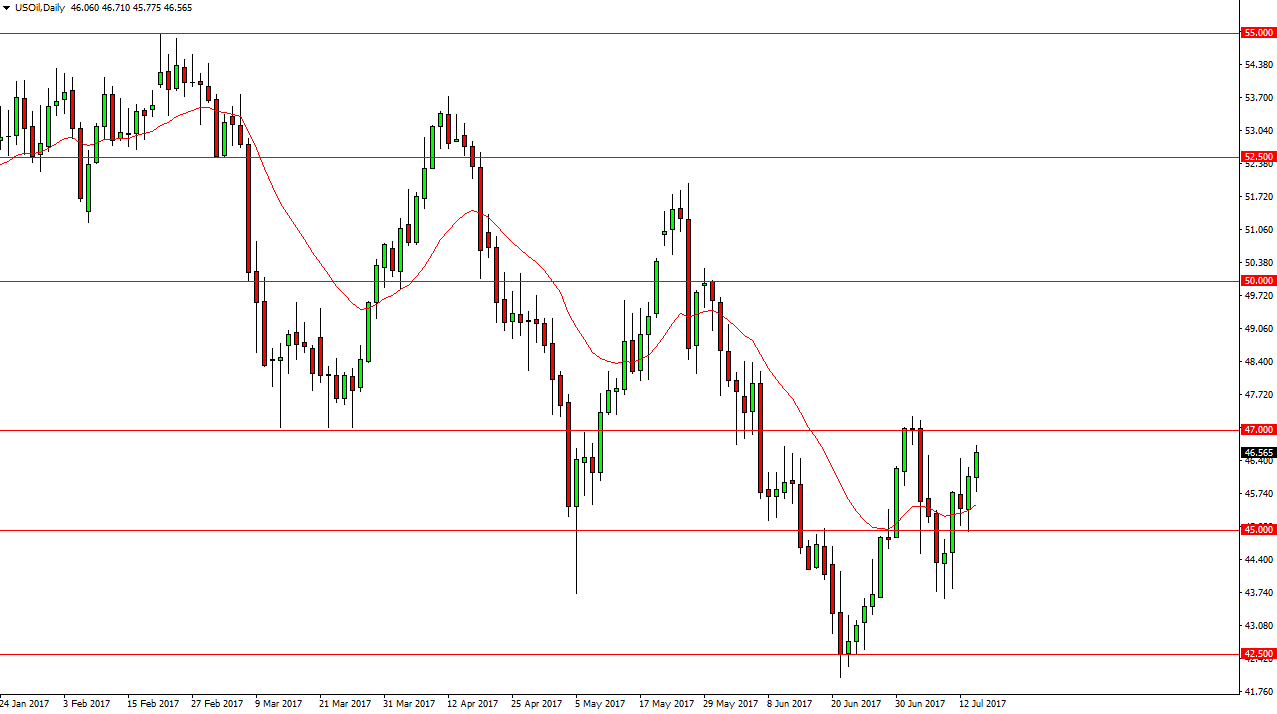

WTI Crude Oil

The WTI Crude Oil market initially fell during the day on Friday, but turned around to break above the $46.50 level. In general, I believe that this has something to do with the US dollar rolling over, and of course we have recently seen quite a bit of short covering. I think the $47 level above will offer a bit of resistance, but if we break above there we could go looking at $48, and then eventually $50. I have a very hard time believing that this market can reach above $50 though, it would become an area where I would be looking to start selling. Alternately, if we break down below the $45 level, I think that’s a selling opportunity as well.

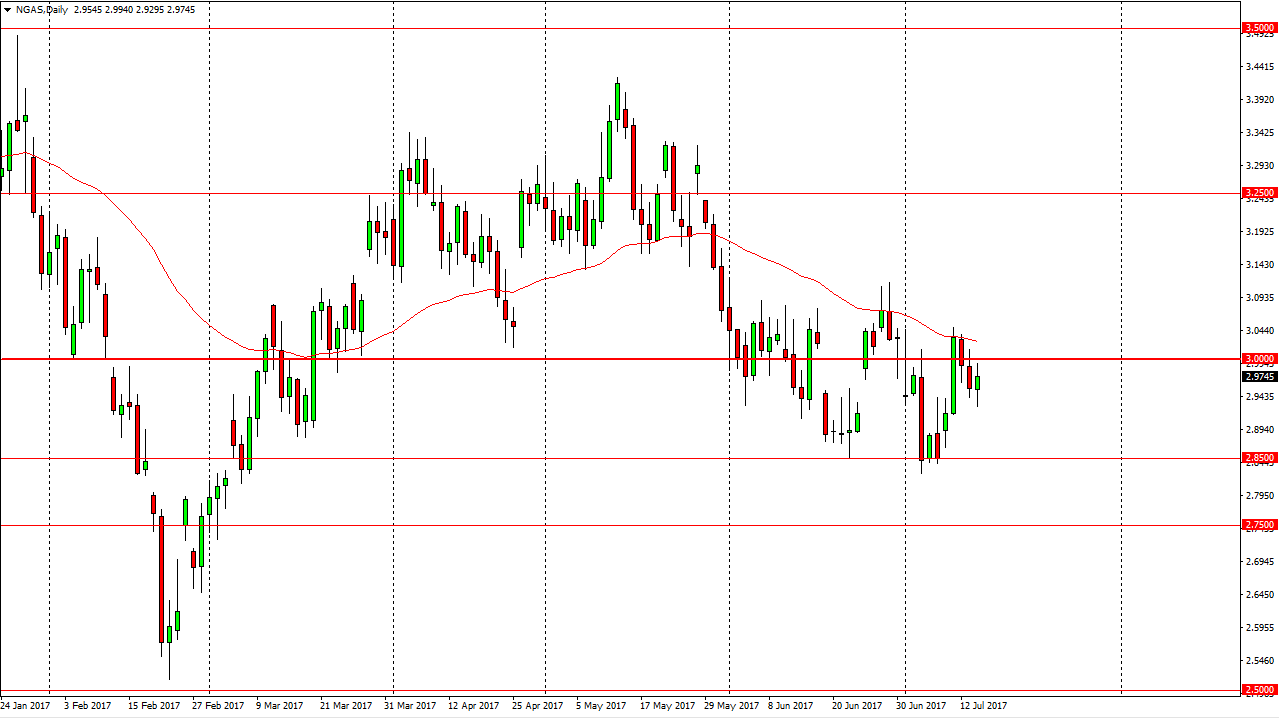

Natural Gas

Natural gas is a market that I am extraordinarily bearish on, as you can see that the 50-day exponential moving average has continue to offer resistance. I believe that the $3.00 level will also be resistance, so rallies at this point on short-term charts are selling opportunities. I believe that the resistance goes all the way to the $3.12 level above, so having said that I think we will eventually reach down towards the $2.85 level underneath, which has been supportive. I think if we can get below there, the market should then go looking for the $2.75 level after that. Ultimately, I believe that the natural gas markets will even extend all the way down to the $2.50 level, but that is a long-term call. Selling rallies continue to be the best opportunities for trading this market, taking a quick smash and grab type moves. I have no interest in buying this market, and don’t even have a scenario where I’m looking to do so.