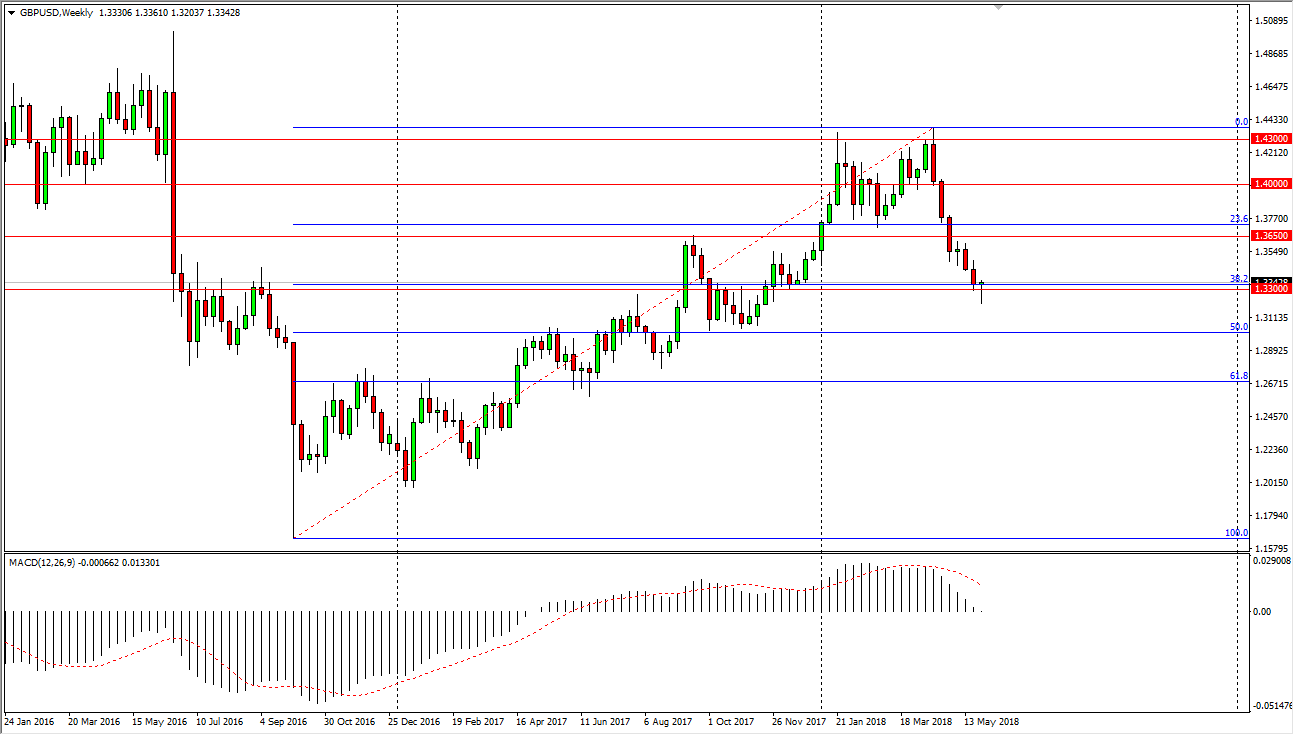

GBP/USD

The British pound also acted very much like the Euro, and I think the 1.33 level may be an area where we see buyers come into the marketplace and try to pick up value. I think a bounce over the next week is to be expected. However, if we break down below the hammer for the week, it’s likely that we would break down to the 1.30 level.

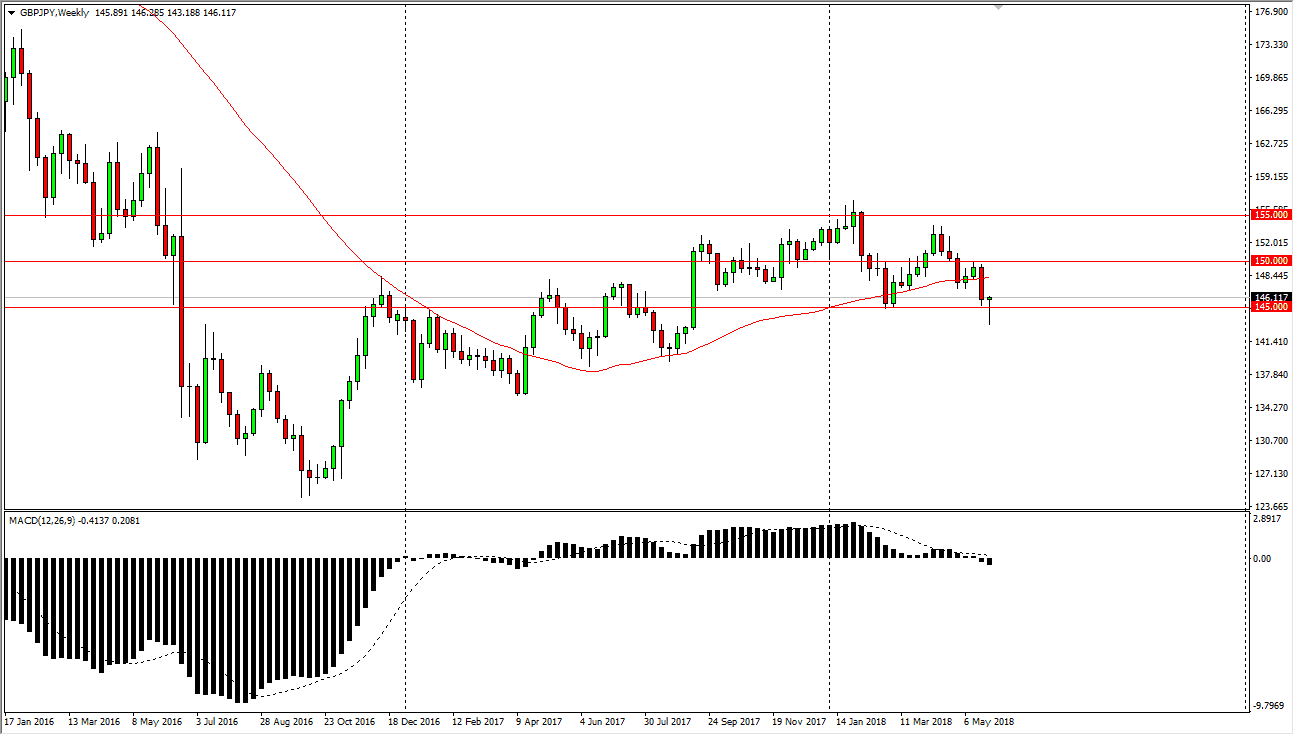

GBP/JPY

The British pound has broken down significantly during the course of the week, slicing through the ¥145 level. However, we turned around to form a massive hammer. If we can break above the top of the hammer, I think the market probably goes towards the ¥150 level again. The overall attitude of the market has been negative over the last several weeks, but with the Americans and the North Koreans meeting in the next couple of weeks, I think that we have a high probability of the risk attitude of market participants pushing this market higher.