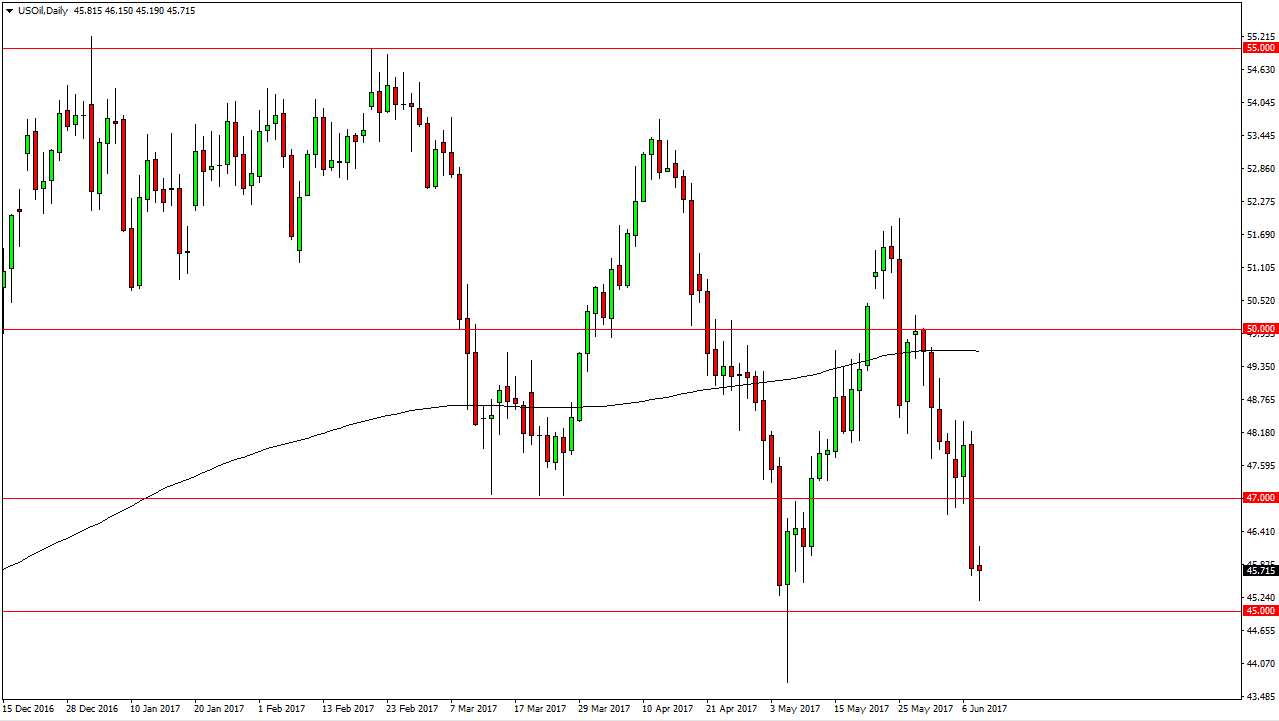

WTI Crude Oil

The WTI Crude Oil market had a volatile session on Thursday, going back and forth several times. We ended up forming a bit of a hammer, and this hammer sits on top of the psychologically important $45 level. Because of this, I would not be surprised at all to see some type of bounce, but that bounce will more than likely only be met with significant selling pressure. Given enough time, I believe that the markets will find the $47 level to be too much to overcome, and therefore I’m looking to sell in that general vicinity. I believe that the markets will continue to be extraordinarily volatile, but more than anything else: bearish.

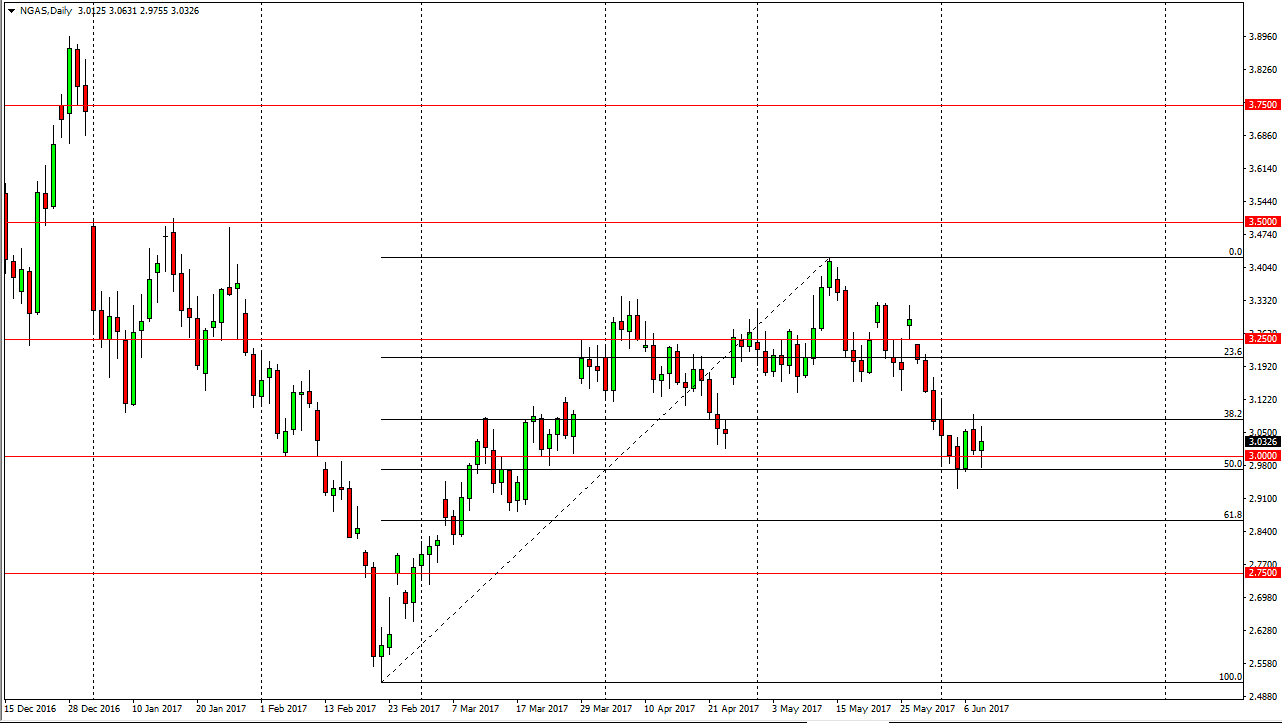

Natural Gas

Natural gas markets went back and forth during the day as well, ultimately settling on a relatively neutral candle. We’re sitting just above the $3 level which of course is a large, round, psychologically significant handle. Not only that, we have the 50% Fibonacci retracement underneath this level, so of course it would attract a lot of attention. Ultimately, I think that the market will probably bounce a bit, but if we can break down to a fresh, new low over the last couple of sessions, I think the market will then go looking for the $2.85 level. I don’t have any interest in buying, least not until we break above the $3.12 level, and currently believe that there is still a significant amount of bearish pressure and the natural gas markets as there is a serious lack of demand for not only natural gas, but energy in general. I believe rallies will continue to be selling opportunities, and that eventually we could find ourselves down near the $2.75 level, and then possibly even the $2.50 level.