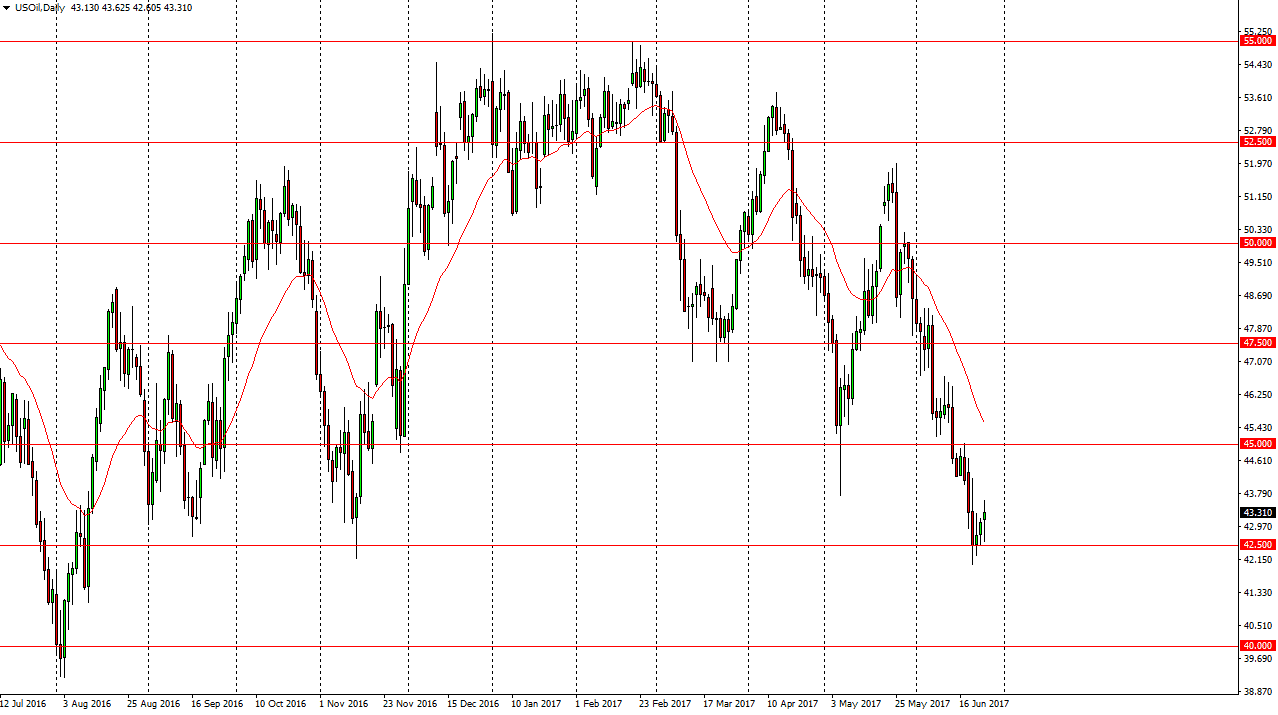

WTI Crude Oil

The WTI Crude Oil market had a volatile session on Monday, using the $42.50 level for support. It looks as if the market could try to find buyers in the short term. However, I’m still very bearish of this market and I recognize that the oversupply continues. I would be more than willing to start selling, on signs of exhaustion and overextension. I believe that the market continues to offer opportunity to short this market but we of course are perhaps a little oversold in the short term. A breakdown below the $42.50 level should send this market to the $40 handle. I believe that the oversupply of crude oil will continue to be a punching bag for hedge funds around the world as they are starting to abandon all hope of OPEC getting a handle on the situation longer term.

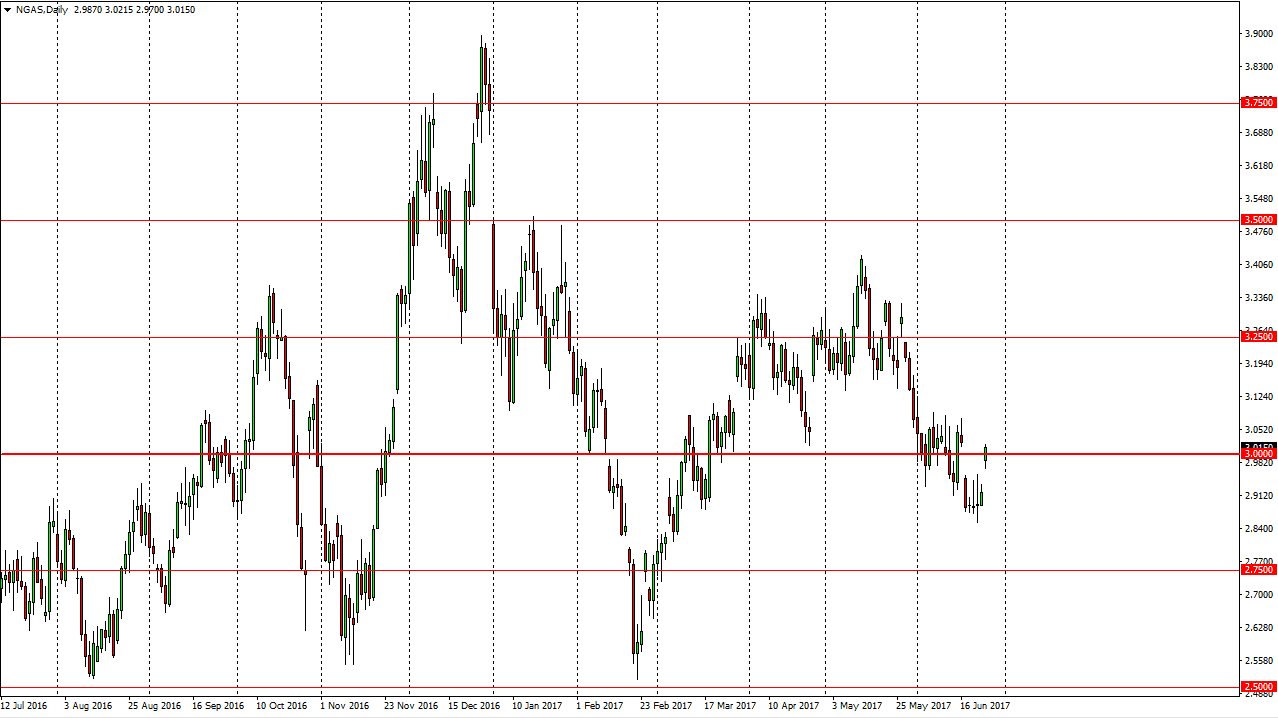

Natural Gas

The natural gas market gapped higher at the open on Monday, slamming into the $3 level. This is an area where I would expect to see a lot of resistance, and as we finished the day, it looks likely that the sellers will come back into this market. The natural gas markets are massively oversupplied, and I think structurally so. Because of this, I’m looking for signs of exhaustion or a move lower to start selling. We will fill the gap, and then go even lower to the $2.75 level. Ultimately, I think we may go as low as the $2.50 level.

The natural gas markets will continue to be soft, as there is a massive amount of natural gas found in the United States and Canada. Ultimately, I think that this is a market that will be much like the gold markets in the 1980s: you simply sell every time he gets a bit too expensive.