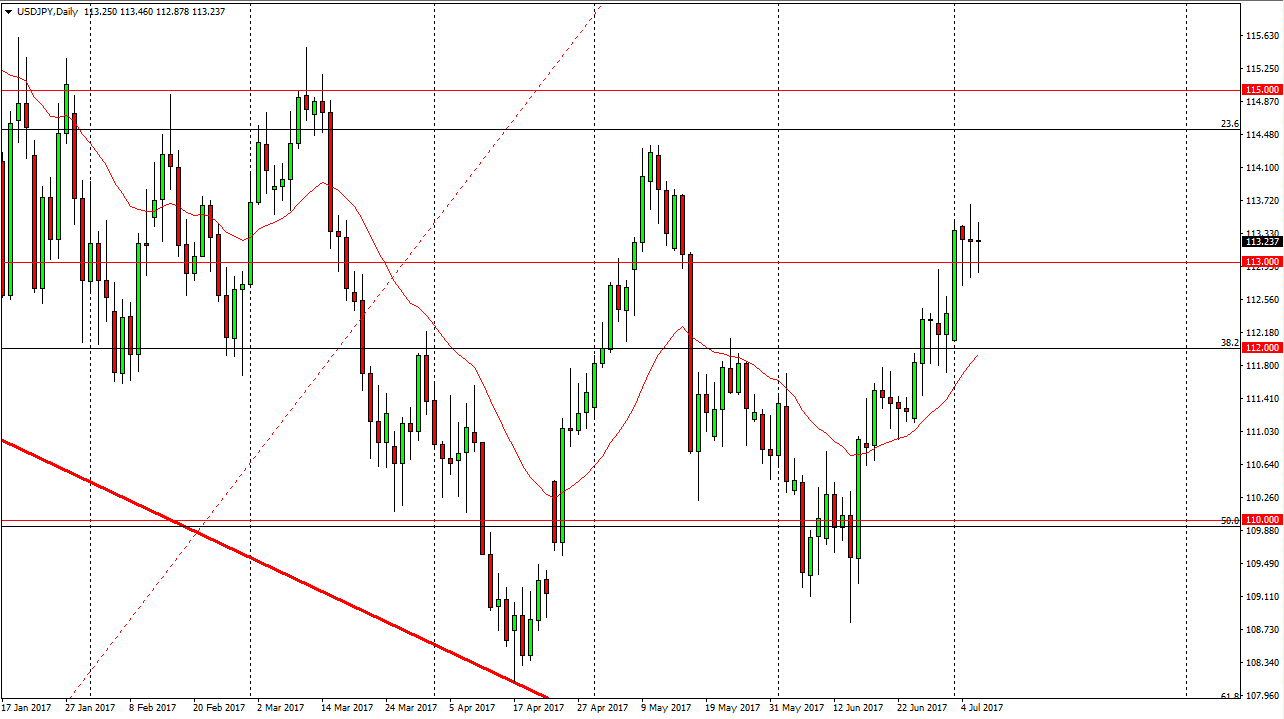

USD/JPY

The US dollar went back and forth during the day on Thursday, as we continue to bounce off of the 113 handle. That being the case, looks as if the market is simply waiting for the Nonfarm Payroll Numbers to come out, as it tells us which direction the market should be heading. The interest rate situation in the United States will be dictated by employment, so it’s likely that we will see volatility, and we should continue to go to the upside. The 114 level will be tested next if we rally, just as the 115 level will be tested after that. Pullbacks from here will continue to see support at the 112 level. Currently, I still prefer the upside, but obviously there’s going to be a lot of choppy noise ahead.

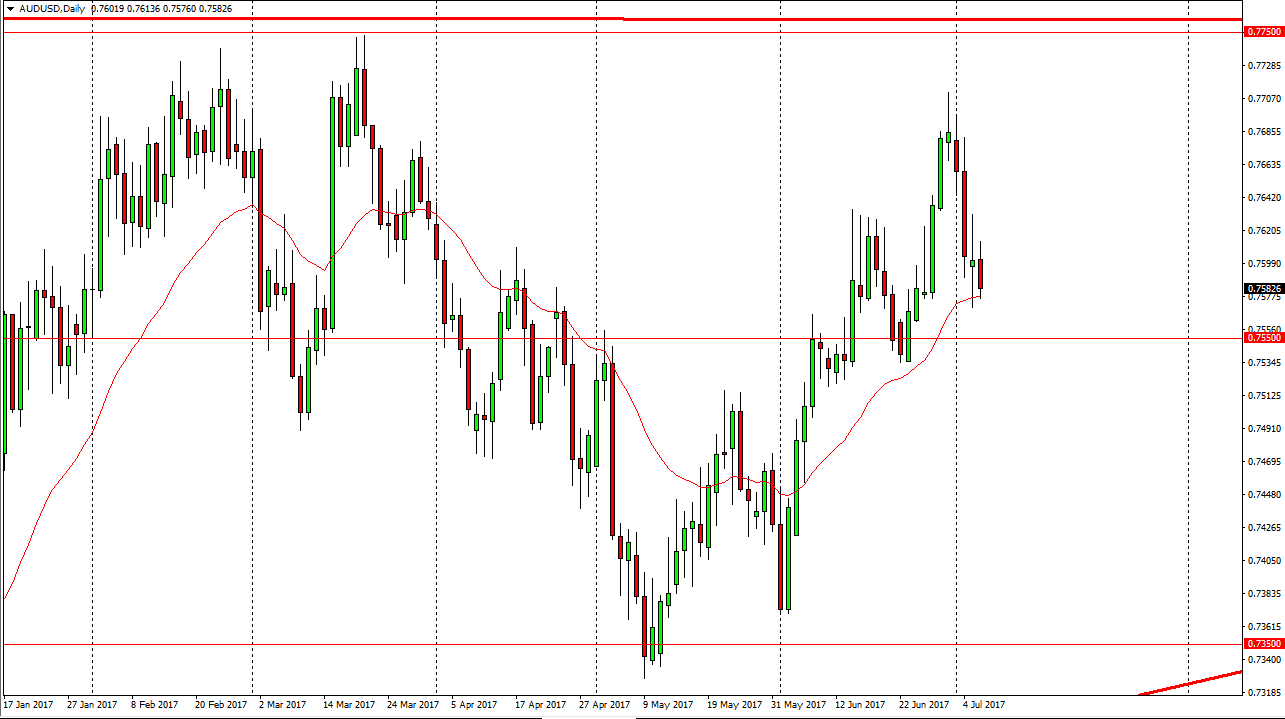

AUD/USD

The Australian dollar fell a bit during the day on Thursday, but sees quite a bit of support underneath, especially near the 0.7550 level. That’s an area that should continue to find buyers, and obviously will be influenced heavily by gold, as the US dollar goes back and forth and value. If the US dollar strengthens, that should bring down the value of gold, and therefore the value of the Australian dollar as well. It’s a bit of a “double whammy” when the US dollar strengthens, and then the Australian dollar falls.

The alternate scenario of course is a run back to the 0.77 level, and if we can somehow break above the 0.7750 level, the market should then go to the 0.80 level above that. A breakdown below the 0.75 level senses market looking towards the 0.7350 level. Expect volatility, you almost always see a during the Nonfarm Payroll announcements.