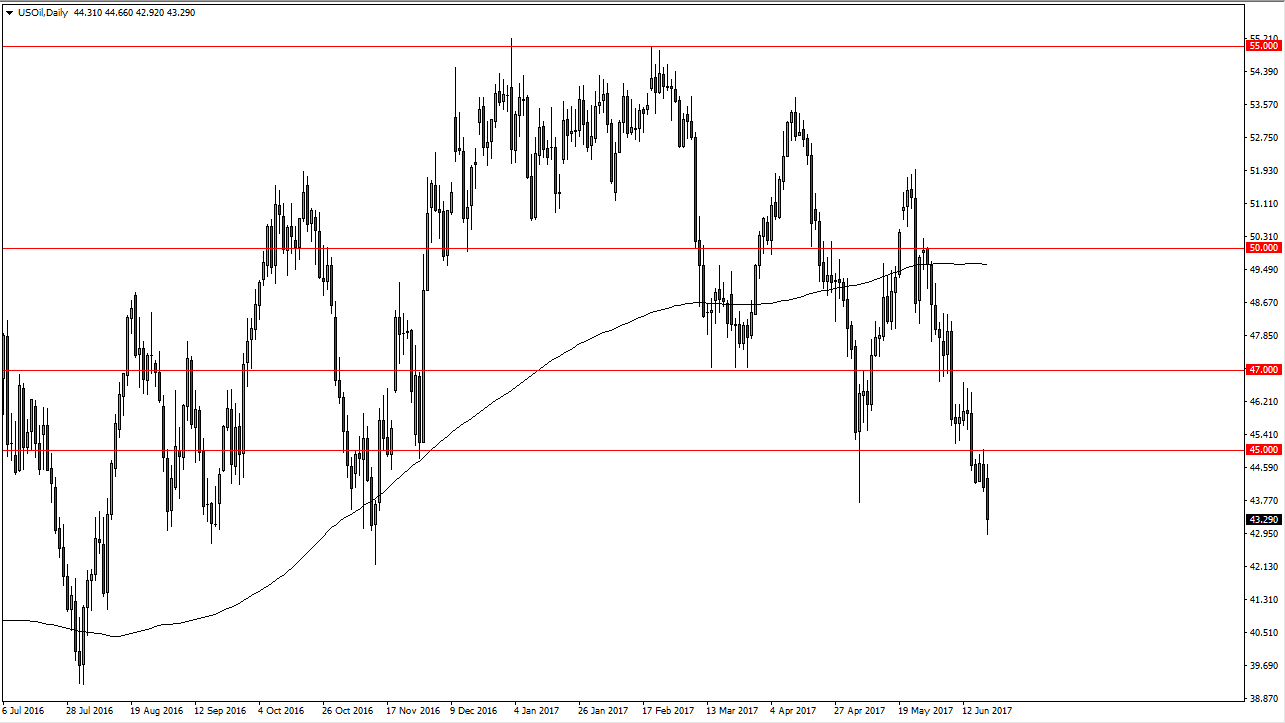

WTI Crude Oil

The WTI Crude Oil market breakdown during the day on Tuesday, as we continue to see significant amounts of various pressure. The day today features the Crude Oil Inventories announcement, and that of course will have a significant amount of influence on this market. The market will react to that announcement, and any assigns of oversupply should continue to work against the value of this market. However, we are a bit extended to the downside at this point, so I think that it is likely to be a scenario where rallies could appear. However, I think that the $45 level above should be resistive, so I’m looking for some type of exhaustive candle to start selling. A breakdown below the bottom of the candle should also show that the downward pressure is increasing, and that should show an impulsive move to the $40 level being possible. However, I do prefer selling rallies.

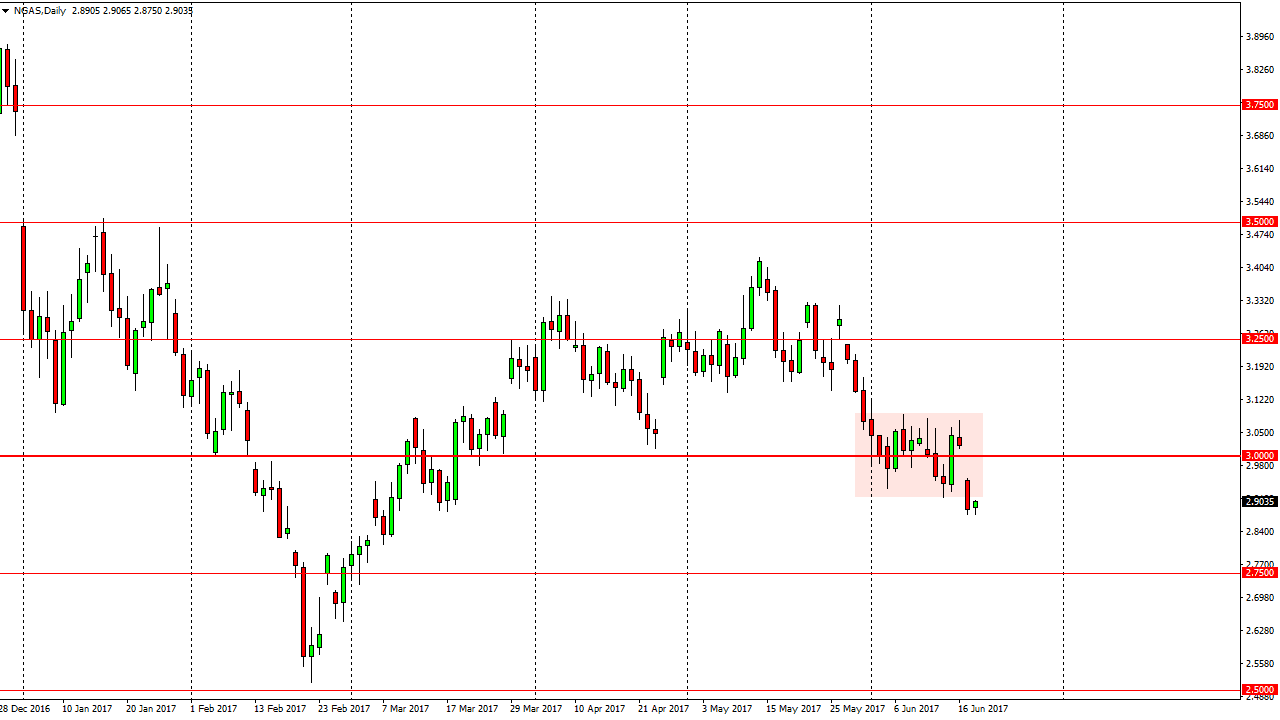

Natural Gas

Natural gas markets did very little during the day on Tuesday, as we continue to see negative pressure overall. We are still below the previous bottom of consolidation, and there is a gap above at the three dollars level that should offer resistance. Because of this, looking for rallies to sell, and I believe that the downward pressure will return time and time again. I believe that we are going to go looking for the $2.75 level underneath, and then perhaps the $2.50 level after that. I don’t have any interest in buying natural gas, this is the wrong time of year to think that the demand will suddenly pick up. Because of this, I believe that every time the market rallies, you should be looking for an opportunity to take advantage of exhaustion.