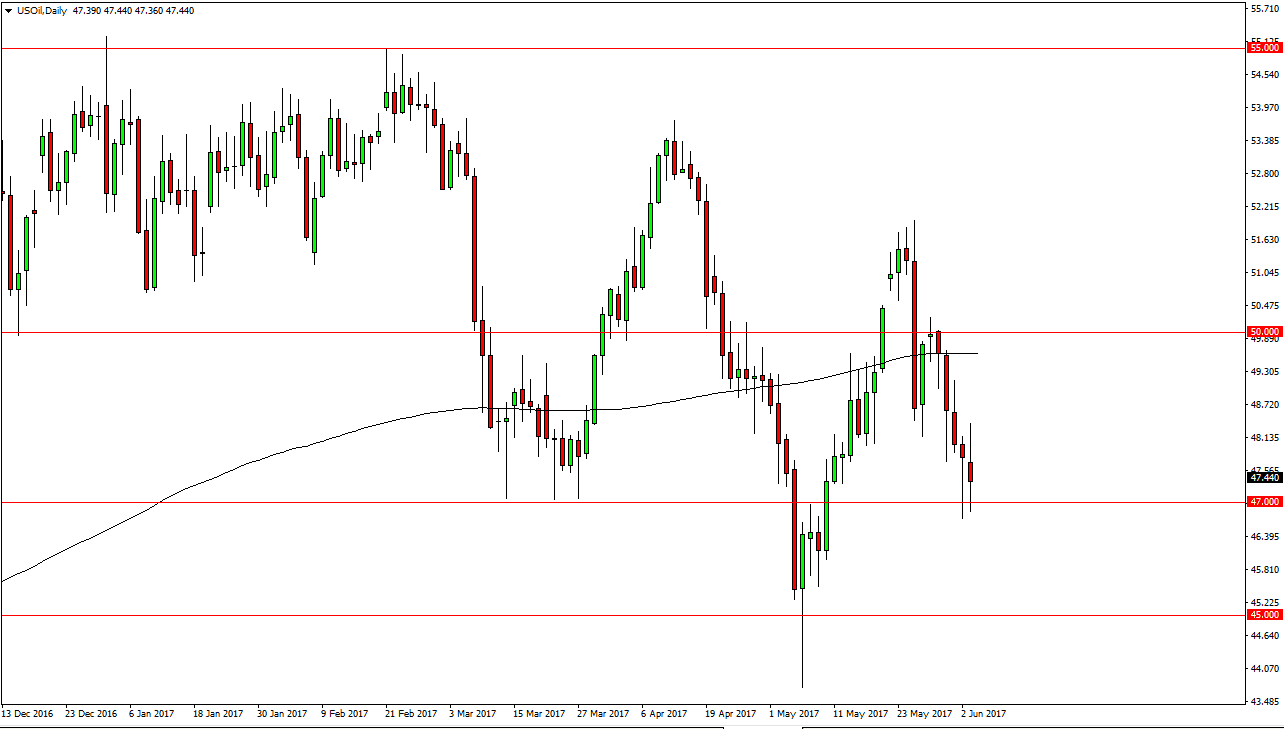

WTI Crude Oil

The WTI Crude Oil market had a very volatile session on Monday, as we initially broke above the $48 level, but turned around to show signs of exhaustion as we then broke below the $47 handle. Ultimately, when it up forming a relatively neutral candle in it looks as if there is a significant amount of support near the $47 handle still. As I look at the start, I believe that the longer-term bearish pressure will continue but I need to see a breakdown below the bottom of the range for the session on Friday to have me selling. At that point, I believe that the market continues to show massive downward pressure, perhaps sending the market down to the $45 level next. Either way, I anticipate that buying is going to be very difficult to do to say the least. Selling rallies on short-term charts will probably continue to be one of the easiest trades in this market, as there is simply a massive amount of various pressure on an oil market that cannot find its footing.

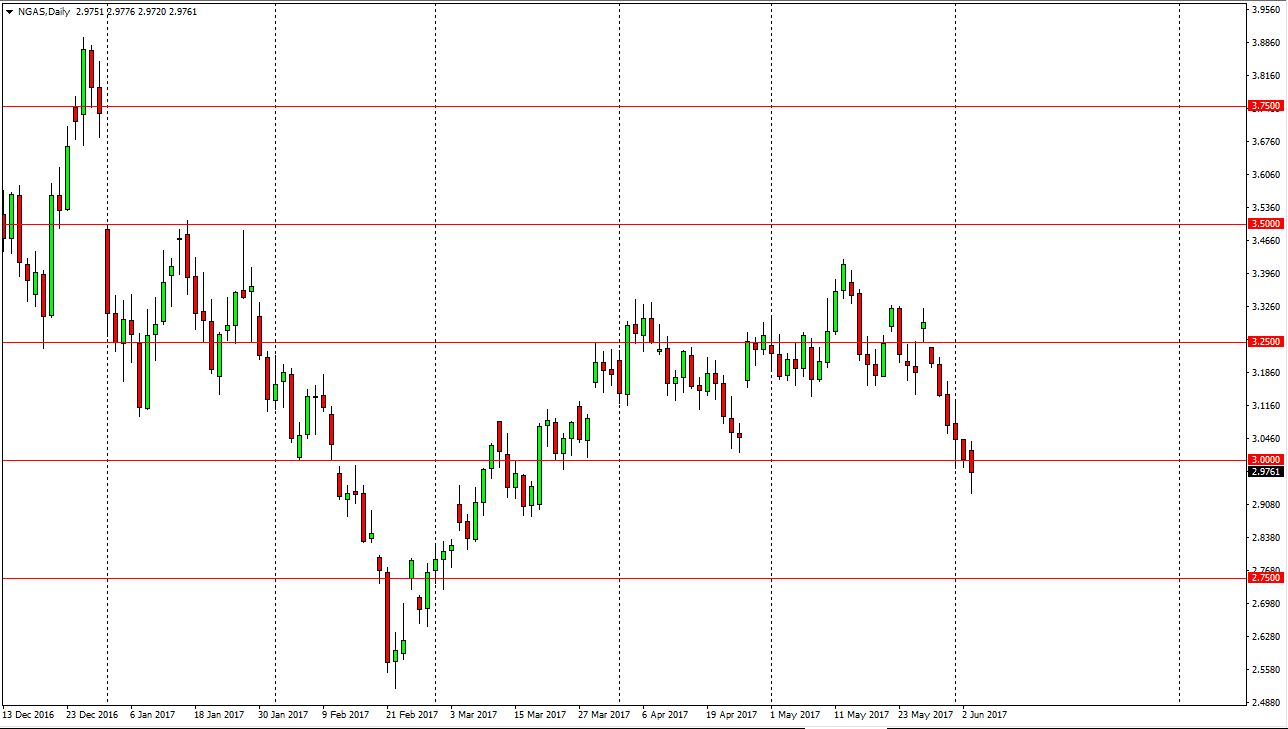

Natural Gas

The Natural Gas market fell significantly during the day on Monday, but found a little bit of support towards the end of the session. It now looks as if we are trying to form some type of a hammer, a quite frankly I think that the market has plenty to worry about, as the overextension of the selling was only moderately pulled back. Because of this, I believe that a breakdown below the bottom of the range for the session is a selling opportunity, just as a rally will be on signs of exhaustion. I believe that the market will probably go looking for the $2.90 level underneath, and then eventually break down to the $2.75 level after that. Currently, I don’t have any interest in trying to buy this market after this massive selloff.