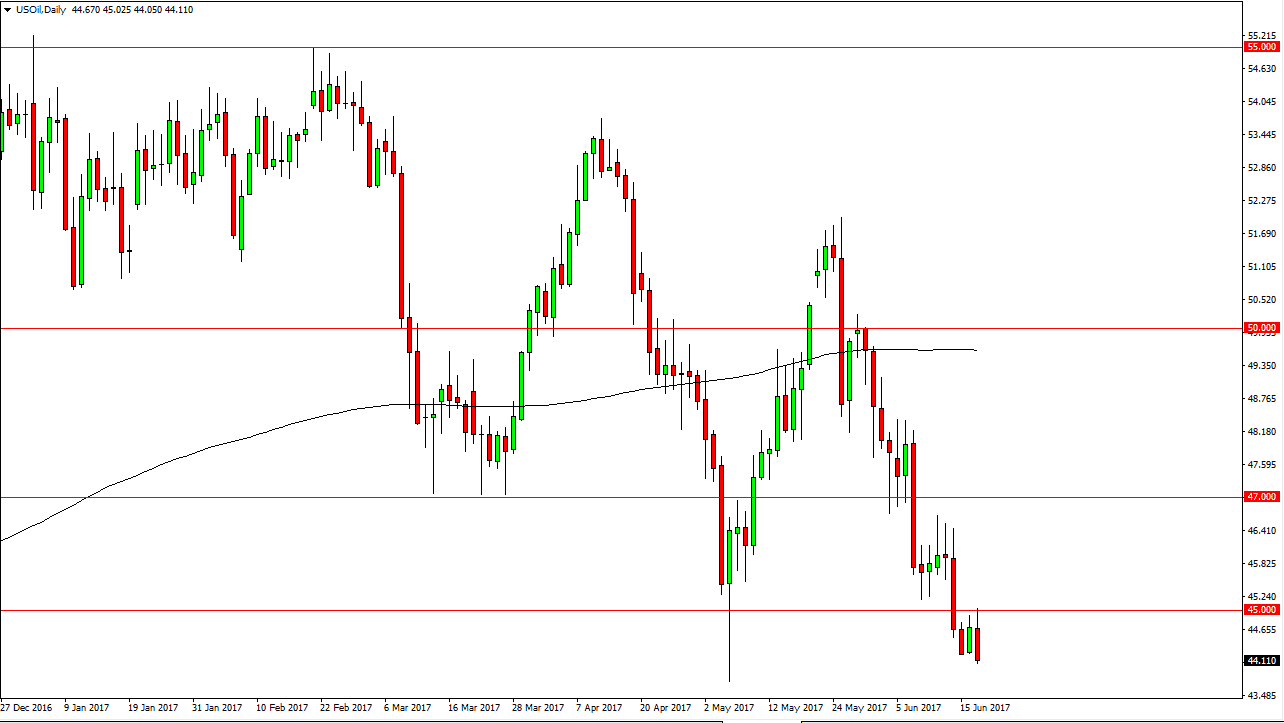

WTI Crude Oil

The WTI Crude Oil market initially tried to rally on Monday, but found enough resistance at the $45 level to turn things around and break down significantly. Towards the end of the day, we found ourselves just above the $44 level, so I think that it’s only a matter of time before we reach towards the $43.50 level underneath. That’s an area that should cause a bit of support, but once we breakdown below their ethical free to go down to the $40 handle. Short-term rallies continue to be selling opportunities, and I believe that there is no way to buy the crude oil market right now, because quite frankly the oversupply issue continues. I believe that a cell on the rallies type of strategy is probably the best way to go for the near future.

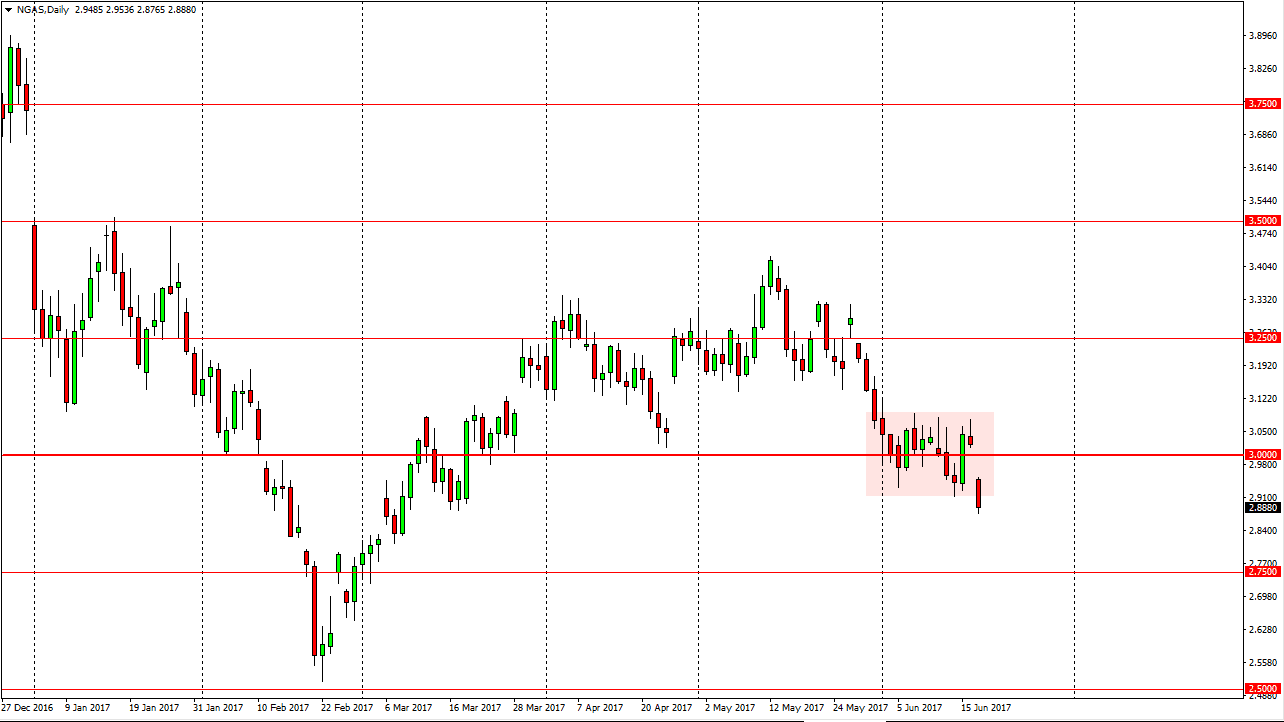

Natural Gas

Natural gas markets gap to a lower at the open on Monday, breaking below the $2.90 level, and thereby breaking below the recent consolidation that the market has been trading in. The market should then go down to the $2.75 level next, and then eventually the $2.50 level underneath. Ultimately, a market move towards the three dollars level should be massively resistive, especially now that we have gapped to the downside. I believe that selling on the rallies is the same way to trade the natural gas markets, just as it is with the WTI market. Ultimately, I have no interest whatsoever and buying, and I believe that the market continues to fall apart, and as the market continues to trade into the summer time in America, there should be plenty of reason to think that the demand will only drop further, and thereby put even more bearish pressure on the market. Buying is not an opportunity that I see happening anytime soon.