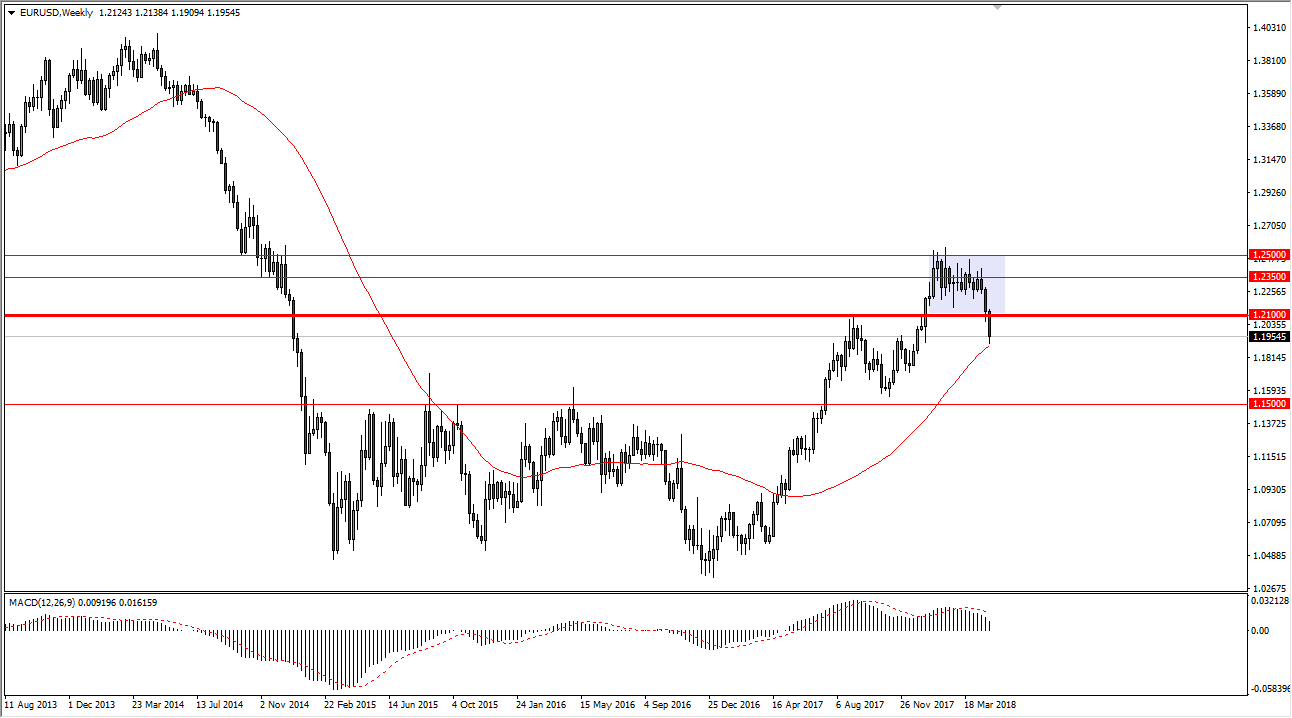

AUD/USD

The Australian dollar fell during most of the week, but then bounced enough to form a bit of a hammer on the weekly chart. That shows that we do have a significant amount of support at the 0.75 handle, but I think that the uptrend line should offer resistance, so I think that in the short term, we probably have sellers get involved in the market, but I think that we will initially show signs of a relief rally. Alternately, if we break down below the bottom of the hammer, then I think the market unwinds pretty significantly.

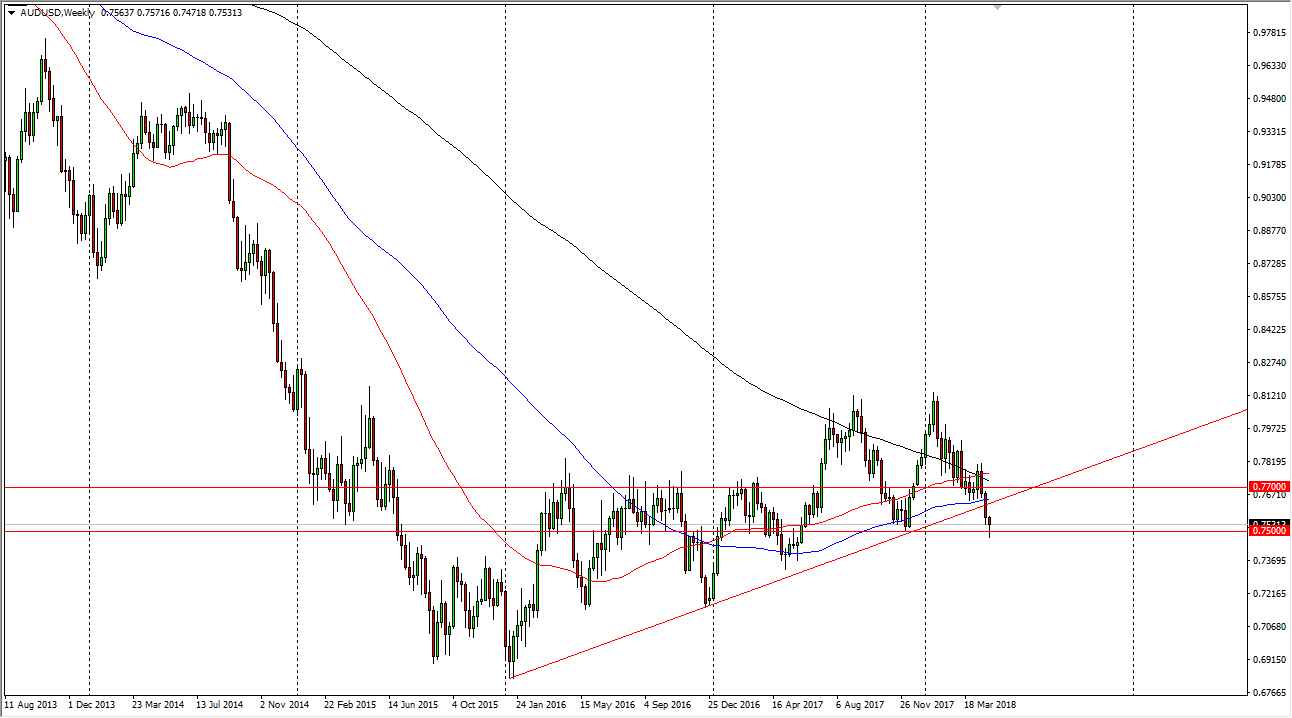

USD/JPY

The US dollar rallied significantly during the week but found the 110 level be far too resistant. We ended up forming a shooting star, which of course is a negative sign, and I think at this point we will probably see some negativity in her this market. This is more or less going to be a bit of exhaustion than anything else, so I’m waiting to see support underneath that the 107.50 level. If the market breaks up above the top of the shooting star, breaking above the 110 handle, then I think the market goes to the 112.50 level.

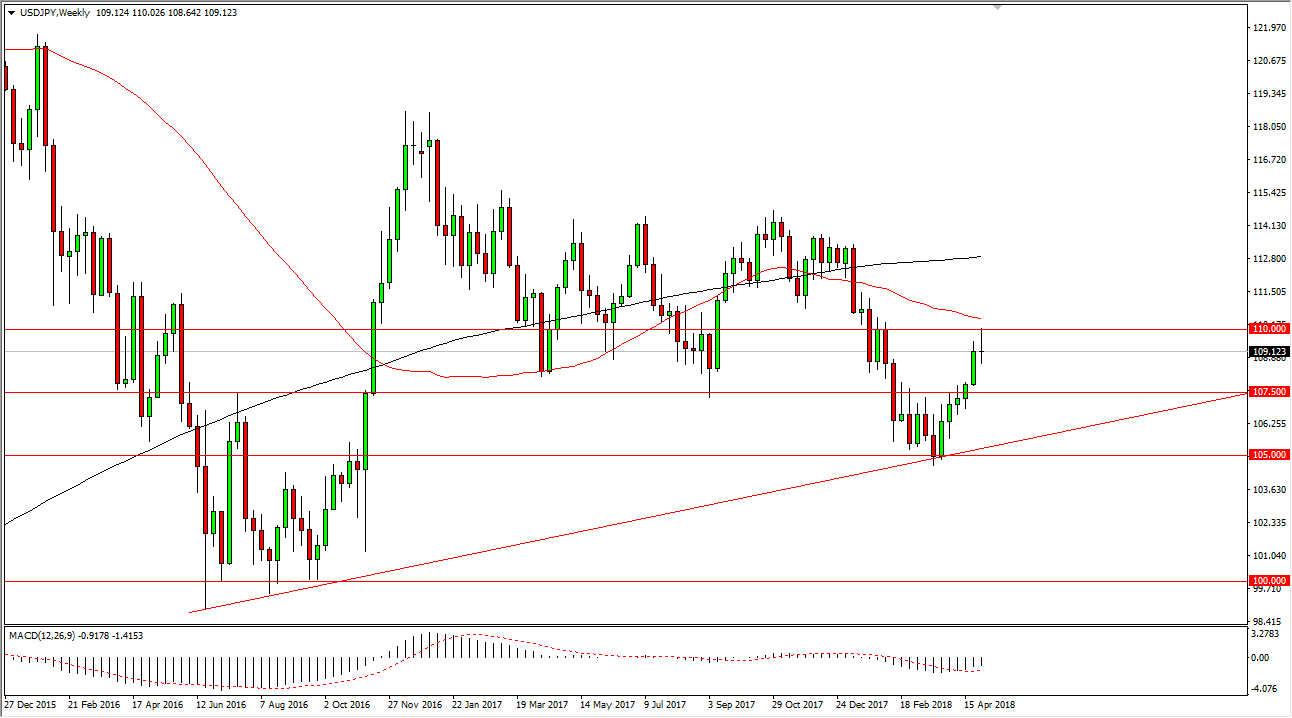

GBP/USD

The British pound has broken down significantly over the last couple of weeks, and I think that if we break down below the weekly candle from this past week, the market unwinds towards the 1.30 level. I think that this market should continue to find plenty of negativity, and if interest rates in the United States continue to rally, that sends this market much lower. Either way, I think that any rally needs to be looked at with suspicion.

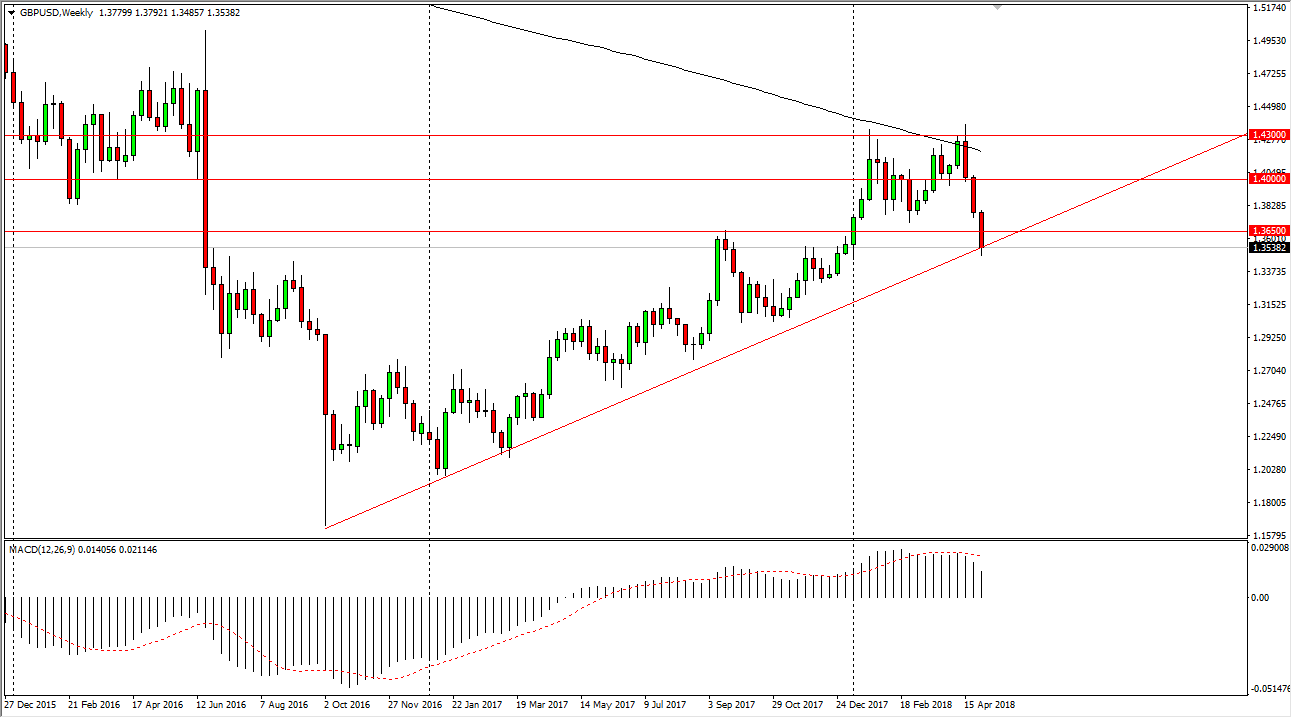

EUR/USD

The EUR/USD pair broke down below the 1.21 handle during the week, and even broke below the 1.20 level. So, I think that if we can break down below the bottom of the candle, the market will continue to unwind, perhaps even as low as 1.15, but that’s the longer-term target more than anything else. I think short-term rallies continue to be selling opportunities, unless of course we can break above the 1.21 handle.