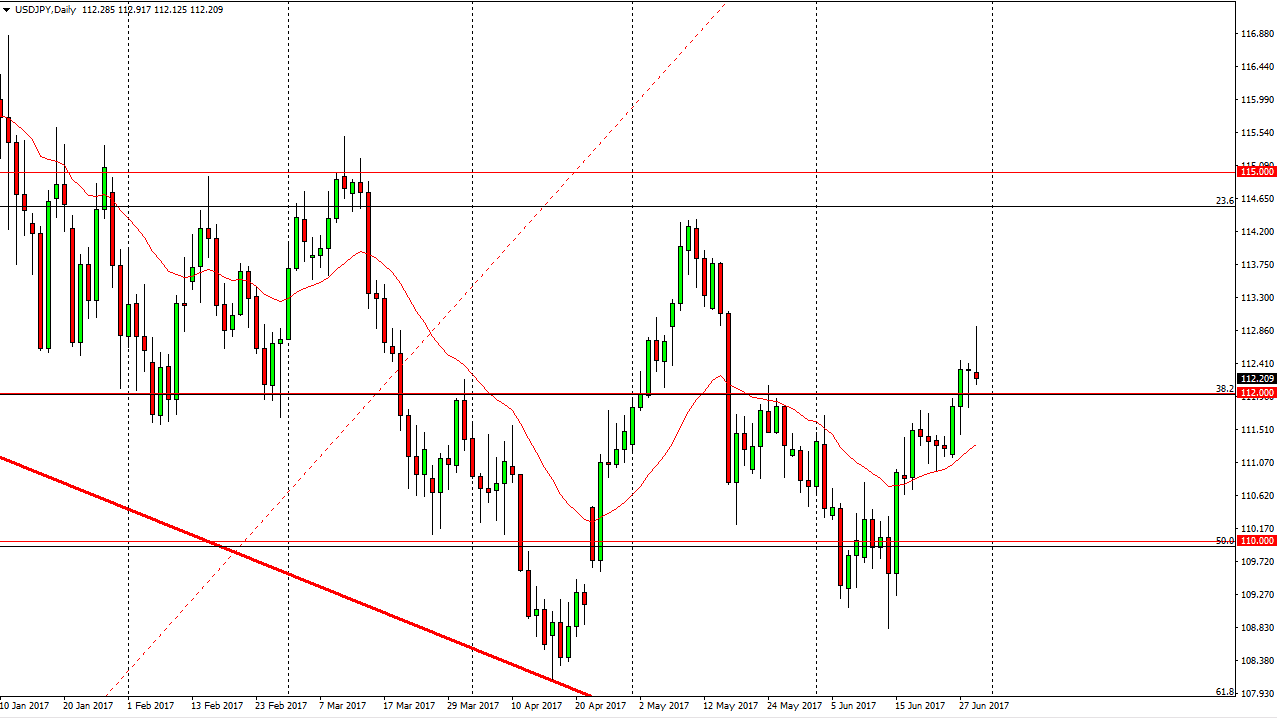

USD/JPY

The US dollar initially rallied during the Thursday session but sold off near the 113 handle. By doing so, we ended up forming the shooting star which is preceded by a hammer. I believe that this shows the market is ready to continue to go back and forth, as we determine whether the 112 level will offer support. I think that the market will eventually go higher but it’s likely that the market will find buyers, and if we can get some type of bullish pressure in the stock markets, that should send this market to the upside, perhaps reaching towards the 114 handle. Stock markets were very weak during the day on Thursday, so we may have to grind a bit before seeing bullish pressure.

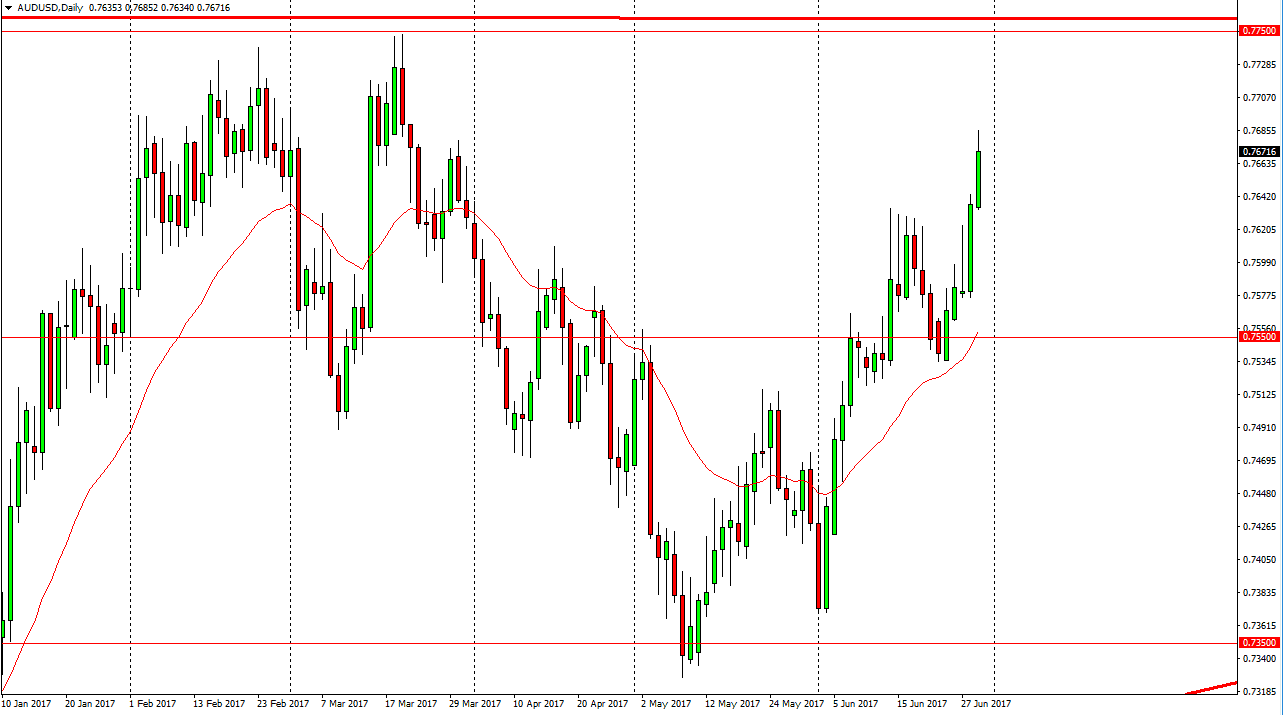

AUD/USD

The Australian dollar rallied during the day on Thursday, breaking out above the 0.7650 level. The fact that we broke above there, the market should then go to the 0.7750 level above. That is a level that will take a certain amount of bullish pressure to break above that, but once we do the market should continue to go to the 0.80 level. Pullbacks continue to offer buying opportunities, some looking for some type of short pullback the show signs of support to go long. Alternately, if we were to turn around and break down below the 0.7550 level, the market should break down rather significantly. However, pay attention to the gold markets, because of the start to pick up again that could help the Aussie as well. Currently, it looks as if this is a market that you should be buying, but finding a little bit of value should be a nice buying opportunity. If we do breakout to the upside, this should be an explosive move just waiting to happen.