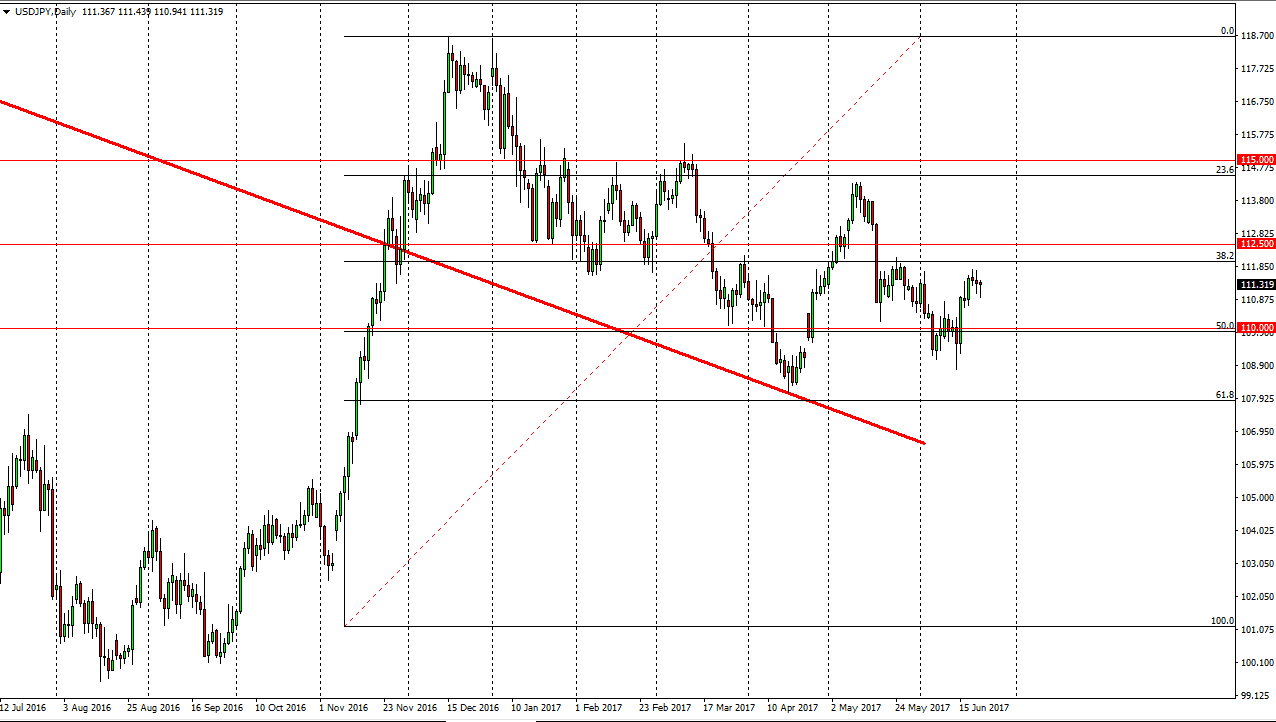

USD/JPY

The US dollar initially fell during the day on Thursday, but found enough support near the 111 level to turn around and bounce. By doing so, we ended up forming a bit of a hammer, and it now looks as if the market continues to reach towards the upside, perhaps reaching to the 112.50 level. A break above there should send this market much higher, perhaps reaching towards the 114 handle. If we break down below the 111 level, the market should then go looking for the 110-level underneath which of course is support. After all, it is a 50% Fibonacci retracement level, which of course will attract a lot of attention. Keep in mind that this market is sensitive the rest, but of stock markets can rally, typically this pair will as well.

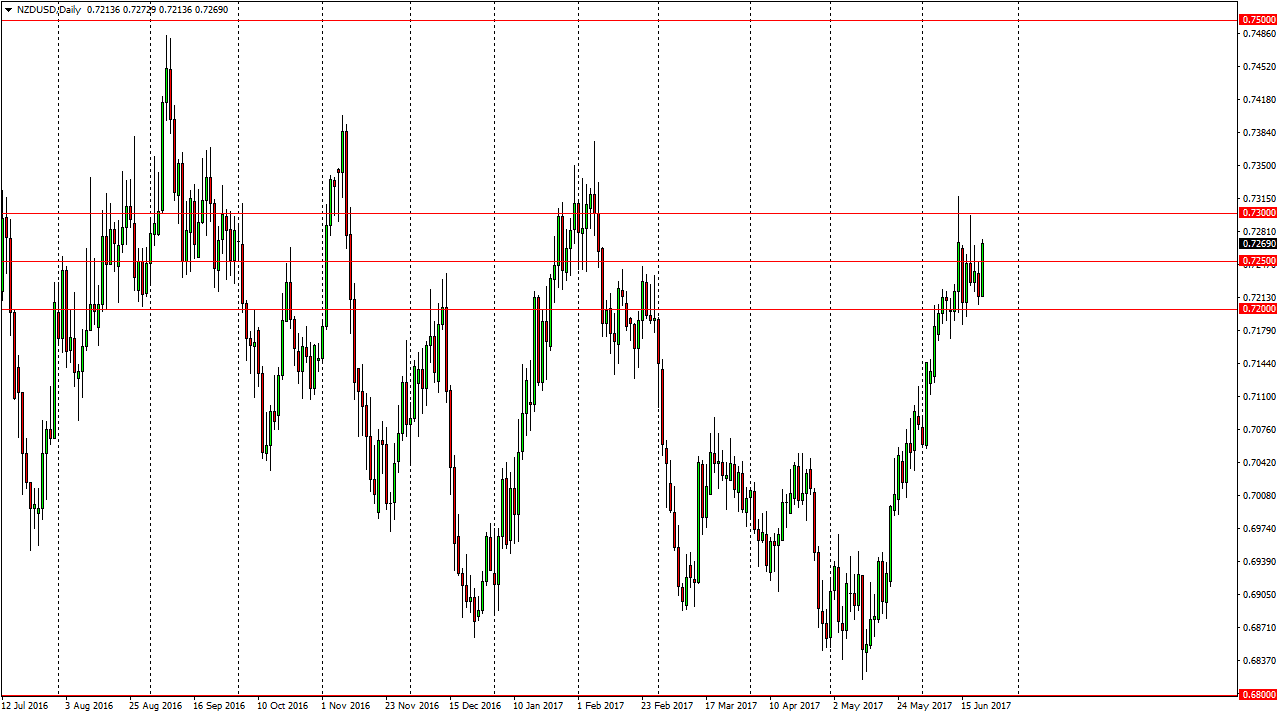

NZD/USD

The New Zealand dollar broke out to the upside during the day on Thursday, as we sliced through the 0.7250 level. The market looks likely to reach towards the 0.73 level above. There is significant resistance there, but I think we will break above there given enough time. After all, we have seen an explosive moved to the upside, and I believe currently we are consolidating to try to build up enough momentum to continue going higher. The fact that we have not fallen significantly after this explosive moved to the upside tells me that there is a lot of inertia build up in the New Zealand dollar, and it should continue to go higher, with a longer-term target of 0.75 above. If we can break above there, market goes much higher. However, in the meantime I believe that short-term pullbacks are the best way to play this market, buying value as it appears in the kiwi dollar. Selling is all but impossible as far as I can see.