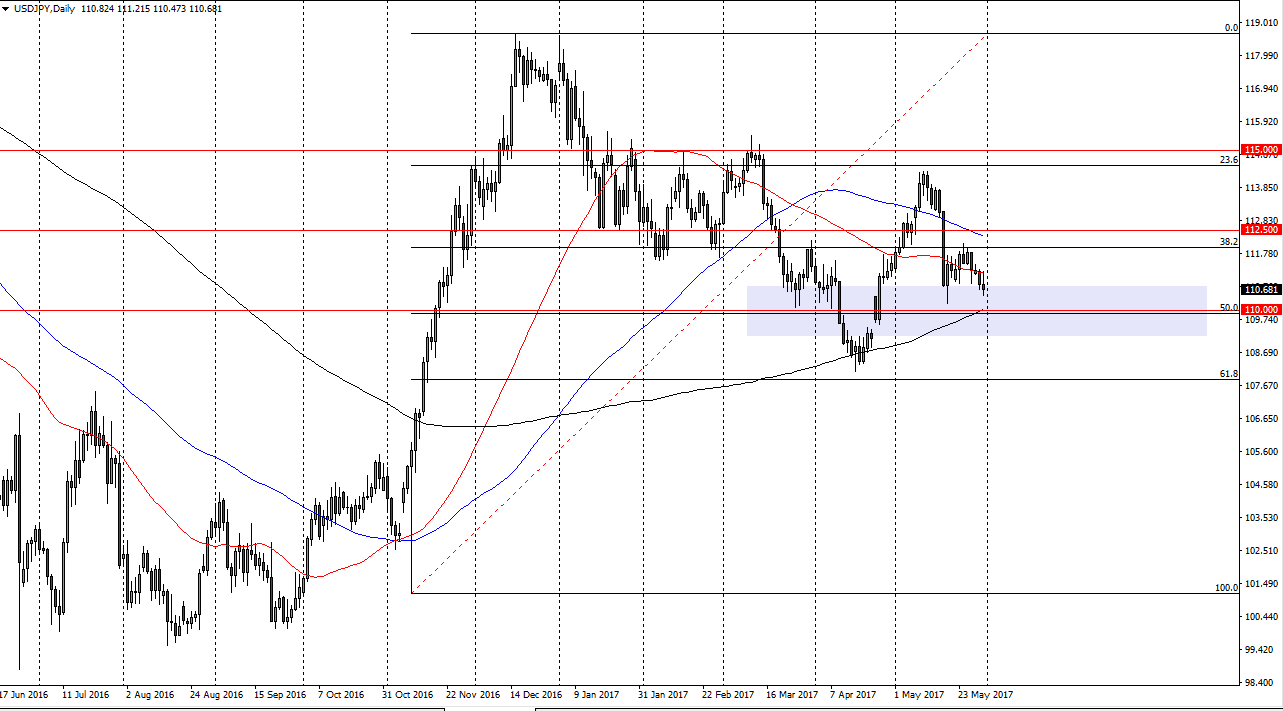

USD/JPY

The USD/JPY pair initially tried to rally on Wednesday but turned around and felt to form a bit of a shooting star. I still see a significant amount of support just below at the 110 handle, and I believe it’s only a matter of time before the buyers return. We may have to test that large, round, psychologically significant number, and perhaps even the gap below there so that we can build up enough momentum to continue the longer-term uptrend. If we can find the right support, the market should then reach towards the 112.50 level, and a move above there should send the market to the 115 handle. Even if we break down, I believe that the 108 level will offer significant support as well, as it is a 61.8% Fibonacci retracement level.

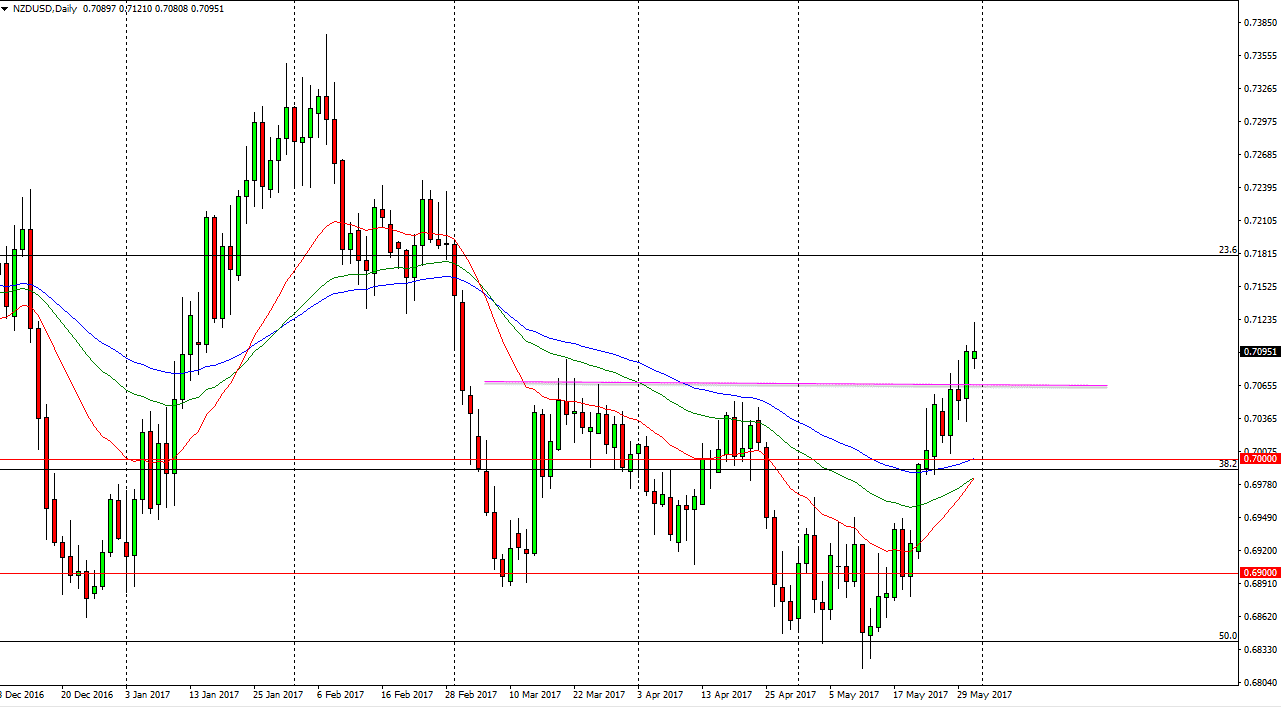

NZD/USD

The New Zealand dollar rallied initially during the day but has turned around to form a bit of a shooting star. The 0.71 level looks to be a little bit resistive, so we may get a pullback from here. However, I see a significant amount of support just below that will probably come into play. I think that buying dips will continue to be the way going forward, and it’s not until we break down below the 0.70 level that I would consider selling. Alternately, we can break above the top of the shooting star for the session on Wednesday, and that of course would be a very bullish sign and more than likely will send this market looking for the 0.72 handle after that. Either way, I expect quite a bit of volatility but we have recently broken out and we may need to consolidate a little bit in order to build up a larger position and more importantly, momentum, to continue going to the upside.