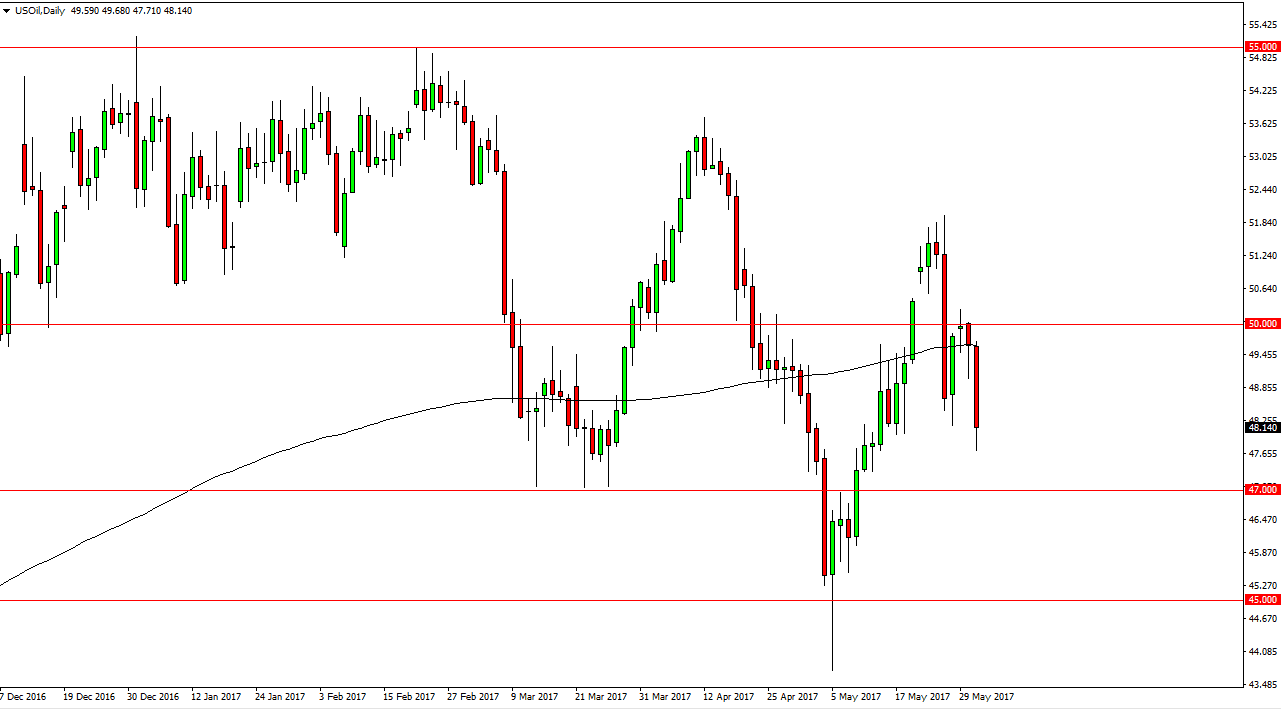

WTI Crude Oil

The WTI Crude Oil market had a very negative session on Wednesday as we broke down below the bottom of the range from the Tuesday session, which was a hammer. That hammer of course should have been a very supportive looking move, but the fact that we broke down below and it looks likely that the market will continue to see negative pressure. At this point, I would expect to see the market tried to go down to the $47 level which should be a bit more supportive. A breakdown below there should send this market to the $45 level after that. I still believe that the $50 level above will continue to be resistance, so, I am a seller in general and believe that short-term rallies will be selling opportunities.

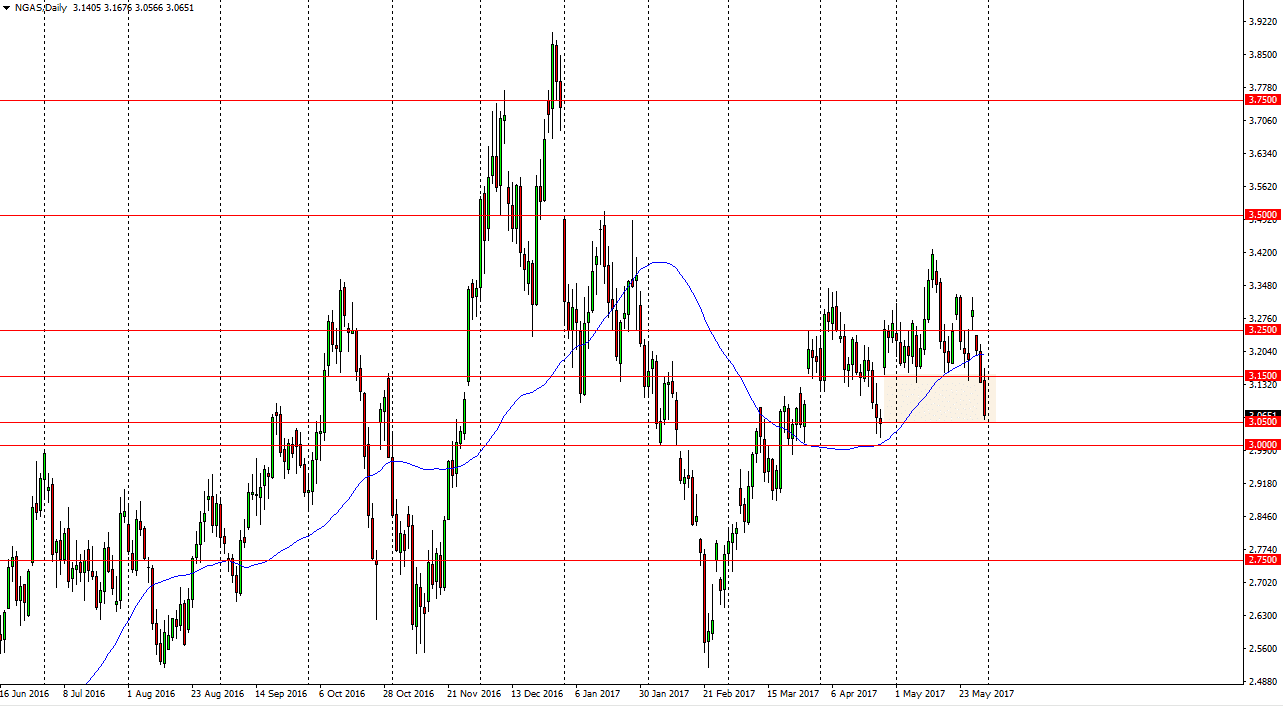

Natural Gas

Natural gas markets continue to be very volatile, initially tried to rally during the day on Wednesday but finding the area above the $3.15 level to be too much resistance. The fact that we did then send the market looking to fill the gap, and thereby run down to the 3.05 level. We have done that, so now the question will be whether or not we can bounce. If we break down below the 3.05 level, I think the market will then go fishing towards the $3 handle. Alternately, some type of significant bounce on the short-term chart might be a buying opportunity as this gap in theory should at least hold some type of support. Either way, I think you’re going to get a lot of choppiness and therefore it should be an interesting day to say the least. Natural gas breaking below the $3 level would be very negative on several accounts, and should send this market down to the $2.75 level next.