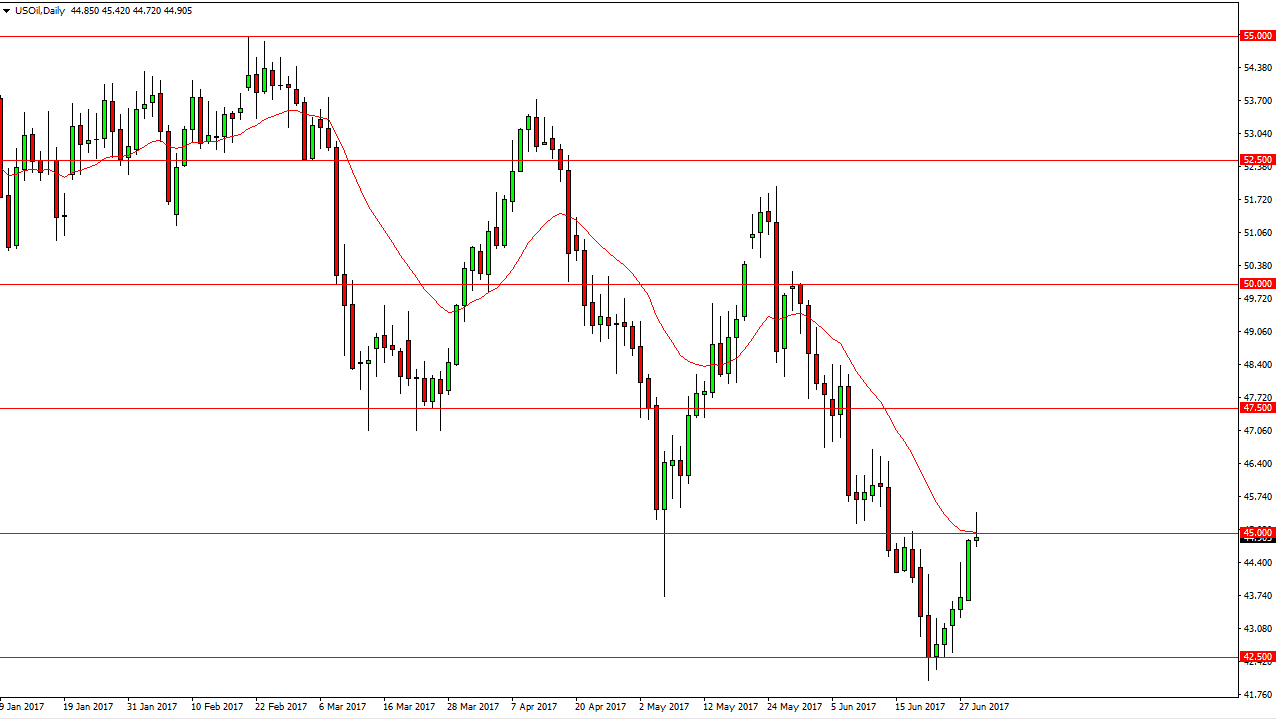

WTI Crude Oil

The WTI Crude Oil market initially tried to rally during the day on Thursday, but found the area above the 50-day exponential moving average to be far too resistive. The $45 level continues to be massively resistive, and we turned around to form a shooting star. That is a very negative sign, and if we can break below the bottom of the daily range from the Thursday session, the market should then go looking down to the $42.50 handle. We are in a longer-term downtrend, so this makes quite a bit of sense, and I believe that the sellers will of course continue to take advantage of the overall pressure and of course the oversupply of crude oil around the world. If the US dollar starts to pick up value, this market should continue to go even lower.

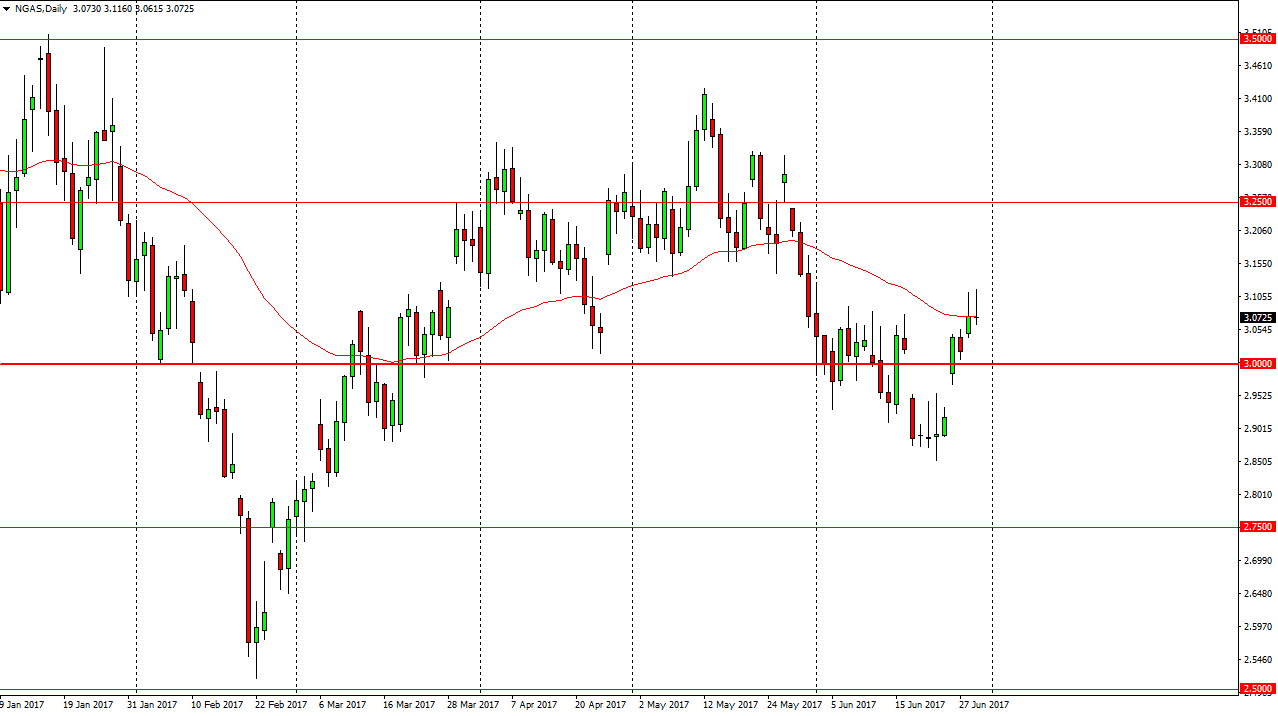

Natural Gas

The natural gas markets initially tried to rally, but broke above the 50-day exponential moving average only to find massive resistance. I think that the market should continue to go lower, and a breakdown below the bottom of the shooting star should send this market to the $3.00 level. There is a gap underneath, so I think we should then go down to the $2.92 level. That gap should only end up being filled given enough time, and a breakdown below there should send this market down to the $2.75 level. The natural gas markets are oversupplied as well, so I’m also a seller of this market. I think that if the US dollar rallies, we will continue to see bearish pressure. Beyond that, the market continues to rally on short-term moves, only to look at the longer-term structural issues in a negative light as they should. Warmer temperatures in the United States and the short-term won’t be enough to deplete stockpiles for any meaningful amount of time.