USD/JPY

The US dollar rallied a bit against the Japanese yen after initially falling on Wednesday, but continues to find the 110 level to be important. This was the 50% Fibonacci retracement level from the longer-term move higher, and now that we have broken below it, I feel that the market will probably find sellers near that level. On top of that, if we can break down below the bottom of the range for the Wednesday session, I feel at that point in time the markets probably going to go looking for the 108 level below which is the 61.8% Fibonacci retracement level. Alternately, if we can break above the 110.50 level, we may continue to go higher. That would be a very bullish move, and lead me to believe that the longer-term uptrend is ready to continue.

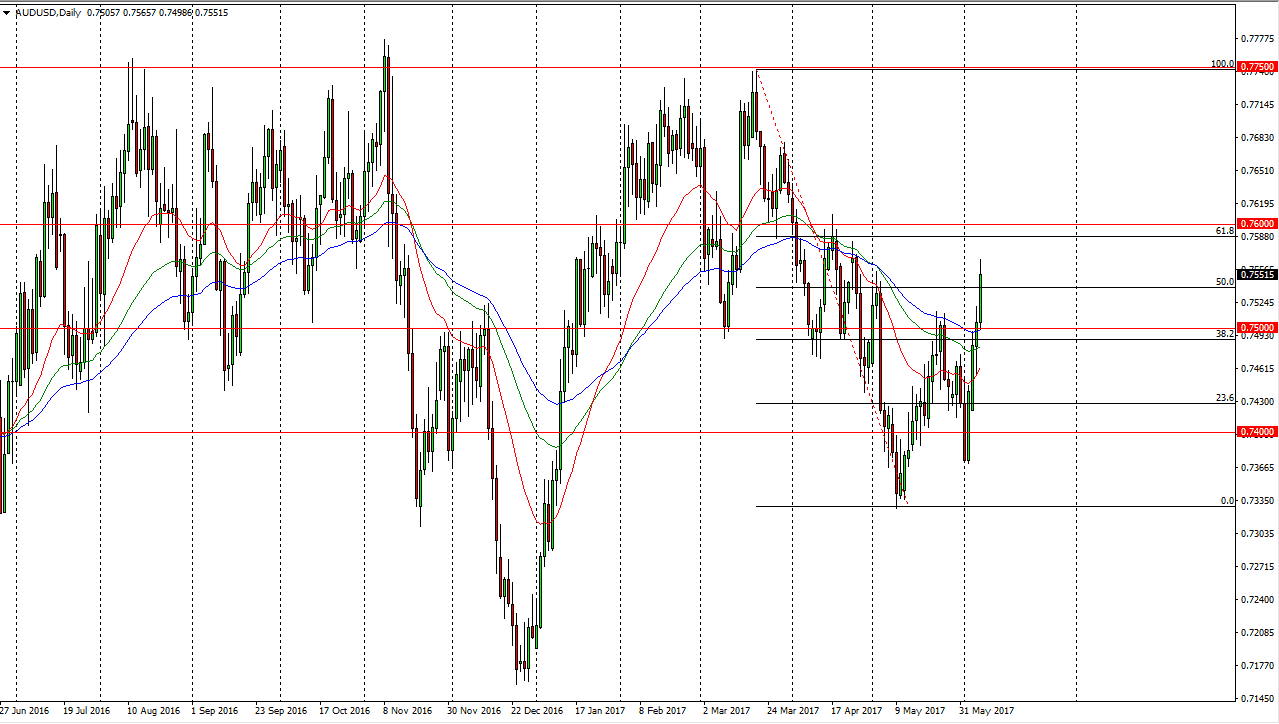

AUD/USD

The Australian dollar rallied significantly during the day on Wednesday as the GDP numbers out of Australia came out stronger than anticipated. Because of this, the market looks as if it is trying to reach towards the 0.76 level, which has a significant amount of resistance built in. I would anticipate that we may get pullbacks from time to time on short-term charts, but those look as if they will be buying opportunities now. I believe the 0.75 level should offer a significant amount of support, and if gold can continue to rally, it’s likely that will only fuel the move higher. A break above the 0.76 level census market looking for the 0.7750 level. Alternately, if we break down below the 0.7450 level, then I think we drop to the 0.74 handle after that. It’s worth noting that the latest low was higher than the previous one.