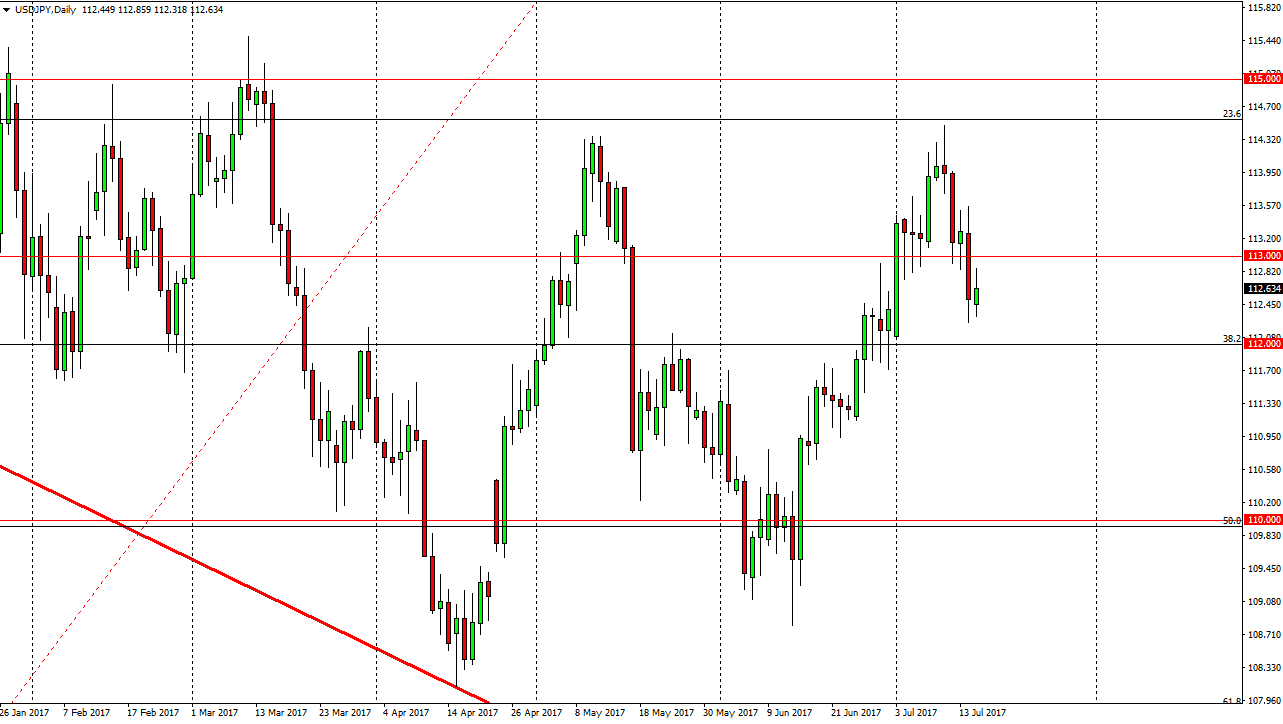

USD/JPY

The US dollar initially tried to rally on Monday, but struggled just below the 113 handle. By turning around and forming a shooting star, the market looks very likely to fall and drop down to the 112 handle. That is an area that should be plenty of support, as it has been both of support and resistance in the past. A breakdown below the 112 level could send this market down to the 110 handle. I think either way, you’re going to get volatility, and a break above the 113 handle could send this market looking towards the 114.50 level as well. Either way, I think that you can see a lot of choppiness, but longer-term I do like this pair even though the Federal Reserve looks to be a bit more dovish than originally thought.

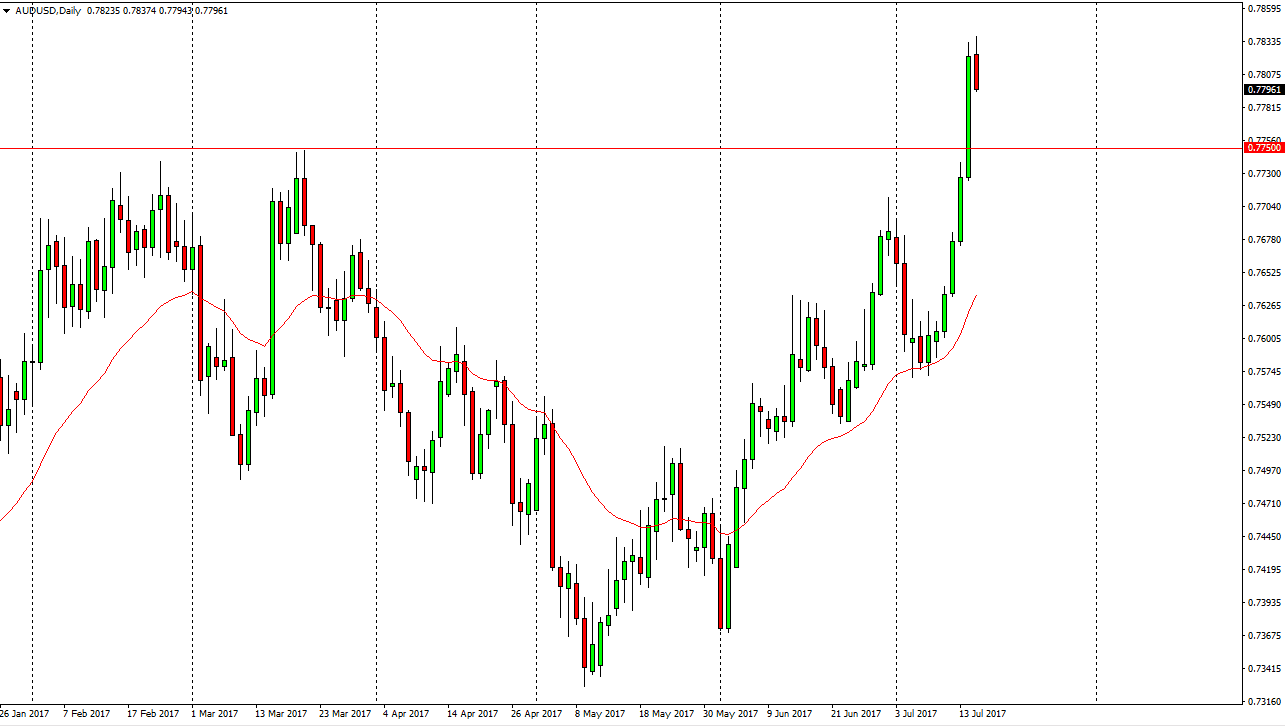

AUD/USD

The Australian dollar as you can see initially tried to rally during the day on Monday, but fell backwards as it appears that the market will have to build up momentum to continue going higher. That being the case, I am not interest in selling this market, and I suspect that the buyers will return near the 0.7750 level. On some type of supportive candle, I am going to be the long of the Aussie dollar, especially if gold markets rallied. Ultimately, I think that the market could go looking for the 0.80 level above, as it has been a magnet for price on longer-term charts, not only the recent past, but decades before. If we break down below the 0.7675 handle, the market should then breakdown from there and go looking to the 0.75 handle. Ultimately though, I believe that the buyers are probably going to run the market much higher over the longer term.