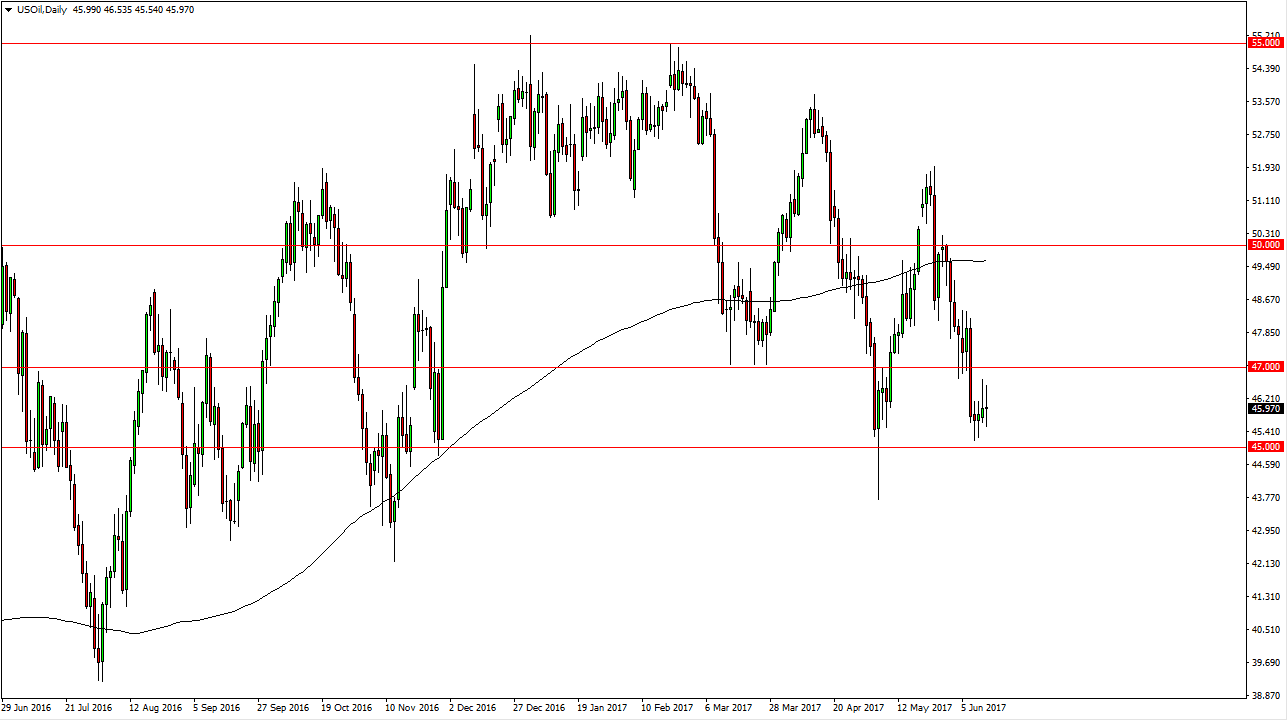

WTI Crude Oil

The WTI Crude Oil markets continue to be very volatile, and I believe it’s only a matter of time before we finally break down. The fact that we rallied and then gave back all of the gains again during the session on Tuesday, just as we did on Monday, tells me that there is a large amount of trading volume out there waiting to get involved to the downside. If we can break down below the $45 level, that would be a very negative sign, and then we could send down to the $43 level after that. I believe that a break above the $47 level would be very bullish, but it doesn’t seem very likely currently. I believe that the market is one that will continue to offer selling opportunities every time it rallies, and of course there is a glut of the commodity to begin with.

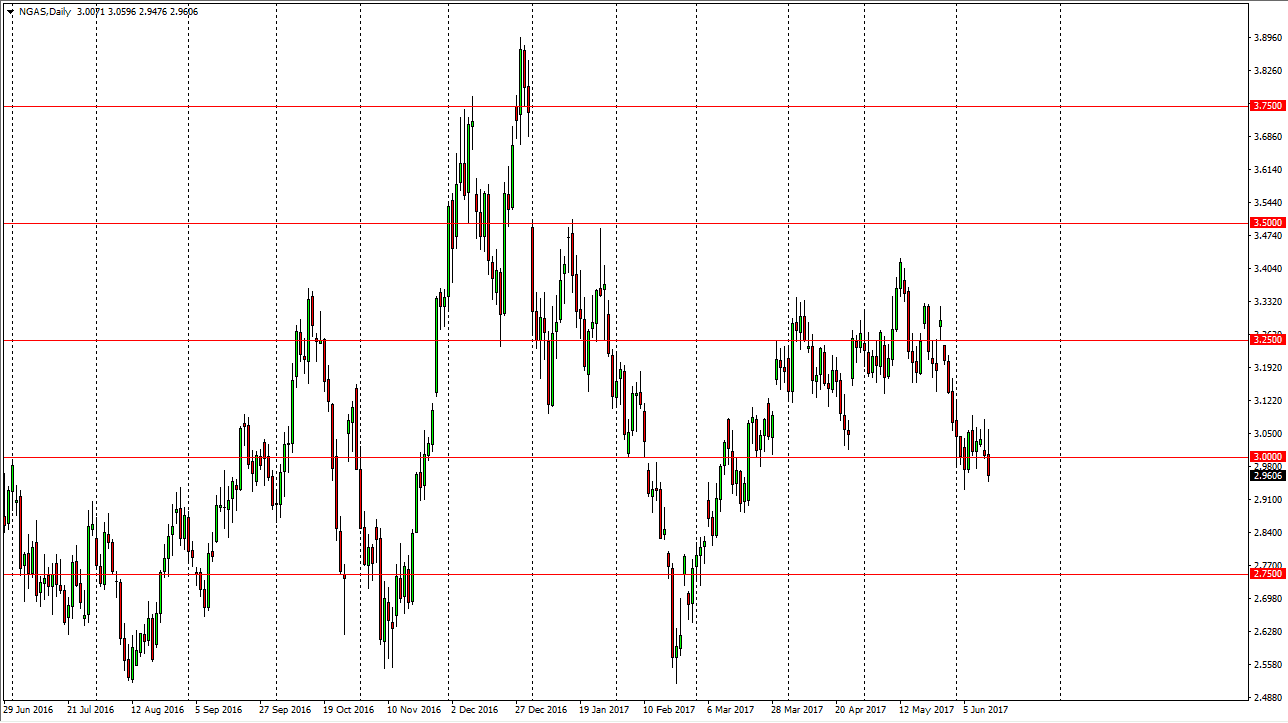

Natural Gas

Natural gas markets initially tried to rally during the day on Tuesday, but then breakdown below the $3 handle. By doing so, we tested the $2.96 level underneath, which is supportive. If we can break down below the bottom of the daily range, I think we will then go hunting for the $2.90 level, and then possibly the $2.75 level after that, followed very quickly by the $2.50 level. There is far too much natural gas out there to keep markets bullish, so therefore I am looking at selling again and again every time we rally. I think that there is no real reason for the market to gain anytime soon, because quite frankly the oversupply is massive. Markets continue to be volatile, but given enough time we should see exhaustion that we can take advantage of every time we bounce.