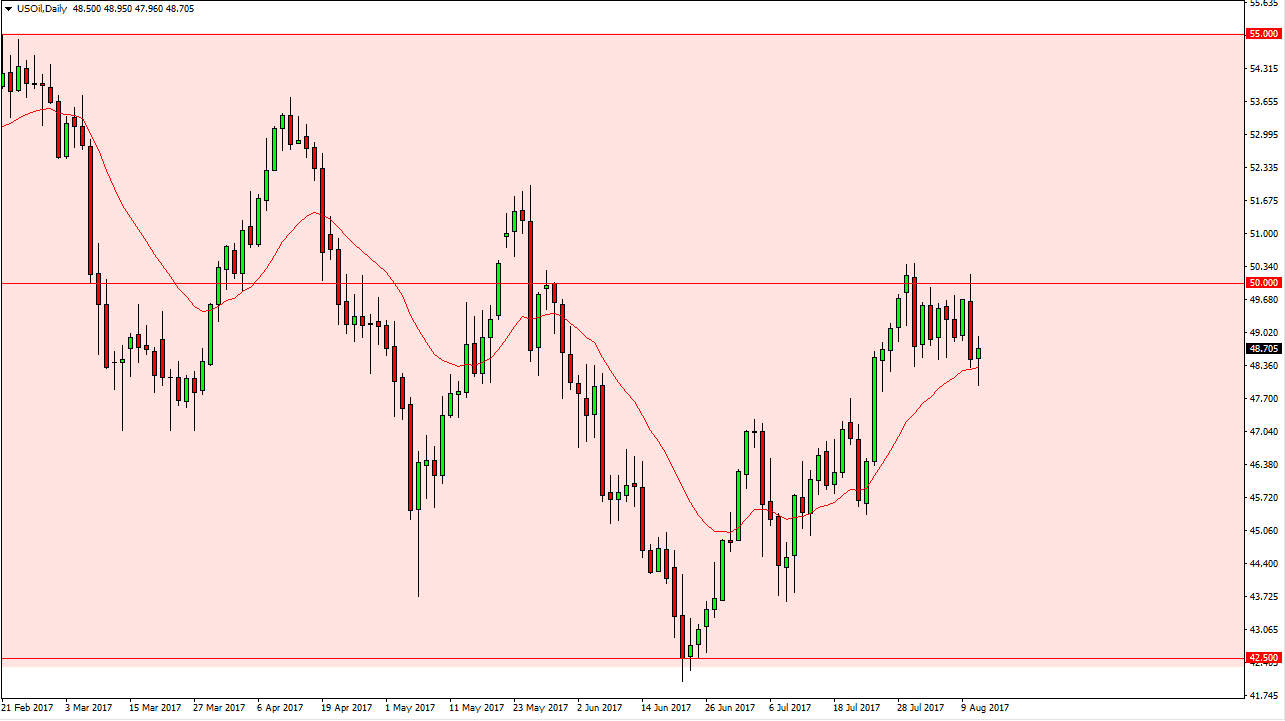

WTI Crude Oil

The WTI Crude Oil market initially fell during the day on Friday, but turned around to form a hammer. The hammer of course is a very bullish sign, and a break above the top of the candle should send this market towards the $50 handle. This is a market that continues to see quite a bit of volatility, and as a result I think that we will probably chop around quite a bit. However, I think that the market should continue to offer short-term range bound trading. If we break above the $50.50 level, the market should continue to go much higher. However, if we break down below the bottom of the hammer, then the market should break down significantly. Quite a bit of volatility could be a factor in this market going forward.

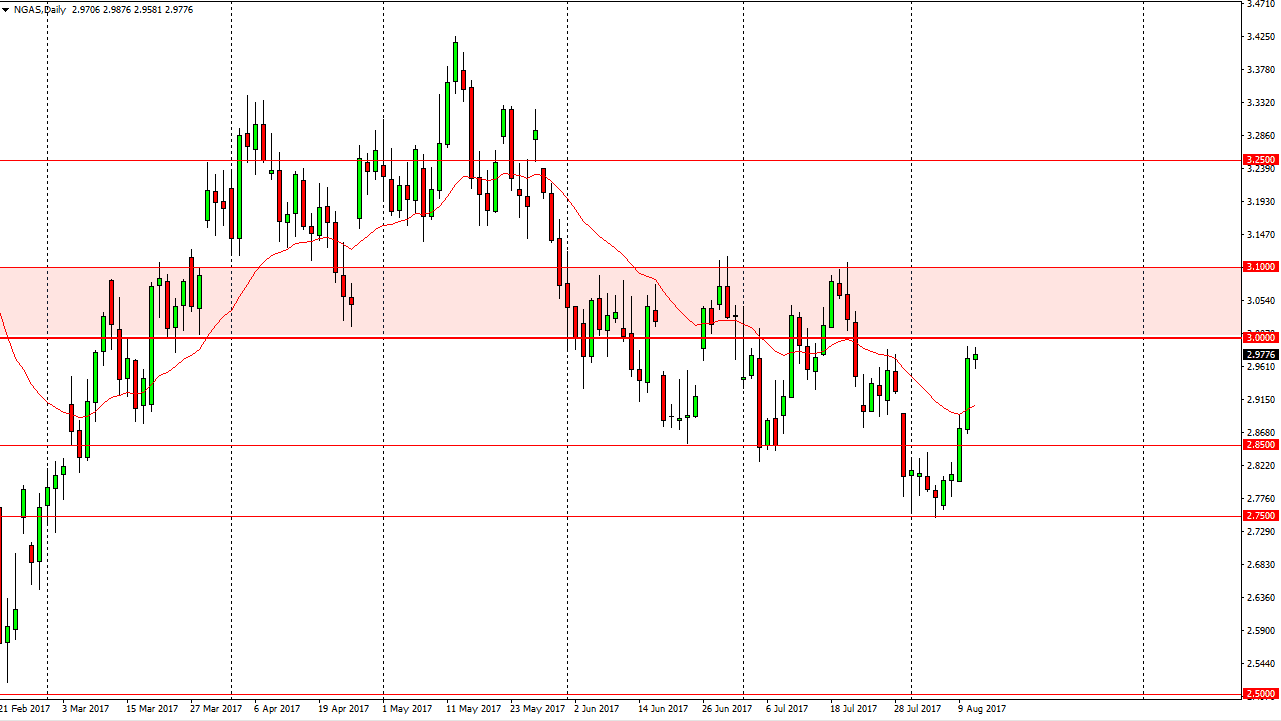

Natural Gas

The natural gas markets went back and forth on Friday, struggling to get above the $3.00 level. Ultimately, this is a market that I think has a lot of resistance above the $3.00 level, extending to the $3.10 level above. The market looks likely to turn around on a breakdown below the bottom of the candle, and it should send this market down to the $2.85 level. I think that the longer-term downtrend should continue to push this market lower. I think the first target would be the $2.85 level, and then eventually the $2.75 level under that. I am a seller of rallies, and I think that the market should continue to see quite a bit of bearish pressure. Ultimately, this is a market that I think will continue to see a significant amount of selling pressure given enough time, as the oversupply should continue to weigh upon the marketplace going forward.