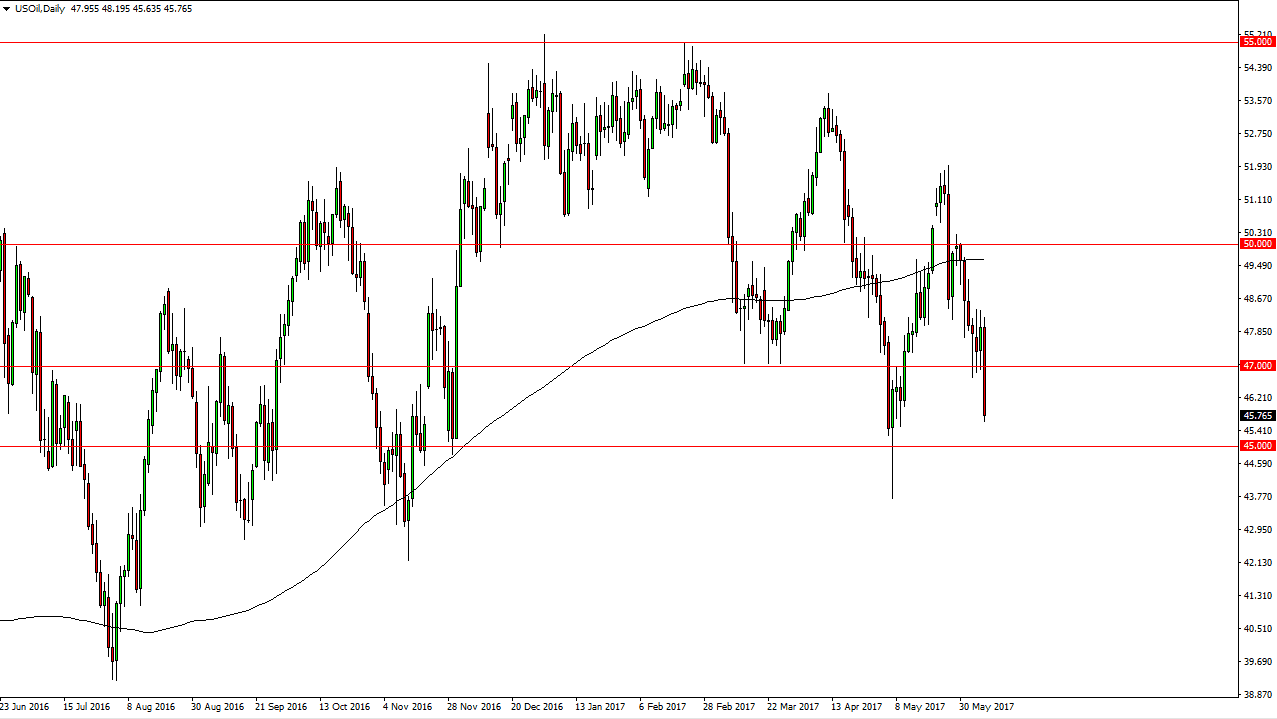

WTI Crude Oil

The WTI Crude Oil market fell apart during the session on Wednesday, slicing through the $47 level handily after the Crude Oil Inventories announcement, which was in addition of 3 million barrels as opposed to the anticipated decline of that same number, which worked against the idea that OPEC could control the market. After all, if there isn’t much in the way of demand, supply will continue to be a serious issue, and a glut of oil is now working against the value of the commodity. I think the $45 level underneath continues to be a target, and short-term rallies that show signs of exhaustion between here and the $47 level should be selling opportunities. Not only do I think we touch the $45 level, but I think it’s probably going to be a situation where we drop as low as $44 after that.

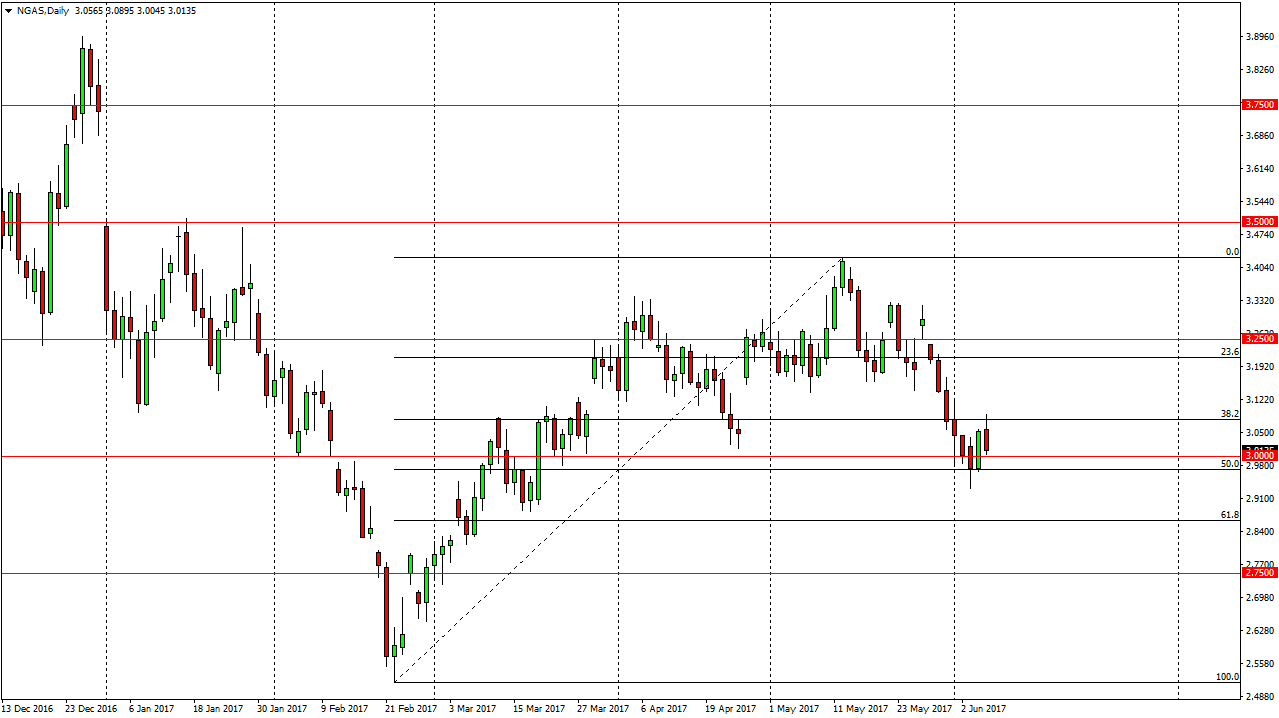

Natural Gas

Natural gas markets initially tried to rally, but turned around and broke towards the $3 handle. It now looks as if the $3.10 level is going to offer resistance, but it also looks as if there is support below. I think we will consolidate and a relatively tight area, but it looks as if the market is trying to break down, and if we can get below the lows of the Monday session, I feel that the market will probably go down to the $2.75 level given enough time. There is a serious lack of demand when it comes to natural gas, and today’s announcement that there was a serious lack of crude oil suggests that it is not a crude oil versus natural gas type of situation, more like it is a demand versus supply situation when it comes to energy overall. Because of this, I remain bearish of natural gas.