The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 13th August 2017

Last week, I saw the best possible trade for the coming week as long DJX. The result was negative: the Dow Jones 30 Index fell by 0.81%.

Last week saw the more bullish U.S. Dollar sentiment continue to prevail, and then market sentiment changed suddenly with North Korea and the U.S.A. trading threats which may lead to confrontation if a missile test in the direction of Guam is conducted by North Korea. This sent stocks falling and although it was broadly positive for the U.S. Dollar, it was more positive still for Gold, the Japanese Yen, the Swiss Franc and the Euro, all of which tend to appreciate in “risk-off” periods.

This week is tricky to forecast as although “risk-off” should persist for a while, the FOMC Meeting Minutes release on Wednesday may change sentiment. Following the current picture, I see the highest probability trade this week as long of the Japanese Yen, the Euro, and Gold, and short of the U.S. Dollar.

Fundamental Analysis & Market Sentiment

The major elements affecting market sentiment at present is “risk-on” sentiment, which is strengthening safe-haven assets and weakening the commodity currencies.

As we are now well into the traditionally quiet month of August, we may see a general decrease in volatility and a flattening out of the market once the FOMC release is out of the way, if it contains no surprises and tensions between the U.S.A. and North Korea decrease.

Technical Analysis

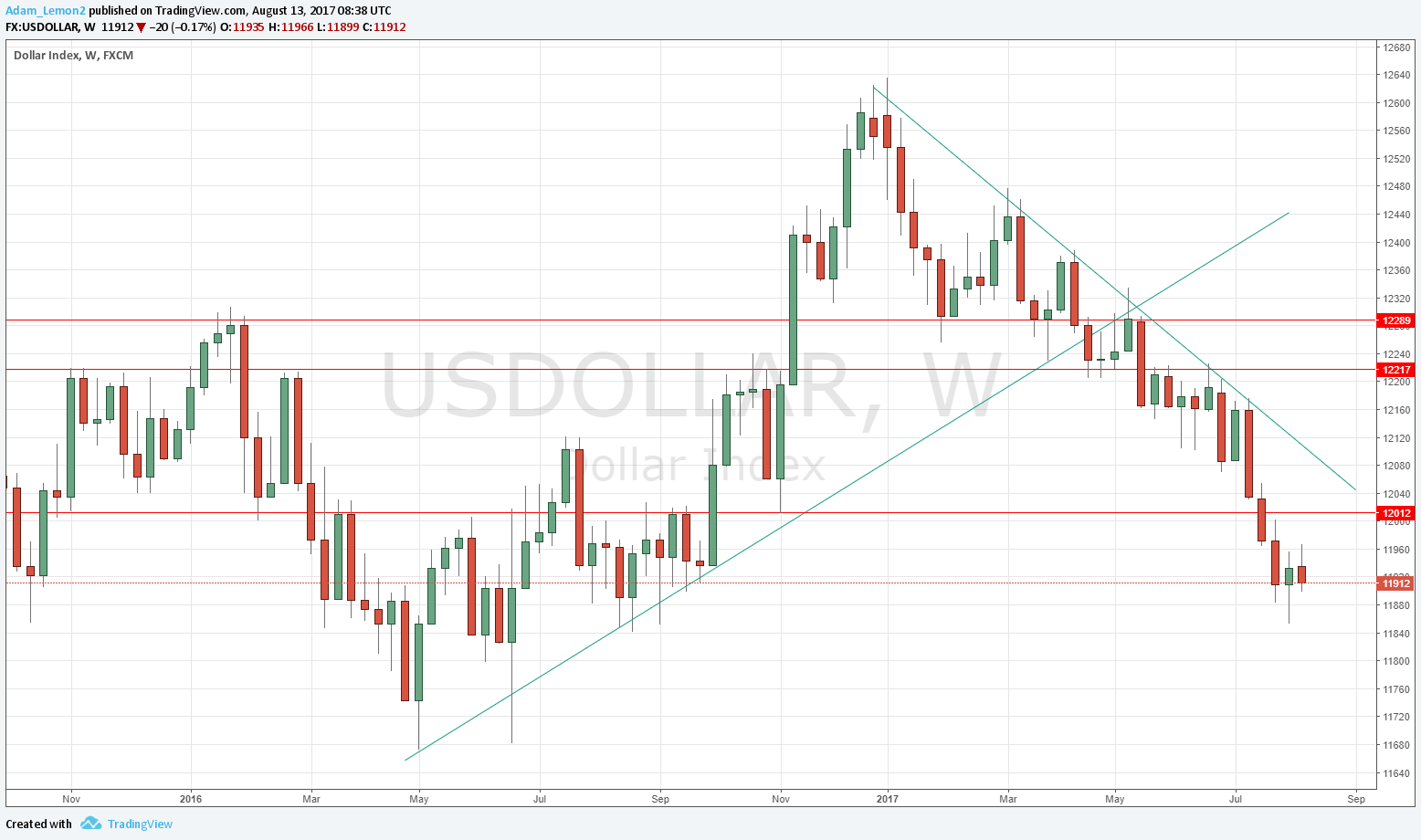

U.S. Dollar Index

This pair printed a small yet bearish candlestick, with a clear upper wick. There is a clear long-term bearish trend and the price has carved out new resistance above, while closely following a dominant bearish trend line. Furthermore, the former key support level at 12012 has been decisively broken. It seems likely that the downwards movement will continue.

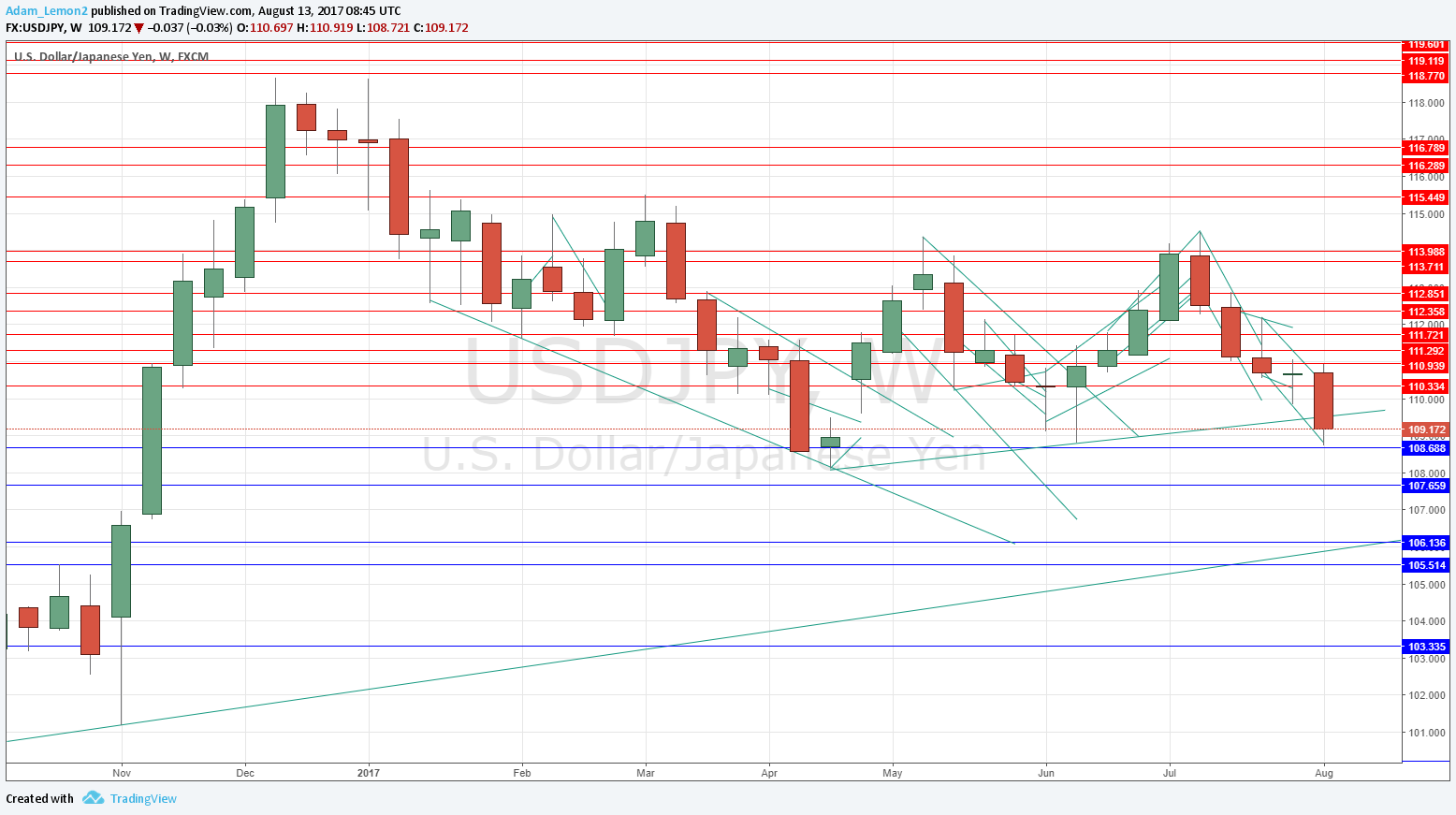

USD/JPY

This pair printed a strongly bearish candlestick, closing near its low. The Yen has been performing well over the last few weeks. However, there is a long-term inflection point not far below which might provide medium to long-term support, raising the question of how much further the price is going to fall over the short term.

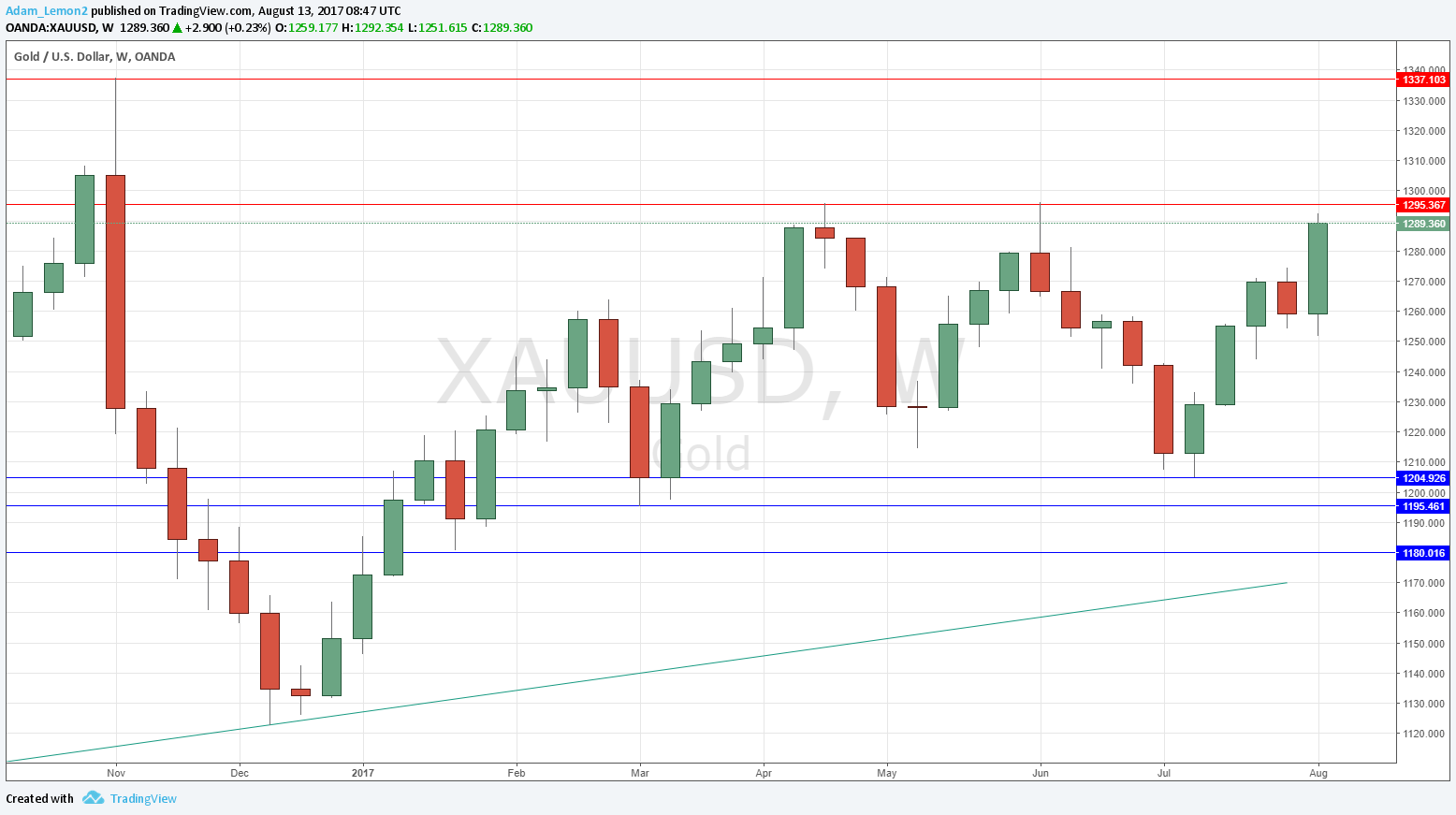

Gold

This pair printed a strongly bullish candlestick, closing near its high. Gold has been performing well over the last few weeks. However, there is a long-term inflection point not far above at around $1295 which might provide medium to long-term resistance, raising the question of how much further the price is going to rise over the short term.

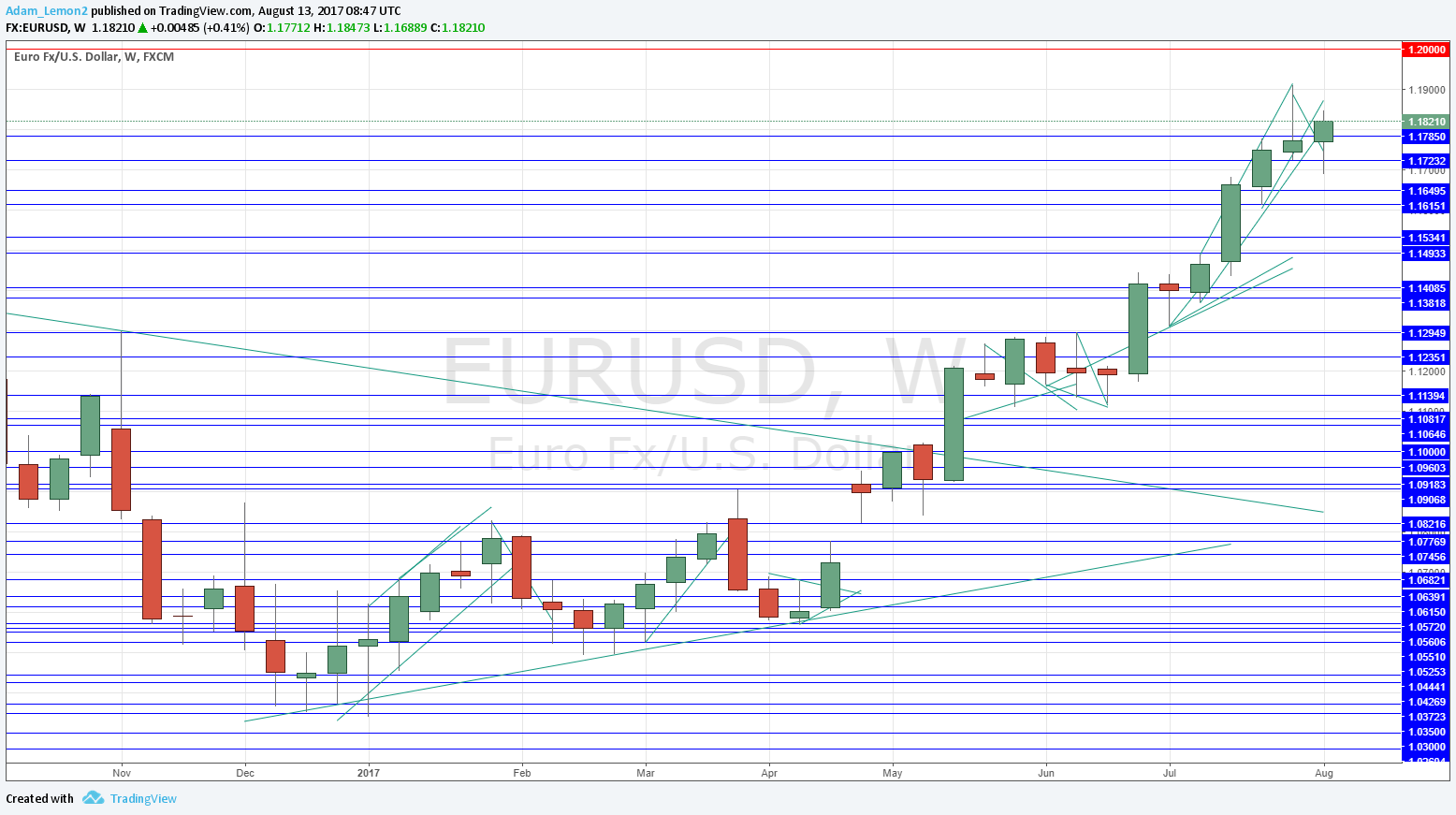

EUR/USD

This pair printed another bullish candlestick, closing near its high with a reasonably strong lower wick. There is a clear long-term bullish trend and the price has been trading in “blue sky” and is close to new long-term high prices. There are few obvious obstacles ahead to a further advance towards 1.2000.

Conclusion

Bullish Japanese Yen, the Euro, and Gold; bearish on the U.S. Dollar.