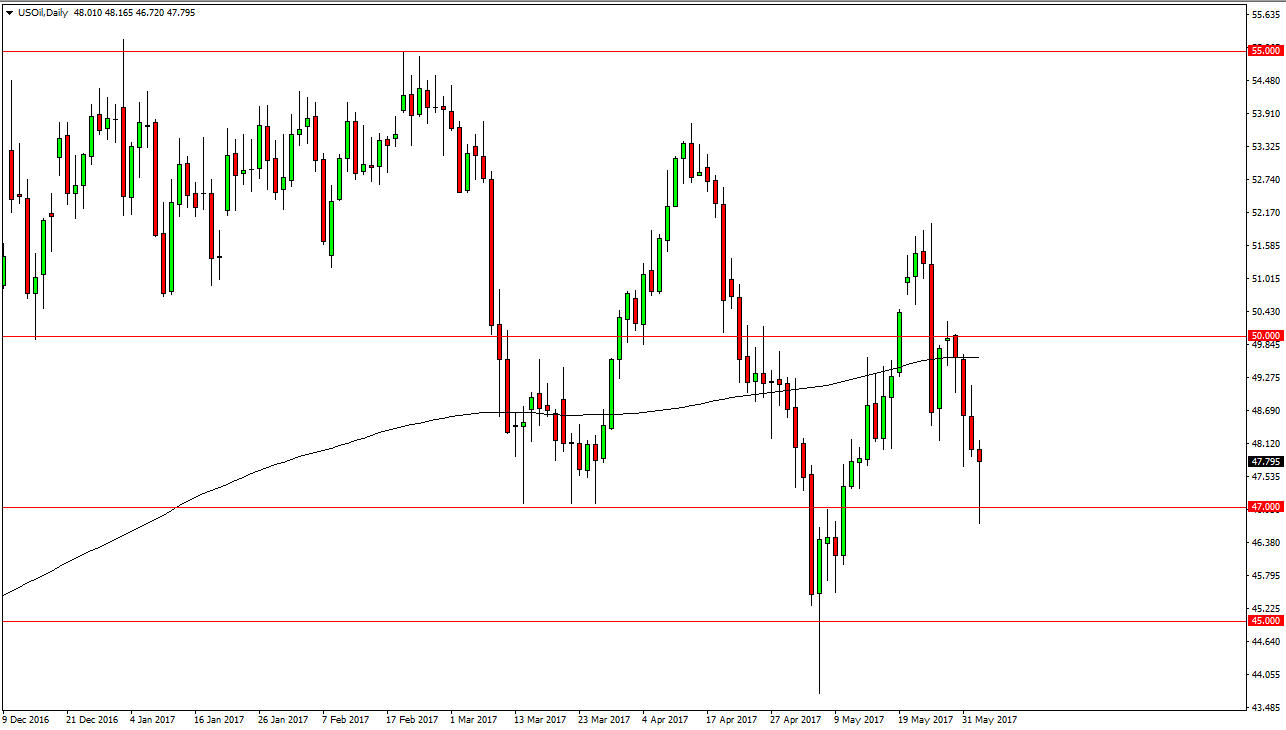

WTI Crude Oil

The WTI Crude Oil market initially fell during the session on Friday, testing the $47 level. However, we found enough support underneath to turn around and form a perfect hammer. This is an area where we have seen support in the past, so I suspect that a bounce is probably coming. However, I find it very difficult to believe that we will be a little break above the $50 level above, as the 200-day exponential moving average should offer more psychological resistance. Short-term, I like the idea of buying the bounce, but longer-term I believe that the sellers come back. Alternately, if we break down below the bottom of the candle for the session on Friday, then I believe the market drops to the $45 level underneath. We continue to see significant volatility due to the OPEC production cuts, and of course the lack of effectiveness.

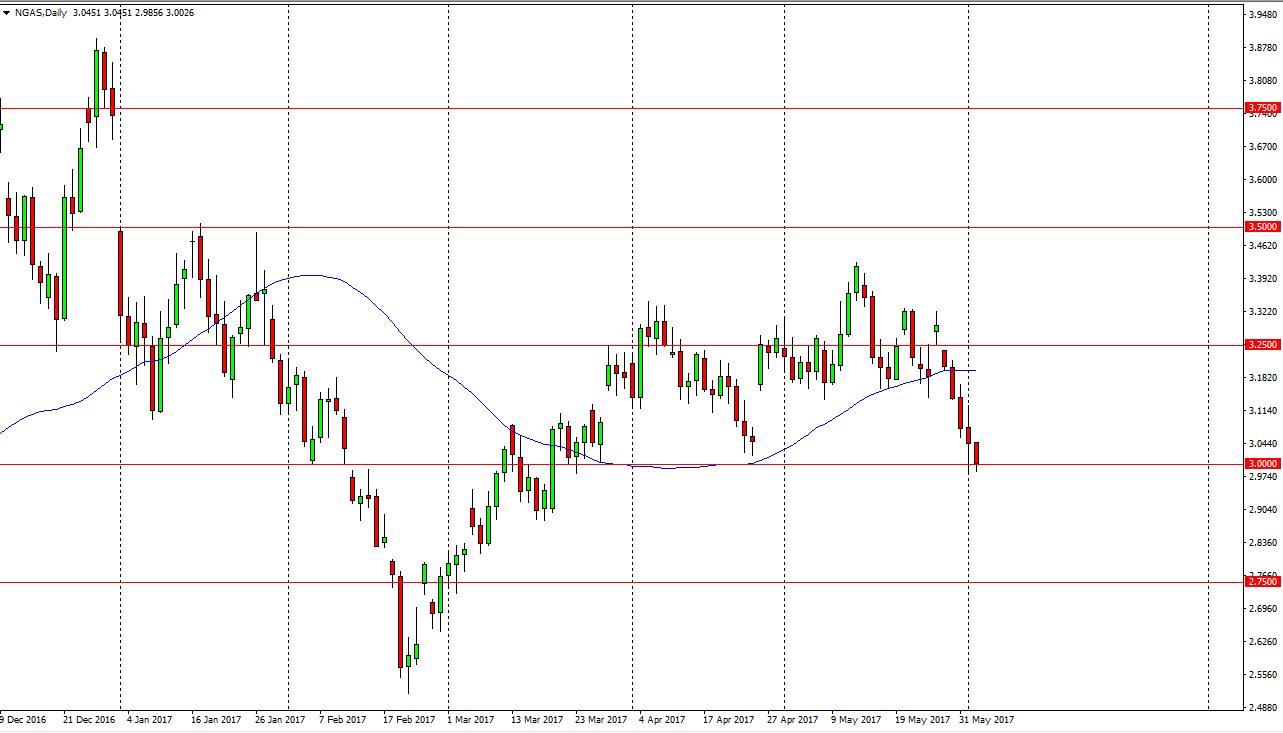

Natural Gas

Natural gas markets fell during the Friday session, testing the $3 level. We are in an area that is massively supportive, so if we can break down below the bottom of the range for both Thursday and Friday, the market will fall apart. I believe the first target will be the $2.90 level, followed very quickly by the $2.75 level. The market does look as if it is rolling over, as we have not only filled the gap from April, but have broken down through it. I believe buying this market is going to be very difficult in the short term, and I suspect that it’s only a matter of time before the sellers exert their will. However, a break above the $3.08 level could offer a hope for buyers. Until then, expect quite a bit of negativity and look at rallies with extreme suspicion, as sellers will more than likely try to take advantage.