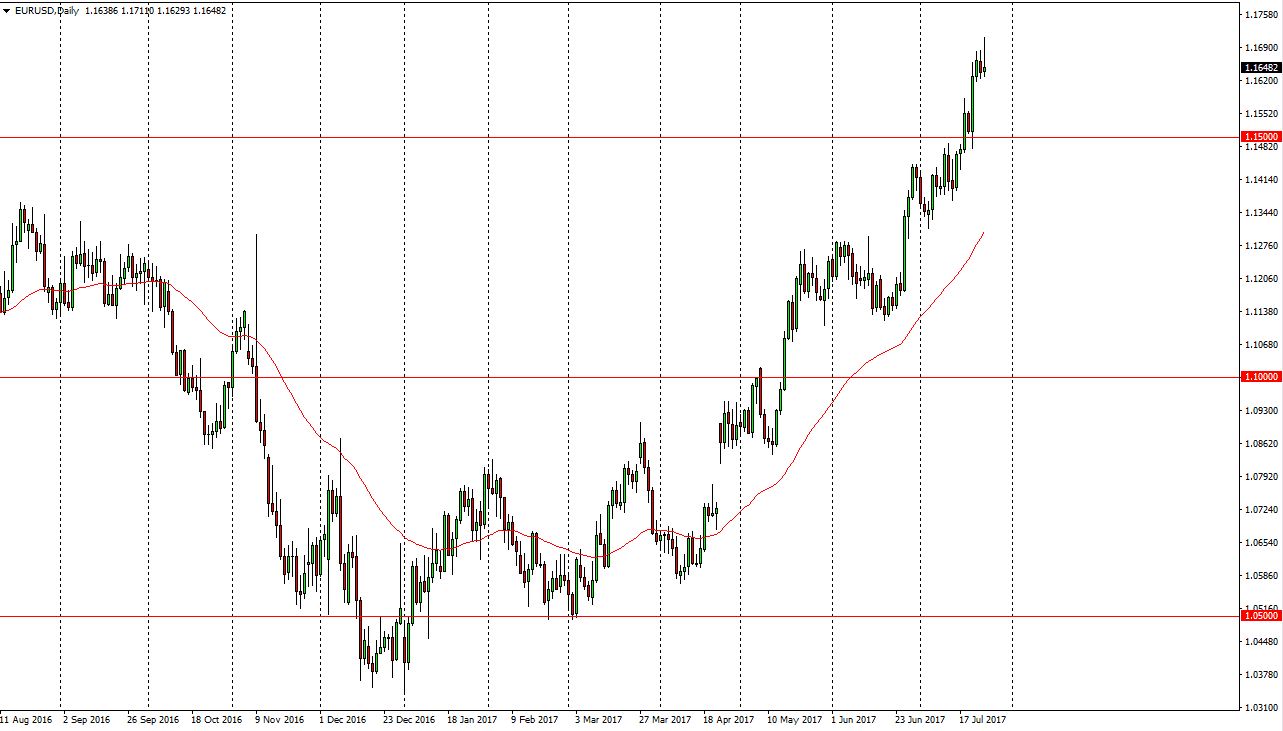

EUR/USD

The EUR/USD pair initially when higher during the session on Tuesday, but turned around at the 1.17 level to form a shooting star. I believe that part of this is driven by profit-taking ahead of the FOMC Statement and of course the interest rate decision, but I think that this could be a bit of a signal that the market is a bit worried that the Federal Reserve might be a bit more hawkish than originally thought. The 1.15 level below is massive support, so I don’t think will break down below there, unless of course the Federal Reserve not only raises rates but suggests that they are going to again in short order. If they do, the market will have been caught on the wrong side of the trade, and we should slice down below there. Alternately, I think the pullbacks that show signs of support between here and there could be buying opportunities. Also, a break above the top of the shooting star is a very bullish sign.

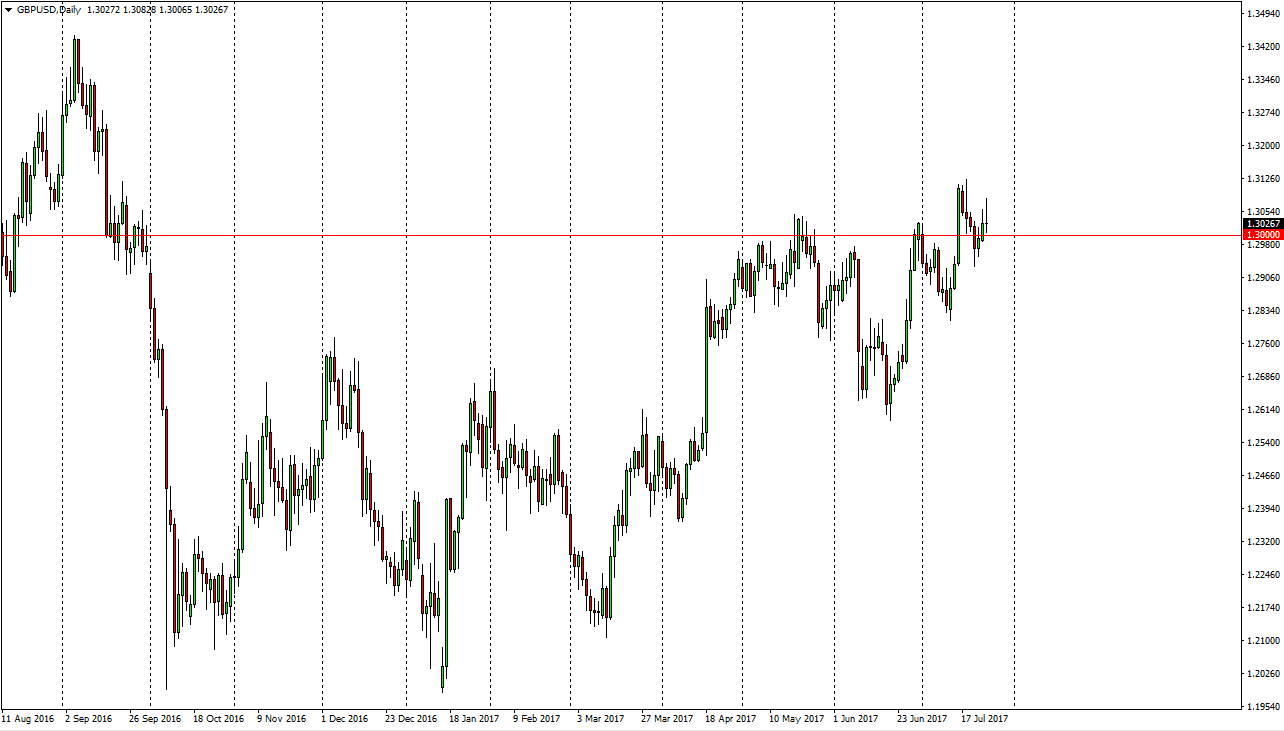

GBP/USD

The British pound had a very similar day, initially rallying, but fell enough to form a shooting star. The 1.30 level underneath is important, it looks very likely that the market should continue to struggle in this area and it appears it is also awaiting on the FOMC announcement as well. That being the case I think that the market is still bullish in general, but I think we may see some bearishness in the short term. Given enough time, we will get more clarity, but we clearly don’t have it right now. With this, I’m willing to stay on the sidelines as I think this market is so sensitive to what’s about to happen. At the end of the day, we should have some clarity.