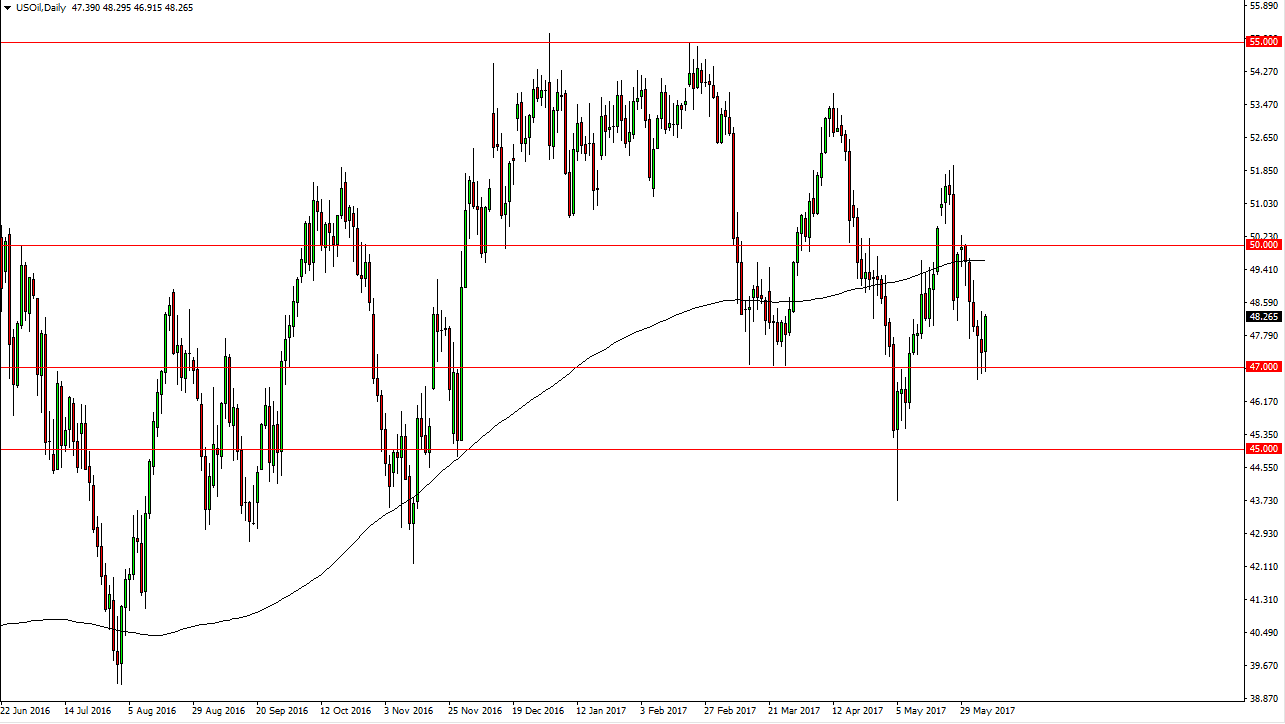

WTI Crude Oil

The WTI Crude Oil market initially fell during the day on Tuesday, but found the $47 level to be supportive enough to turn the market back around. The market continues to be very volatile and choppy, and having said that it’s likely that we will probably continue to try to go higher, but the $50 level above for me is massively resistant. We get the Crude Oil Inventories announcement coming out today, and that should cause quite a bit of volatility in this market. Ultimately, I think longer-term we have more bearish pressure than bullish, but we may need to bounce a little bit to build up the momentum to break down. Obviously, the announcement will have a massive effect on this market, and if it disappoints, that could send this market much lower in very short order.

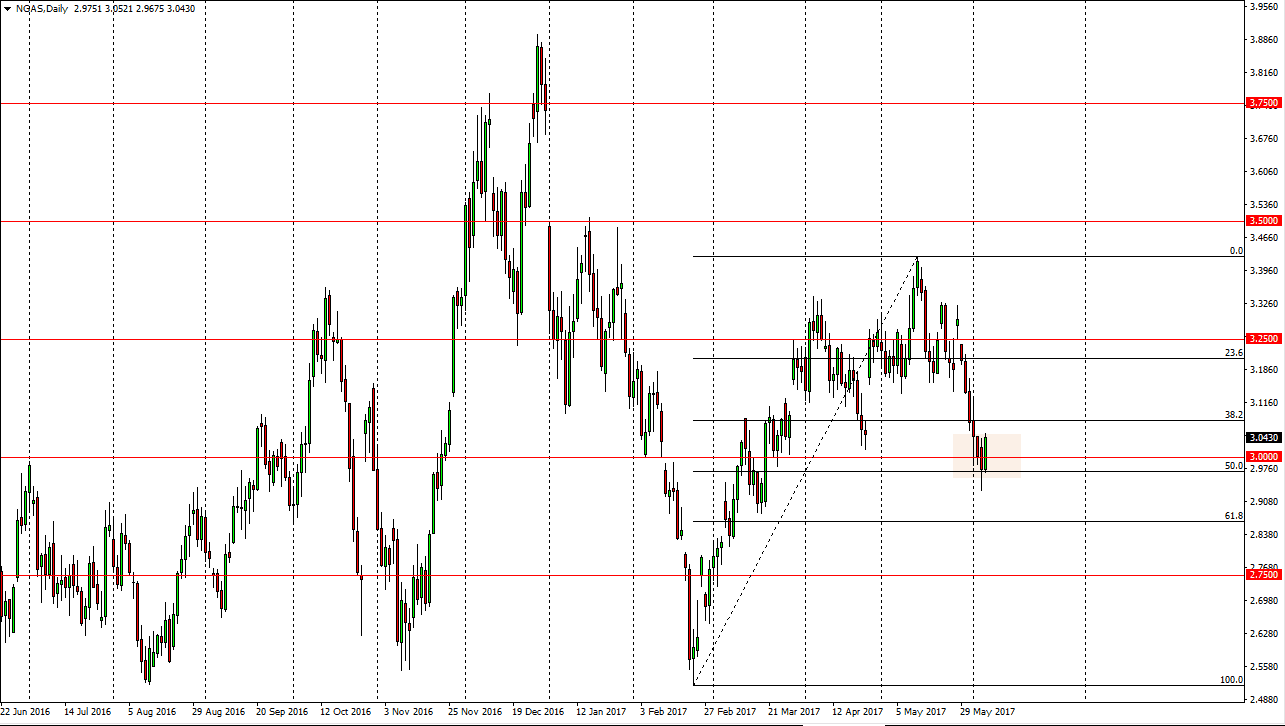

Natural Gas

Natural gas markets had a significant bounce happen during the session on Tuesday, reaching towards the $3.05 level. I still think that we are going to see quite a bit of volatility, and if we can break down below the bottom of the range for the session on Tuesday, the market should continue to drop, perhaps reaching towards the 61.8% Fibonacci retracement level, which is the $2.85 level. After that, I expect the market to then go looking for the $2.75 level underneath. Alternately, if we can break above the $3.10 level, the market should then go to the $3.20 level. I expect to see quite a bit of volatility in this market, and either way we go, I think there is going to be a lot of choppiness. Seasonality is working against the value of natural gas anyway, so I think that it’s only a matter of time before we drop in value.