By: DailyForex.com

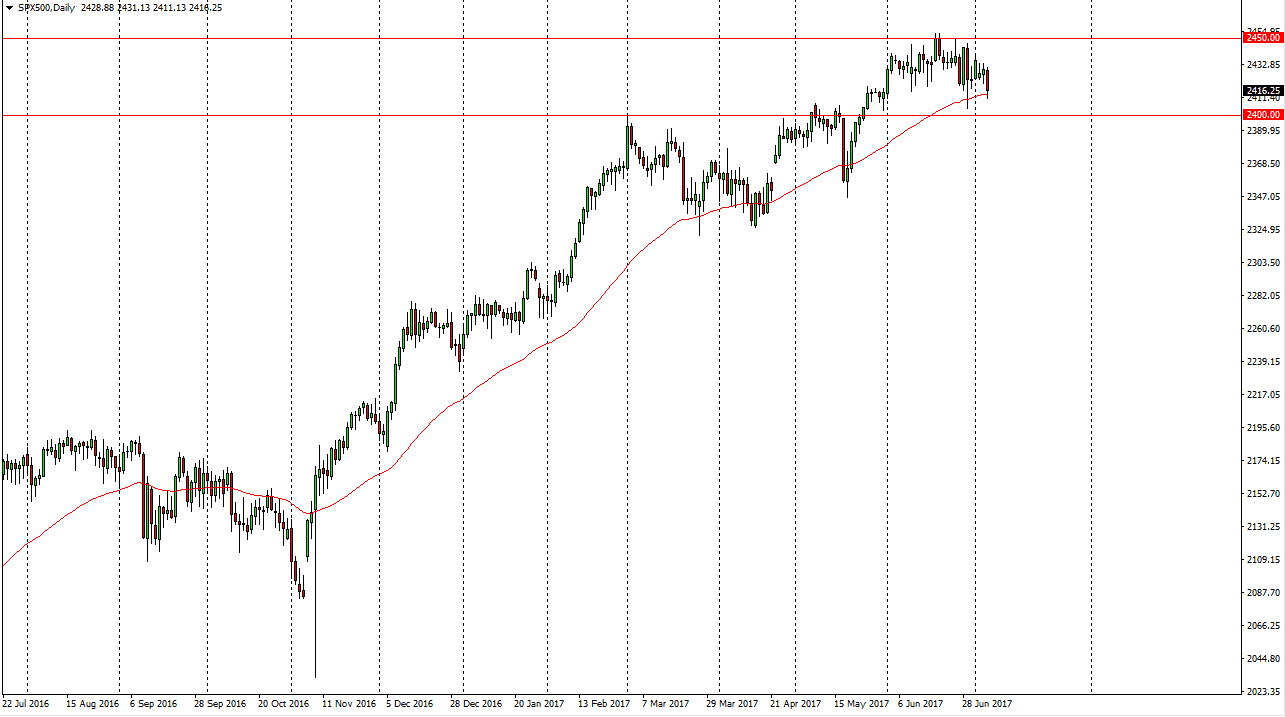

S&P 500

The S&P 500 fell a bit during the day on Thursday, reaching down towards the 2400 level. The 2400 level is of course supportive, as it has previously been resistive, and I think that a bounce is probably coming relatively soon. A bounce should send this market to the 2450 handle, which has been resistance in the past. A break above the 2450 level would be very bullish, and it should send this market looking towards the 2500 level. Ultimately, I think the volatility is about the only thing that you can count on, as the S&P 500 is coping with relatively decent earnings, but at the end of the day, we have the jobs number coming into the marketplace and pushing things around as well. I do favor the upside, so if we can stay above the 2400 level, I’m a buyer of the S&P 500 as it should continue to show strength.

NASDAQ 100

The NASDAQ 100 went sideways during the session on Thursday, as we await the Nonfarm Payroll Numbers. The 5700 level above offers a significant amount of resistance, and if we can break above that level, I think we will then test the previous uptrend line for resistance. Once we break above there, I am much more comfortable buying. Alternately, if we break down below the 5500 level, I think that the market should continue to go lower. Either way, I think that this market is going to be choppy and volatile, and quite frankly I don’t have much interest in trying to trade the market today as there will be a lot of headwinds in both directions as the volatility will be extraordinary. I will wait until the end of the day to assess the situation, and then place a trade.