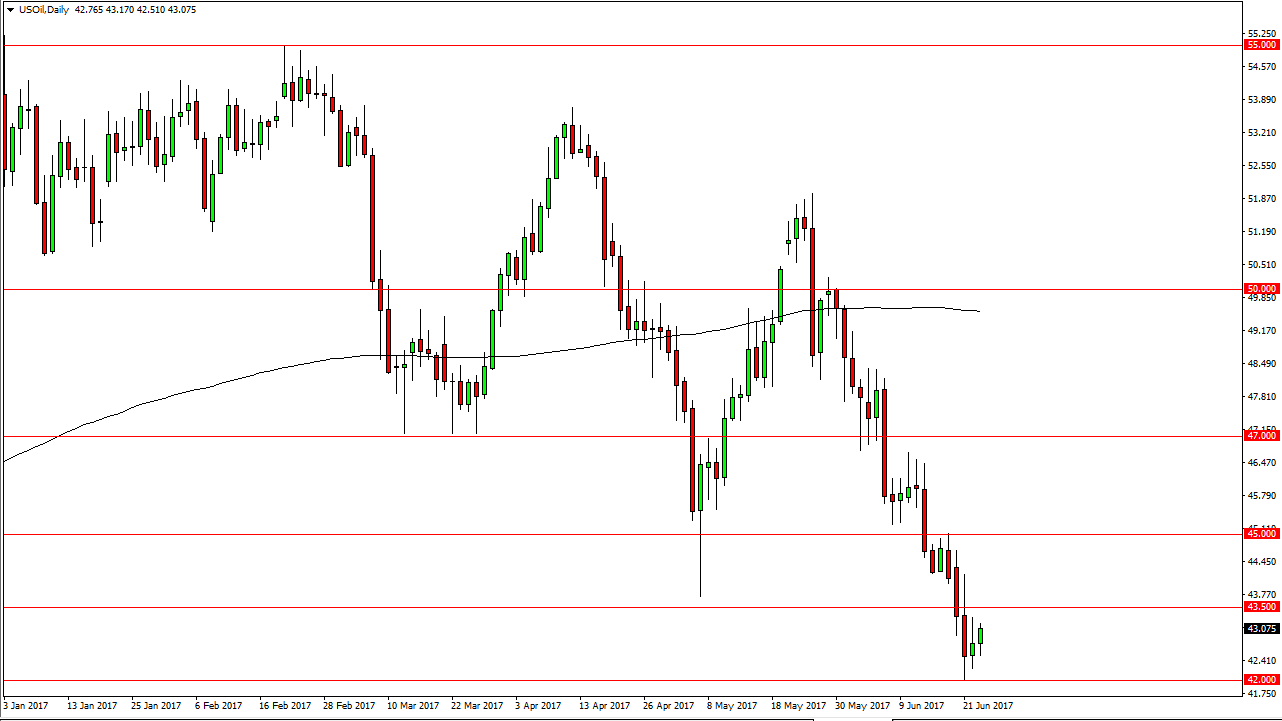

WTI Crude Oil

The WTI Crude Oil market fell initially during the day on Friday, but found enough support to break above the $43 level. The $43.50 level above of course has offered resistance over the last couple of sessions, and I believe that the sellers will return every time we get close to that area. Even if we did break above there, I think $45 will almost certainly be far too resistive. I have no interest in buying this market, I believe that crude oil is in serious trouble, as the oversupply issue is not only a major problem, but it seems to be getting worse. I think that we will see this market try to get down to the $40 level rather soon.

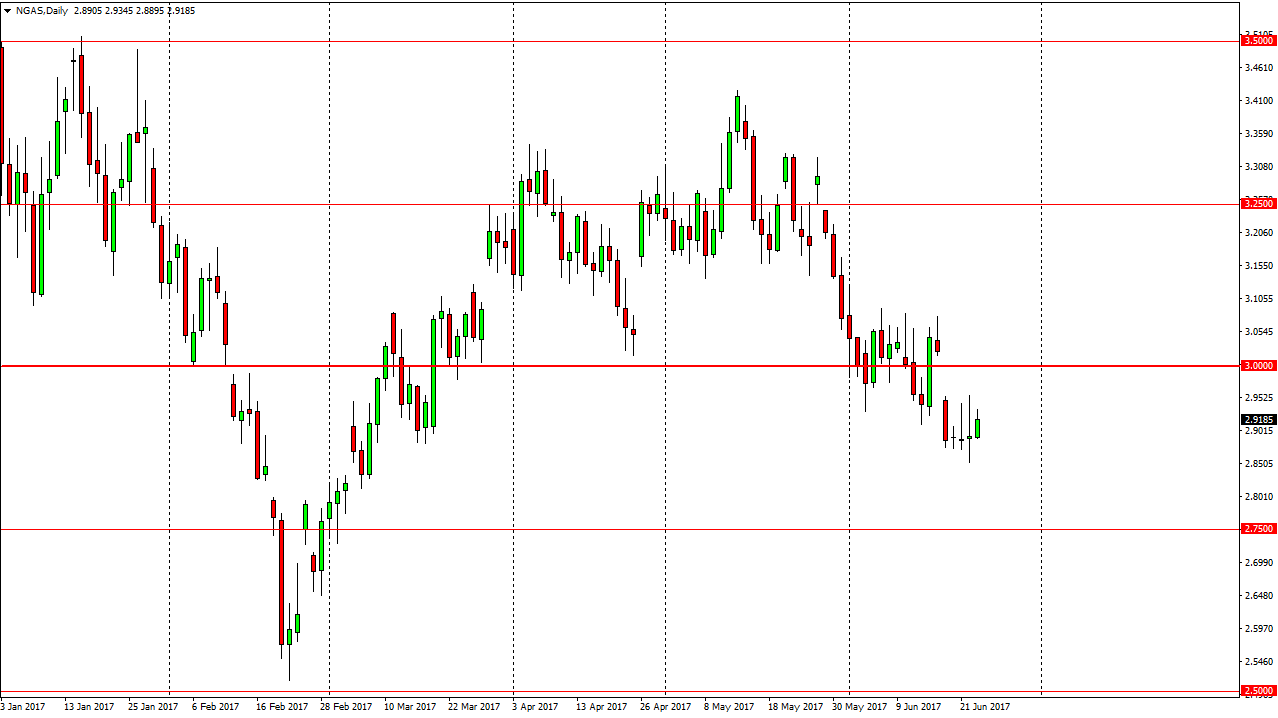

Natural Gas

The natural gas markets rallied a bit during the day on Friday, bouncing off the $2.90 level. The market is certainly in a bearish market, and the $3.00 level above offers massive resistance due to the gap in the market, and of course the large, round, psychologically significant number. The market continues to go lower, and with that being the case I look at any time this market rallies as an opportunity to pounce on what is a massive negative. I believe that the market should then go to the $2.75 level, which is even more support. However, the downward momentum looks as if it is trying to send this market down to the $2.50 level, an area that I think will probably be where we end up towards the end of the summer, perhaps the fall. I have no interest in buying this market until we can break above the $3.10 level, something that does not seem likely to happen anytime soon, as the market continues to be volatile, yet very negative.