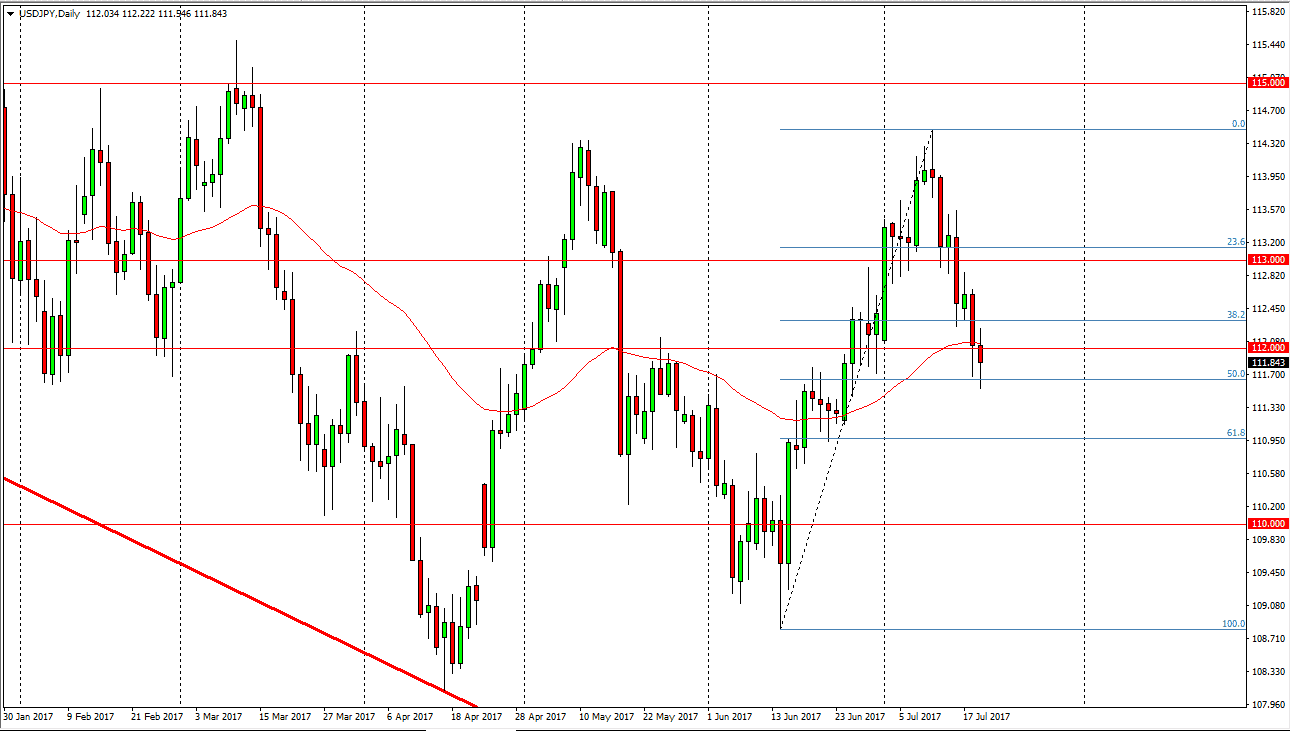

USD/JPY

The US dollar had a volatile session on Wednesday against the Japanese yen as we sliced below the 112 level. We have found a bit of support at the 50% Fibonacci retracement level, so it’s likely that we could bounce from here. A break above the top of the candle for the session has this market going much higher, perhaps the 113 handle, maybe even above there towards the 114.50 level. This being the case, the market will more than likely become bullish on a move higher, as we will see value hunters in her the marketplace. Alternately, if we break down below the candlestick for the Wednesday session, I think we then go to the 111 level, which is the 61.8% Fibonacci retracement, and then possibly even down to the 110 handle.

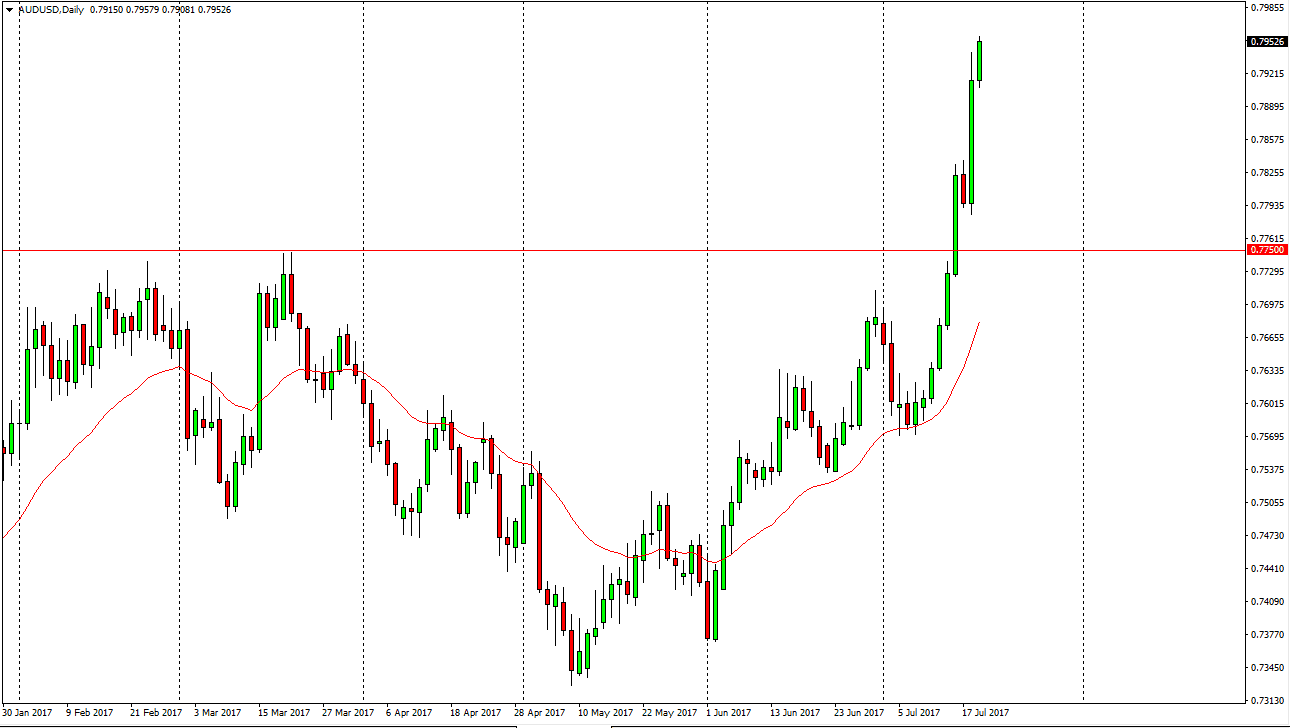

AUD/USD

The Australian dollar continued its moved to the upside during the Wednesday trading session, reaching towards the 0.7950 level. We are overextended by just about any metric you measure the pair with, so having said that I think that a pullback is necessary. I still believe in buying though, and I think that the 0.7750 level underneath should be massively supportive. I also recognize that the market has been a bit overextended, so it’s difficult to imagine that it will be able to break above the 0.80 handle anytime soon. With this being the case, I believe that you should pay attention to gold, as it will give you an idea as to where the Australian dollar will go next. After all, the 2 markets are highly correlated, and certainly seem to be at the moment. I think pullbacks offer value, and I think that value will continue to be bought by traders around the world. Keep in mind that a weaker US dollar list gold prices, which of course lifts the Australian dollar.