Friday is the third bearish session of the USD/JPY settling below 112.00 level, with the negative affect on the USD from Trump policies, as well as the move towards safe heaven assets led by the Japanese Yen. It seems that the support at 111.55 is respected by the USD/JPY, as the pair retreated towards that level in 3 sessions, and the settled back slightly on top of 112.00 waiting new stimulations to avoid more bearish pressure.

The pressure on the pair was supported by the drop of the USD against other majors due to American political worries and the disappointment from the votes on Trump’s alternative healthcare program to Obama care.

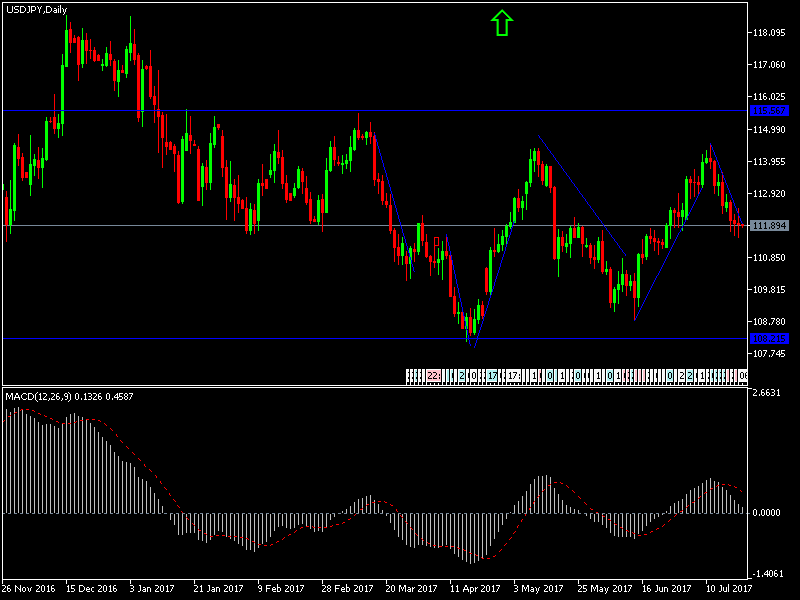

Technically, the USD/JPY is still under bearish pressure from the weak US inflation data, which negatively affected the Fed’s directions to continuing interest rate raises for the third time this year. The pair is trying hard to avoid moving below support at 112.00, which will strengthen the bearish outlook for this pair. On the daily chart, there is a break of the upward movement of the pair, which is currently at special buying levels, and moving below there will threaten any expectations of a nearby upward on the medium-run.

This pair, like the rest of JPY crosses, faced selloffs to collect profit after the strong gains. The USD was especially subject to more bearish pressure, even with positive unemployment claims data and the Philadelphia Industrial Index.

Technically: The USD/JPY pair still have a chance of upward correction if it can settled above 113.60 and 114.20 again. On the bearish side, the nearest support levels are located at 111.50 and 110.70, and the later will confirm the significance of the pair’s bearish correction.

On the economic data front today: The pair is not expecting any economic announcements from the US or the Japan today. The pair’s performance will be dominated by the investor’s approach towards the USD due to the worries regarding Bank of Japan maintaining his monetary policy as is yesterday. This is in addition to the renewed move towards or against safe heaven assets.