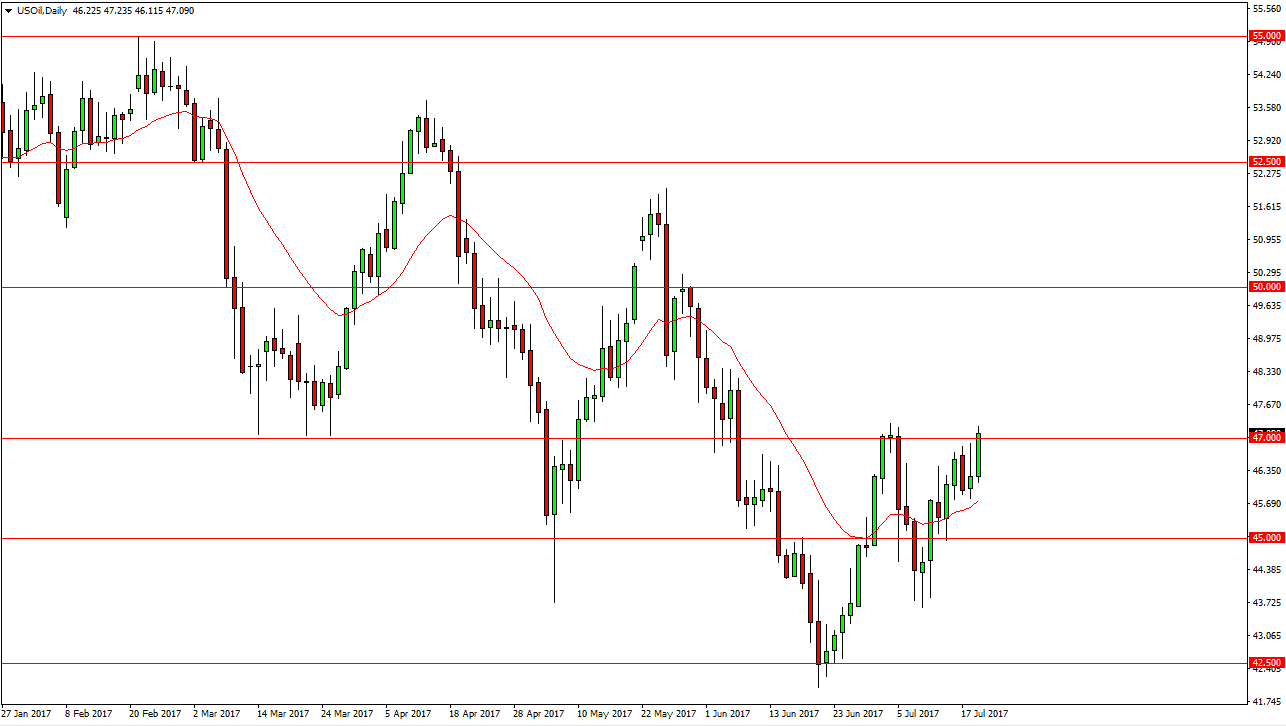

WTI Crude Oil

The WTI Crude Oil market rallied during the session on Wednesday, breaking above the top of the shooting star from Tuesday. This is a technically strong signal, and if we can break above the top of the range for the day on Tuesday and Wednesday, that would be a very strong sign that the markets are ready to go higher. Ultimately, I think we would go looking for the $48.50 level next, but I also recognize that a selling opportunity may be presented itself. We will have to see whether we break above these ranges to start buying, or if we get a turn around and start selling. All things being equal, I think the buyers are going to be aggressive in the short term at the very least. I still believe that we have a massive oversupply of crude oil, but the inventory numbers were very bullish during the Wednesday session.

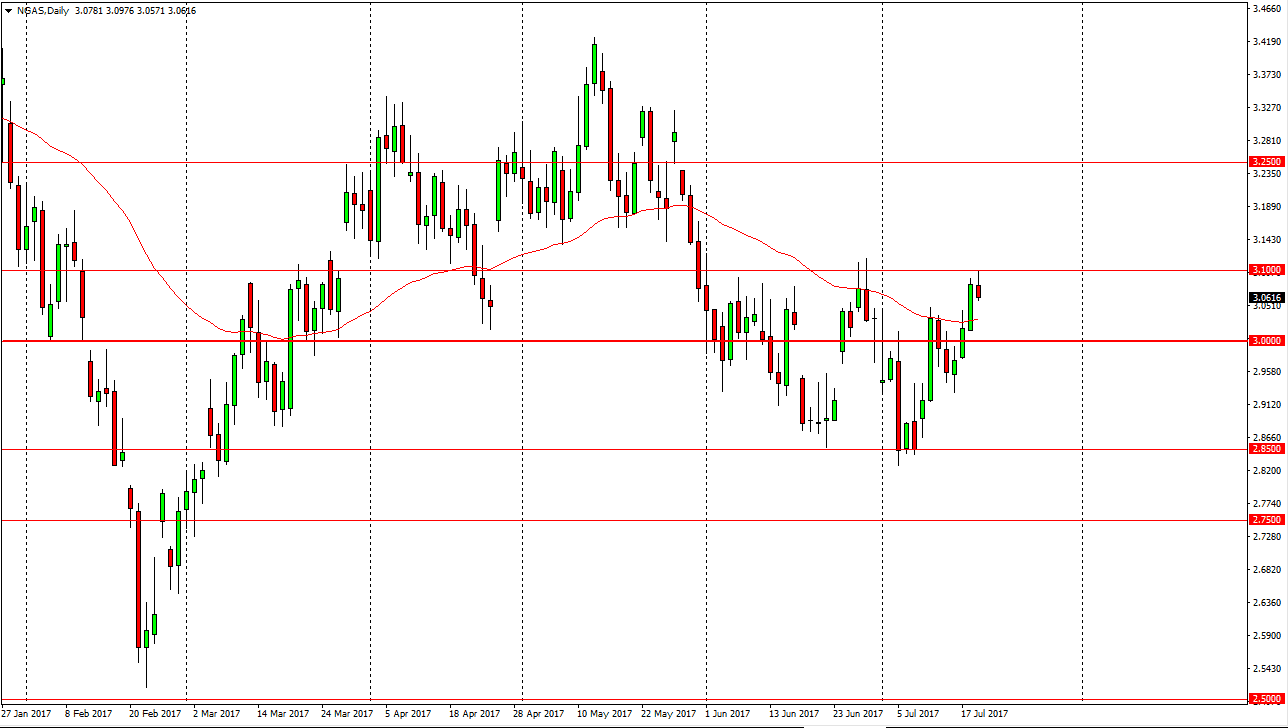

Natural Gas

Natural gas markets initially tried to rally during the day on Wednesday, but found the $3.10 level to be far too resistive. The shooting star that we form suggests that we are going to roll over, and if that’s the case we should then go down to the re-$.00 level. A breakdown below the $3.00 level, the market will more than likely continue to go much lower, perhaps the $2.95 level, and then the $2.85 level. Given enough time, I believe that the sellers will return, as the markets are very aware the fact that the overhang of supply and the natural gas markets should continue to be a major factor in the market. I have no interest in buying, and even if we break above the $3.12 level, the market then finds resistance starting at $3.20 level above there.